Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Dismantling John Williams' Hyperinflation Predictions

Update: A few weeks after this article was published I received an email from Kitco's senior analyst, which has been published below.

Dear Mike,

I took the liberty of trying to contact you in the wake of reading your January 31st article on gold and John Williams.

If EVER there was a more cogent, cut-to-the-chase, honest, devastating article about EXACTLY what is going on out there in this industry at the moment, well, your article has to be IT.

Honestly, I am stunned at how well you seized on the situation, and could not be more in accord with what you wrote.

I will try to open people's eyes with your excellent analysis. Take it from someone who has been in this industry since 1977. You are SPOT ON. Kudos to you.

You might have heard that, based on MY commentaries at Kitco, http://www.kitco.com/ind/index.html#nadler I have become the whipping boy to the hypesters and to the radical extremist gold bugs.Sincerely,

Jon NadlerSenior AnalystKitco Metals Inc.North America

Kitco Senior Gold Analyst Agrees with My Views on Gold

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

If you look around on the various gold bug web sites, you are likely to see the same crowd posting the same lines of hyperinflation and everything else they can conjure up in order to scare people into loading up on excessive amounts of physical gold. Note the emphasis on “physical gold” rather than gold ETFs.

Never mind that gold has very little utility. Never mind that physical gold is not considered a liquid asset. Never mind that gold hacks are financially tied into rising gold prices and therefore have a financial interest in pumping up the price of gold. You should buy gold and hold it because it’s going to continue to rise in price as the end of the dollar nears, right? Not so fast.

Recently, I discussed one key aspect of the gold story no one has ever mentioned…

“Remember, gold dealers make a living by selling gold rather than buy and holding onto it. This activity is contrary to what one would expect if gold dealers really felt that gold will continue to rise in price. Thus, at the same time dealers are advising you to buy physical gold and hold it long-term, they are buying and selling it. In doing so, dealers are not only taking advantage of the price volatility, they are also maintaining a very liquid position in gold because they realize that one of these price corrections will represent the beginning of the end of the gold bull market. This means they are making money trading gold short-term, which reduces their risk, all while advising you to use a buy-and-hold strategy.

Moreover, those who make money from gold ads and commercials aren’t spending that money buying gold. Thus, those who own gold must keep these points in mind whenever they hear ridiculous predictions like the end of the dollar and hyperinflation as support for gold price “forecasts” because the best way to make money from gold is to sell it, or else sell the idea that the price of gold has no ceiling.” [1]

While most gold bugs preach myths and exaggerate the macroeconomic picture as a result of misguided views from their sources, others have been fueled by a more intentional motive when disseminating their marketing campaign for gold.

The fact that tens of thousands of gold bugs agree that gold offers “protection against inflation” and the “inevitable and permanent collapse of the dollar” should serve as sufficient impetus for you to convert all or at least a good deal of your investment capital and savings into gold bullion, right? Not if you truly understand the full picture. I previously discussed the proper use of gold and silver in another recent article. [2]

It would appear that a great deal of individuals who own gold and silver have a poor understanding of macroeconomics and investments. This is the target audience the gold hacks have focused on because it represents an easy sales pitch as you can imagine.

Some of these individuals don’t have much of an investment portfolio consisting of stocks because they don’t have much savings to invest. Others have lost all faith in the integrity of the U.S. capital markets, so they don’t want to risk losing more than they already have. As a result, many of these individuals have a sizable portion of their entire investment portfolio in precious metals. Needless to say, this is a very dangerous move because gold will not remain above $1000 forever. When the gold bull market ends, it is likely to end without much warning.

Loading up on gold at current prices is even a very dangerous move for sophisticated investors who realize the gold bull market will not last forever. While they think they will be able to unload gold prior to its collapse, history shows that most people are likely to get stuck holding the bag when it empties.

Ever since the financial crisis, thousands of gold hacks have propagated greatly exaggerated and misguided views of the U.S. economy so as to heighten widespread panic. They have insisted that the U.S. will soon encounter a period of hyperinflation that will make the dollar virtually worthless. And they have positioned gold as the solution to the dollar’s demise. Indeed, it has been a boon for conspiracy figures from radio and television, as they have convinced their frustrated and confused audience that Armageddon in the U.S. is not far away. [3]

Everywhere you turn you’re likely to run across these hacks, as their propaganda has infected virtually every website in some form or another, whether through gold ads and economic articles, YouTube videos, or interviews from gold hacks in print and broadcast media.

While the U.S. economy is certainly in bad shape, it’s not as bad as gold hacks and perpetual doomers would have you believe. Over the past couple of years, I detailed the state of the U.S. economy on several occasions. [4] [5] [6] [7] [8] [9] [10] [11]

.jpg) Prior to the economic fallout, I wrote a 500-page analysis in 2006 (America’s Financial Apocalypse) to support my claims that the U.S. would face a depression spearheaded by a collapse in the real estate bubble, so it’s not as if I think things are rosy.

Prior to the economic fallout, I wrote a 500-page analysis in 2006 (America’s Financial Apocalypse) to support my claims that the U.S. would face a depression spearheaded by a collapse in the real estate bubble, so it’s not as if I think things are rosy.

Furthermore, in this book I also forecast gold to head to $1400 with a good deal of certainty, and potentially higher thereafter. Thus, no one can make the claim that I am a gold “basher.”

Through my experience managing assets on Wall Street, as well as my work in the venture capital industry, I feel I have a pretty good understanding of valuation, risk, and the relationship each shares with the other.

However, you don’t exactly need to be an expert in valuation or risk management to understand this relationship. It’s quite simple. The higher an asset price rises, the higher the risk becomes. This is especially the case for assets that possess very little intrinsic value, such as the case with gold.

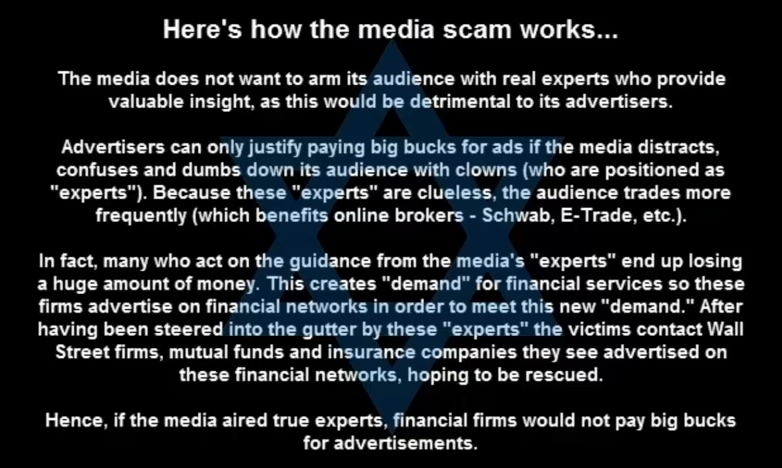

But forget about my views for a moment. After all, I’m not one of the “experts” designated by the media, so you don’t see me plastered all over the financial networks. So how could anything I say hold much credibility? If that is the basis of your conclusions then you really have no idea how the media works. I have discussed how the media intentionally dupes its audience on numerous occasions. [12]

Only on rare occasion will you find accurate and unbiased investment guidance from the financial media. Instead, the media opts to air a regular selection of individuals from its pool of extremists and marketing professionals who have been positioned as investment experts. The media covers both extremes, from the perma-bulls to the perma-bears. The only problem with this approach is that extreme views are never profitable over the long haul because things change. Thus, knowing when to shift gears is of vital importance.

We all know how the media is filled with perma-bulls. This extreme view represents the main theme of the financial media because this is how the media makes most of its money through promoting the agendas of Wall Street.

We all know how the media is filled with perma-bulls. This extreme view represents the main theme of the financial media because this is how the media makes most of its money through promoting the agendas of Wall Street.

But the media has also formed a strong bond with perma-bears because this strategy not only offers another source of ad revenues, it also serves to convince its audience that they are giving you both sides of the picture.

The only problem is that extreme views, whether they are aligned with the bull market or bear market mentality will lead to losses more than gains.

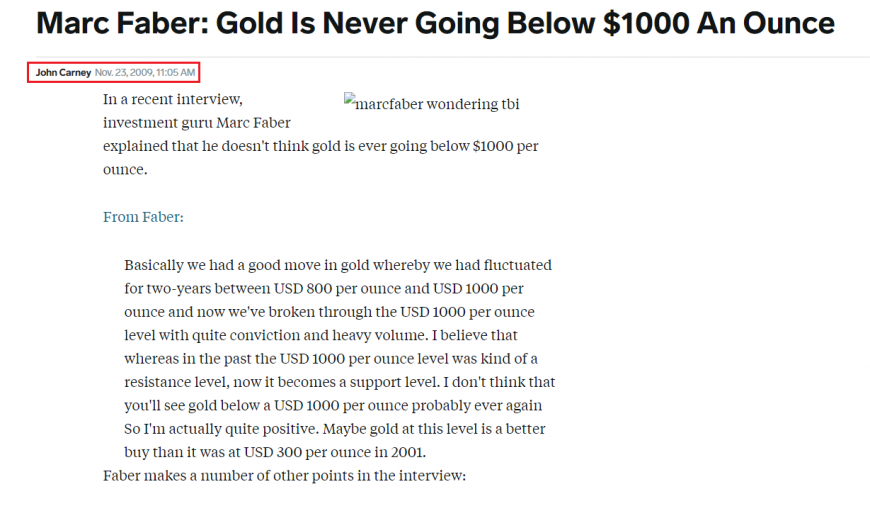

When we examine the propaganda from gold bugs and perma-bears, this is all too obvious. For instance, Marc Faber has gone on record as stating he is 100% certain that the U.S. will experience hyperinflation. Moreover, he has even stated that gold will never again fall below $1000. [13]

Note that the media source that conducted this interview (Business Insider) refers to him as a guru. That should tell you all you need to know about Business Insider. It’s a common trick used by the media. They want you to think they are providing you with value so they will always position those they interview as experts despite the fact that very rarely does this turn out to be the case. The most important ingredient one can use to determine credibility is to examine a person’s track record. This is something the media never does when selecting its “experts.” [14] [15] [16] [17]

Perhaps Mr. Faber drank a bit too much wine during this interview. Once you take a good look at Faber’s track record, you might agree his credibility is in question at best.

Perhaps Mr. Faber drank a bit too much wine during this interview. Once you take a good look at Faber’s track record, you might agree his credibility is in question at best.

Like his perma-bear peers, Faber has been calling for doom year after year. He is likely to continue this mantra for the rest of his life. And because every economy has good times as well as bad, his predictions have very little meaning. Similar to other perma-bears, Faber is like the pig who cried wolf.

This barrage of gold propaganda and doom over the past couple of years has set the stage for predictions of gold soaring to the moon, with forecasts such as $5000, $10,000 and even $20,000 per ounce. Many others who propagate similar exaggerations are gold dealers, like Peter Schiff. Schiff has gone on record “predicting” that gold would hit $10,000 per ounce and perhaps even higher.

I can tell you this. The only way gold would hit $10,000 an ounce is if all of these gold hacks convince enough people that it will to the extent that they buy enough gold to drive the price to $10,000. Nothing else will drive the price of gold to this level. It is impossible to forecast gold prices based on valuation metrics since it has very little if any inherent value.

Gold bugs have been trying to scare people and infect them with greed so they will buy gold and raise the price. Thus, rather than predictions, these wild claims serve only to function as a self-fulfilling prophecy. Even some of the gold dealers who stand to benefit from soaring gold prices think Schiff’s forecasts of $5000 and $10,000 are ridiculous.

Will gold head to $2000 per ounce? It’s certainly quite possible. What about $2500? That too is a possibility. For prudent investors, the most important question is not how high the price of gold will rise, but when to exit gold because when the gold bull market ends, the price will collapse and remain low for many years. Prudent investors focus on valuation and risk in order to create entry and exit strategies because this forms the basis of a responsible investment management process.

Regardless how high gold rises, the rise in price has nothing to do with real investment dynamics. It’s pure speculation. Sophisticated investors understand this. In my opinion, the gold pumping campaign resembles a pyramid scheme whereby gold dealers profit, along with those who bought gold earlier in the bull market. Meanwhile, most of the people buying gold at these levels stand to lose money down the road because they have no exit strategy. They have been convinced that gold will remain above $1000 per ounce forever. This assumption is not valid and is likely to cost many people a lot of money.

The pumping of gold seems to have no limits. The following video features another gold hack (Mike Maloney) who predicts gold to soar to at least $15,000. I find it ironic that thestreet.com interviewed this individual. If you don’t already know the reality behind thestreet.com, I suggest you get up to speed. [18]

Others who receive indirect forms of compensation in exchange for pumping gold have made similar “predictions.” The same can be said of their credibility in my opinion. Remember, not only does timing matter, but the fine details are also very important. That means you cannot claim to have predicted much of anything when you have been saying the same thing for 15 years, because as we all know, eventually it rains even in the dessert.

If you have been listening to those who have preached doom for many years, you missed out on tremendous gains. Even when the collapse occurred, if you had listened to the investment advice these individuals provided, you are likely to have lost more than those who remained in the stock market.

The bottom line is simple. If you are not able to get things right in a manner that leads to net investment gains, then you are better off with a buy-and-hold investment strategy.

In reality, gold bugs are not offering legitimate predictions. They are trying to create a self-fulfilling prophecy. You see, because there is no way to value gold using accepted forms of valuation, the price is determined solely by perceived value, which is itself based on the anticipation of price appreciation. So if all of the gold bugs keep telling you that gold will reach $5000 or even $10,000 all while creating doomsday scenarios, it just might reach $5000, but only if YOU make it happen. That’s not investing. It’s speculating because such price levels are not sustainable, nor are they based on valid economic fundamentals.

In practice, many gold bugs are involved in what I feel resembles penny stock pump-and-dump scams. You’re probably familiar with how these scams work. I see them almost every day. A wave of propaganda is pumped out to unsophisticated investors who believe the hype and exaggerations by stock promoters. And while these worthless stocks sometimes rise substantially in price, the party usually ends without warning, leaving most people stuck holding the bag after it has emptied. One invariable characteristic of these scams is that the promoters never discuss the risks.

Tens of thousands of individuals and hundreds of gold dealers are involved in the movement to pump up the price gold because their bank accounts swell as more people buy it. But one does not need to be a gold dealer in order to cash in on this gravy train. In many cases, just being a gold hack can make you a good deal of money in the form of gold ads on websites.

My advice to you is this. If you do not see articles or interviews about gold that discuss the other sides of the picture by unbiased experts, you should stay away from these media sources. Investors must learn to recognize when a financial show or website serves as a cheerleading session versus a source of open debate and unbiased analysis. While many televised and radio shows are disguised as an open debate, the reality is much different. The often one-sided picture painted on most websites is much more obvious to those with an objective mindset.

Back in early 2008, John Williams predicted the U.S. would experience hyperinflation by 2010. Williams’ predictions of hyperinflation predated this period. Of course, 2010 came and went without any signs of hyperinflation.

Recently Williams updated his report and is calling for the same in 2011, but adds it will certainly come no later than 2014. For the remainder of this piece, we will examine this report.

Let’s have a look at a couple of Williams’ statements.

“Risks are high for the hyperinflation beginning to break in the year ahead; it likely cannot be avoided beyond 2014.”

“…risks are particularly high of the hyperinflation crisis breaking within the next year.”

I recall several gold hacks preaching the same lines over and over, all while predicting gold would reach $5000 by 2010.

Other gold hacks warned about a complete collapse of the economy by the end of 2009, then 2010. Many of these same individuals are saying the same thing about 2011.

Those who have listened to these hacks have missed out on more than 85% gains from the largest stock market rally since the Great Depression. While I realize the economy is not improving in an absolute sense, I have kept my clients in the U.S. stock market ever since recommending a buy when the Dow reached 6500 in March 2009. [19] [20]

Most likely the gold hacks will continue to say the same thing next year and the year after, over and over until people finally realize the sewer of doom caused them to miss out on lucrative investment opportunities. If you have been paying attention to the media, you know who these individuals are. But they are also infested throughout the Internet.

Williams goes on to link the rise in the price of gold with a declining dollar. While this relationship is partially valid, it is not as clear-cut or consistent as he and other gold bugs have claimed. A much more direct relationship exists between a declining dollar and rising oil prices. This is something all top Wall Street professionals realize. I will get back to this relationship later.

When I first stumbled upon Williams’ report, thoughts of the late Matt Simmons immediately came to mind. As you might recall, Simmons was known as an “expert” and maverick from the oil industry who wrote a book about peak oil that caught on with many oil bugs.

Simmons was certainly not alone in his predictions of rising oil prices. Many others made similar forecasts. However, Simmons’ forecasts failed to include key drivers of oil demand, namely that of Southeast Asia. As a result, Simmons approached his thesis from a near-sighted standpoint rather than a big picture perspective. Thus, from an economic and investment perspective, I was not impressed by this book.

Prior to his recent and sudden departure, you might recall Simmons’ wild predictions that British Petroleum wouldn’t make it through the summer and would definitely file for bankruptcy. [21]

Even the oil services research firm he founded disagreed with his analysis and upgraded the stock after his ridiculous statements. [22]

When you create this type of drama you will position yourself as a good candidate for TV interviews because the media loves to create drama, panic and fear. This type of programming drives a large audience with which the media can air ads and commercials. And this is how the media makes its money.

I do not know for certain whether Simmons’ goal was to gain media exposure through his wild claims. Alternatively, perhaps he had become a bit senile in his later years.

The case of Mr. Simmons is similar to that of Mr. Williams because it points to the critical need to decipher between extremists and realists. Doing so could prevent you from losing a good deal of money over time.

When it comes to gold we have seen the same song and dance. Forget about credibility as demonstrated by a person’s track record; forget about the fact that many of these gold bugs have financial agendas tied to their “predictions” of hyperinflation, and myths that gold serves as a hedge against inflation.

All that matters to gold hacks is that they generate publicity so that they can make money selling gold, securities, gold-related books and newsletters, or making speaking appearances at gold investment conferences.

In fact, Peter Schiff, Marc Faber and other members of the media club have hit the public speaking circuit, charging thousands of dollars for appearances. The question you need to ask yourself is this. Do credible investment strategists spend most of their time at speaking events, giving interviews in the media, making daily YouTube videos and pumping articles to hundreds of websites, or do they spend it doing research? I spend most of my time doing research and submitting it to my clients.

The tremendous financial opportunities that come with media exposure account for strict adherence to the rules set forth by the media. These rules basically state that “you cannot expose the truth about our sponsors, and you cannot let our audience know that we are liars and jug heads.”

Everyone you see interviewed by the media goes along with this code of conduct because they want free publicity. If the media has any reason to believe that you will violate this code of conduct, you will be banned. This is how the game is played. It explains why you have never heard anyone from the major networks in the U.S. raise the issue of why not one of the Wall Street executives has been indicted for committing blatant securities fraud that resulted in the collapse of the global economy.

Rather than a source of unbiased news and insight, the U.S. media serves as a whore for corporate, Wall Street and government interests. The sooner you realize this, the better off you will be.

In the past I have discussed the fact that hyperinflation is not a possibility in the U.S., at least in our lifetime. I addressed this topic because I felt the need to act responsibly in attempt to caution amateur and professional investors alike, who have been bombarded by this propaganda. Unlike others who preach the opposite, I have nothing to gain by alerting Main Street to these realities other than the satisfaction knowing that I helped investors avoid huge losses. [23] [24]

Before I dismantle Williams’ hyperinflation prediction, I think it’s important to consider a few things about me.

First, I am not a deflationist. This designation comprises a large category of extremists who have insisted that the U.S. has been in a deflationary environment since 2008 (mostly amateurs writing blogs), and academic economists who warn either warn of deflation, or else have concluded that the U.S. is closer to deflation than inflation.

Second, I made predictions of an inflationary depression in America’s Financial Apocalypse. I came to this conclusion because I felt the Federal Reserve would continue to try to print its way out of the mess as it had in the past. In my opinion, there was no way the Fed would permit deflation of any significant duration. As well, I studied inflation trends and other data prior to forming my conclusion.

I stated that if things got really bad the U.S. would experience periods of deflation. But the longer-term trend would be that of massive inflation, which is much different than hyperinflation. Other than brief deflationary periods which follow crises (which we saw in late 2008 and early 2009), the Fed has at its disposal the ability to flood banks with money. This would prevent a lasting period of deflation. This is the Fed’s game plan. But the Fed’s debasement of the dollar will not lead to hyperinflation.

I might end up being wrong about the duration of deflation we are likely to encounter over the next several years, although I do not (currently) anticipate this to be likely. But I can tell you I am 100% confident that the U.S. will not enter hyperinflation, at least in our life time.

You might want to compare my track record with Faber’s, Schiff’s or anyone else who has made these claims before you decide whose “100%” is likely to be valid. But don’t forget to account for those of us who may or may not have financial agendas tied to the price of gold and the absolute and permanent collapse of the dollar. If you are not closely monitoring track records and agendas, you’re walking into a landmine thinking you’ve been given a safe route by guys who face no danger.

Third, I am not an inflationist. I have no agenda for holding firmly onto my forecasts for inflation. Unlike others, I am not pitching an investment strategy that relies on sticking with an underlying macroeconomic theme. I am not a salesman. I report what I see based on the continuous research I conduct. If I determine that hyperinflation will become a possibility, I will state this to be the case.

Fourth, I do not sell gold or silver and I do not receive any compensation for gold, silver or any other ads. Moreover, I do not sell securities. Thus, my views on inflation and deflation are untainted. In fact, many of my investment recommendations stand to perform much better if the U.S. experiences hyperinflation. My only goal is to navigate the economic environment and capital markets in a manner that positions my clients ahead of the curve.

If the Federal Reserve is determined to print its way out of this depression, why won’t hyperinflation occur in the U.S.?

First, with very rare exception, hyperinflation has been the worst economic consequence of destabilized (politically and/or economically) second and third world nations. While the U.S. certainly has a good deal of issues to resolve, it is very far from resembling a destabilized second or third world nation.

Second, in order to experience hyperinflation a nation must flood astronomical amounts of currency into the banking system rapidly and continuously. Conservatively, I would define hyperinflation as a long duration of increasing levels of inflation at 30% to 40% per month. Many others have defined it at higher levels.

Moreover, this flood of currency must be made widely available to consumers and businesses so that demand for goods is dwarfed by the available supply. As we know, despite the printing of currency over the past two years, very little has reached consumers and businesses. Finally, this demand must continue to increase each month at a very high rate.

Although U.S. banks have not provided credit to businesses and consumers in proportion to the amount that has been issued by the Federal Reserve, inflation has been increasing throughout the globe due various stimulus packages, the carry trade and other forms of speculation by banks and other financial institutions. But still, we do not even see any sign of massive inflation at this stage, although I feel it is very likely in the future.

What is the definition of massive inflation?

It depends on who you ask and the nation under consideration. In my opinion, massive inflation would resemble what the U.S. faced in the late 1970s and early 1980s, which is not even in the same universe as hyperinflation. Alternatively, we could experience a more protracted but less severe period of inflation. Either way, hyperinflation in the U.S. is not a reasonable possibility in our life time.

Third, the Federal Reserve is able to print an excessive amount of currency without creating a proportionate increase in the inflation rate because of two factors. First, the U.S. runs trade deficits with much of the world. This is especially the case with Asia. This alone serves to export inflation out of the U.S. This dynamic is aided by the dollar-oil link. Second, China’s currency peg has actually diminished the chances of a hyperinflationary event in the U.S. While China will eventually lift this peg, it will be a gradual process. Even if both of these relationships were to change abruptly, they would not lead to hyperinflation.

Why?

The principal force making hyperinflation a virtual impossibility in the U.S. is the dollar-oil link. As a consequence of this link, it could be argued that the dollar is not exactly a true fiat currency. At the same time, the dollar is not backed by a finite asset directly under its possession, although the Saudis realize that any threat to decouple the dollar from oil sales would be met with very severe and immediate consequences. Therefore, the U.S. has a good deal of influence in maintaining this vital economic link.

Regardless whether or not you consider the dollar a true or partial fiat currency, the end result remains the same. The dollar-oil link enables the U.S. to print an excessive amount of currency without a proportionate increase in inflation. Since the dollar is used to buy oil throughout the world, the U.S. actually exports a good deal of the inflation created by the Federal Reserve. Similar to others who fail to understand the importance of the dollar-oil link, Williams concludes that the fiat currency in the U.S. combined with the reckless actions of the Federal Reserve will lead to hyperinflation.

“With the creation of massive amounts of new fiat dollars (not backed by gold or silver) will come the eventual destruction of the value of the U.S. dollar and related dollar-denominated paper assets.” (p.4 paragraph 1)

Large amounts of inflation, such as that seen during the late 1970s and early 1980s can be managed through prudent monetary policies of the Federal Reserve. Hyperinflation, by contrast signals the end of the currency. While I feel the dollar still has a considerable amount of downside over the next few years, it isn’t destined for use as toilet paper unless Washington and the Fed decide this as its fate. And if you believe that to be the case, you’re likely to be a bit too conspiratorial for your own good.

Let’s consider some additional points that add to this argument. The U.S. has the most powerful and aggressive military force in the world combined with the most advanced technological resources money can buy. No one can dispute that. In the end, the currency of a nation is not only backed by the perception of a nation’s ability to repay its creditors, but also by the ability of these creditors to force the indebted nation to repay its loans.

In addition to the very strong link between the dollar and oil, the dollar is also linked to commodities markets worldwide. That means is that you cannot buy commodities without the dollar. This too has made the dollar the world’s universal currency. Without the dollar’s link to commodities, the U.S. would surely experience extraordinarily high levels of inflation. The extent of inflation would depend not only on the Federal Reserve’s monetary response, but also the response of the U.S. military.

Thus, due to the dollar-oil link, it is the Middle East rather than China that ultimately controls the U.S. economy. The members of OPEC know this. Accordingly, if the dollar-oil link were threatened, Washington would send troops to Saudi Arabia immediately, and the Saudi Royal family is well aware of this.

The vital importance of the dollar-oil link to the U.S. economy explains why Iran has formed its own oil exchange opting for other currencies, and has tried (without any level of success) to encourage other OPEC members to do the same.

Saddam Hussein did the same thing in 2000, requiring payment in euros for Iraq’s oil. And we saw what happened to him. As you might imagine, Iran’s efforts to severe the dollar-oil link have served as the primary impetus for Washington’s campaign to find a way to justify military actions against Iran.

Finally, if for whatever reason the dollar-oil link were severed or even weakened, the Federal Reserve would alter monetary policy to adjust to the more vulnerable position of the dollar. Incidentally, quantitative easing represents one of the ways the Fed is positioning to protect against the possibility of a global dump of dollars.

To support his prediction of hyperinflation, Williams first points to numerous events in the past. He implies these events serve as evidence of the misguided path taken by the Federal Reserve.

“…Recognizing that the U.S. economy was sagging under the weight of structural changes created by government trade, regulatory and social policies -- policies that limited real consumer income growth -- Mr. Greenspan played along with the political and banking systems. He made policy decisions to steal economic activity from the future, fueling economic growth of the last decade largely through debt expansion... Complicit in this broad malfeasance was the U.S. government, including both major political parties in successive Administrations and Congresses. As with consumers, the federal government could not make ends meet while appeasing that portion of the electorate that could be kept docile by ever-expanding government programs and increasing government spending. The solution was ever-expanding federal debt and deficits.” (p.2, paragraphs 2-4)

“The U.S. economy is in a deepening structural change that has resulted from U.S. trade, social and regulatory policies driving a goodly portion of the U.S. manufacturing and technology base offshore. As a result, a large number of related, high paying jobs have disappeared for U.S. workers. Accordingly, U.S. consumers have found increasingly that their household incomes fail to keep up with inflation. Without real growth in income, there cannot be sustained economic growth...” (p.13, paragraph 2)

While the statements made by Williams are largely true, his hyperinflationary scenario is not valid. Among his other poorly-formed arguments, Williams bases this scenario on the assumption that nothing will ever be done to curb spending, cut entitlements and raise taxes. These are predictions I laid forth in America’s Financial Apocalypse. While these actions will certainly have negative ramifications for economic growth and living standards, they represent a good portion of the required changes; changes that will definitely be made.

Williams goes on to conclude that the U.S. will face a hyperinflationary great depression. He claims this will cause a “likely realignment of the U.S. political environment.” (p.2, paragraph 1)

What Williams fails to understand is that there will be no political system collapse as long as the media is able to keep Americans brainwashed to think they have a real democracy. In reality, the U.S. political system has resembled a fascist regime for several decades. The latest example of the media’s control over Americans can be seen by the farce of the Tea Party movement, which has gone from being a group of angry Americans that sought to fight against the Washington mafia, to a group of largely republican supporters.

I summed up the current state of the U.S. in a recent article discussing America’s Second Great Depression…

“Regardless who is in office, these criminally destructive policies will continue as one would expect with any fascist nation. Although the definition of fascism is not clearly agreed upon by many authorities, I use the definition embraced by Benito Mussolini, which attributes fascism as a partnership between government and corporations. This is similar to corporatism, a political system whereby legislative authority is provided to corporate bodies representing economic, industrial and professional groups. Rather than the people, these corporate bodies dictate the laws of the nation.

This is precisely what we see in the U.S., with CEOs of the Fortune 50 wielding more power than any senator or congressman. Corporations exert their control over Washington via huge sums of money shuttled to politicians by lobbyists. Moreover, the corporate giants provide Washington with often illegal if not unconstitutional access to the nation’s backbone, whether it is in the telecommunications, railway and air transport, or banking sectors. In return for these favors, Washington permits these corporate giants to engage in monopolistic expansions, thereby destroying small businesses, in order to eliminate competition so that they gain complete control over pricing of their goods and services.” [25]

A great depression has in my opinion already commenced. However, it will be an inflationary depression, as opposed to one caused by hyperinflation. This depression is not purely a consequence of the financial crisis, nor is it due to the inherent weakness of the dollar. It is a complex myriad of chronic problems that have accumulated over many years. While Williams lists many of these problems (trade, healthcare, entitlements, income disparity, etc.) he fails to make the necessary links. Therefore, in my opinion he fails to understand the full complexity and unique characteristics of this depression. As well, his conclusions are based on the assumption that Washington will never make the required changes.

Williams insists that a “massive economic collapse” will push America into a “hyperinflationary depression.” We already witnessed a massive economic collapse in 2008. But further economic demise is not likely to come in the form of a collapse per se, but rather through less conspicuous forces.

Washington and the Federal Reserve will do all that’s required to prevent another collapse similar to the magnitude we experienced in 2008. However, these actions will serve to spread the effects of this depression over many years if not decades. While the severity of this depression will be contained in any given year, its duration will be very long. In short, the U.S. faces a silent depression as I have discussed in the past.

The Silent Depression (originally published on September 10, 2008)

"In a few years, the real estate and banking crisis will have cooled off and Washington will start reporting much improved numbers; numbers that will continue to be manipulated.In reality, things will only get worse. Real wages won’t budge, inflation for basic necessities will remain high and most likely be higher, and job quality will continue to decline. It will be a silent depression because there will be no crisis.You won’t feel the full effects on any given day. If you’re in the lucky majority, you will go to work and carry out your life as usual. But you just won’t be able to make ends meet like in the past. Each year things will get worse so you’ll spend more on credit.It will be more difficult for your children to raise their income status because higher education is becoming an unaffordable luxury for the wealthy. Millions will be stuck in slave labor, working for low wages and no benefits. And they won’t be working in factories churning out goods for the global economy. They will be working in service jobs, tailoring to the needs of America’s wealthy.And when you retire, only then will you realize that you’ve lived through a depression because you will run out of money. If you are lucky enough to have a home, you might have to end up selling it to pay for your medical bills, even if you have health insurance. The smaller minority will have a much worse fate."Reference: The Plain Truth

Next, Williams describes a hyperinflationary scenario consisting of one of the most severe and rapid elevations of inflation seen in centuries. He attributes this scenario to the historical precedent faced by fiat currencies. What Williams fails to mention is that currencies backed by gold have also collapsed.

“The circumstance envisioned ahead is not one of double- or triple- digit annual inflation, but more along the lines of seven- to 10-digit inflation seen in other circumstances during the last century. Under such circumstances, the currency in question becomes worthless, as seen in Germany (Weimar Republic) in the early 1920s, in Hungary after World War II, in the dismembered Yugoslavia of the early 1990s and most recently, in Zimbabwe where the pace of hyperinflation may have been the most extreme ever seen. The historical culprit generally has been the use of fiat currencies -- currencies with no hard-asset backing such as gold -- and the resulting massive printing of currency that the issuing authority needed to support its spending, when it did not have the ability, otherwise, to raise enough money for its perceived needs, through taxes or other means.” (p.5, paragraph 2-3)

Now let’s have a look at some of the terms Williams defines.

“Hyperinflation: Extreme inflation, minimally in excess of four-digit annual percent change, where the involved currency becomes worthless. A fairly crude definition of hyperinflation is a circumstance, where, due to extremely rapid price increases, the largest pre-hyperinflation bank note ($100 bill in the United States) becomes worth more as functional toilet paper/tissue than as currency.” (p.5)

“Depression: A recession, where the peak-to-trough contraction in real growth exceeds 10%.” (p.6)

“Great Depression: A depression, where the peak-to-trough contraction in real growth exceeds 25%.” (p.6)

Once again Williams consistently makes inaccurate assumptions. A depression is NOT defined solely by the extent of a recession. It is a much more complex socioeconomic period filled with one or more severe recessions. But it is also characterized by lasting socioeconomic effects and widespread feelings of loss of hope for the future.

Williams then publishes a quote from a law professor (which I suppose is meant to offer credibility) describing the hyperinflation that occurred in Germany’s Weimar Republic during the early 1920s…

“It was horrible. Horrible! Like lightning it struck. No one was prepared. You cannot imagine the rapidity with which the whole thing happened. The shelves in the grocery stores were empty. You could buy nothing with your paper money."

He then insists that the U.S. will face a similar fate.

“The hyperinflation in Germany's Weimar Republic is along the lines of what likely will unfold in the United States.” (p.7, paragraphs 1-2)

Later, he states that the situation in present day U.S. is even worse than in Weimar, implying that the U.S. will face a more severe level of hyperinflation.

“The Weimar circumstance, and its heavy reliance on foreign investment, was closer to the current U.S. situation than it was to the U.S. Civil War experience. In certain aspects, the current U.S. situation is even worse than the Weimar situation. It certainly is worse than the Civil war circumstance.” (p.9, paragraph 3)

Of all of the things Williams gets wrong, perhaps his most sensational statement is his estimate of the pace of his hyperinflationary scenario, implying that it will be worse than the hyperinflation faced by Zimbabwe. Williams is basically saying is that the dollar will become worthless within a year. His argument is as follows. Zimbabwe ran a black market for U.S. dollars which cushioned the effects of its hyperinflation to some extent. Well sure it did because the dollar is not truly a fiat currency; again, it’s linked to oil and commodities.

“What helped to enable the evolution of the Zimbabwe monetary excesses over the years, while still having something of a functioning economy, was the back-up of a well functioning black market in U.S. dollars. The United States has no such backup system, however, with implications for a more rapid and disruptive hyperinflation than seen in Zimbabwe, when it hits. This will be discussed later.” (p.10, paragraph 4)

Does this comparison with Zimbabwe sound familiar?

Perhaps you have heard others (Peter Schiff and Marc Faber) make similar comparisons.

Williams goes on to mention the fact that oil prices are denominated in U.S. dollars. While he explains that the debasement of the dollar has led to rising oil prices, he does not carry this argument forward. For instance, if the U.S. were to experience hyperinflation, oil would the absolute best asset class to protect against the collapsing dollar. Instead, Williams positions gold as a good hedge against a worthless dollar despite the fact that gold has no economic relationship to the dollar.

“Inflationary pressures have started to surface from the Fed's efforts at dollar debasement. A weakening U.S. dollar has placed upside pressure on dollar-denominated oil prices, which in turn have begun pushing annual inflation higher. This is not inflation generated by strong economic demand, but rather inflation driven by Federal Reserve efforts to weaken the dollar.” (p.16, paragraph 3)

Williams goes on to discuss how the dollar has lost the vast majority of its buying power over the past several decades due to the effect of compounding inflation. But he fails to mention the same thing all gold bugs never discuss. While inflation has increased, wages have also increased. Certainly, median incomes have not kept up with the rate of inflation for a few decades now. However, Williams has greatly exaggerated this disparity. To highlight his misguided view of inflation, it would appear that he intentionally left out data on rising median incomes over his selected time frame.

Williams points to periods of deflation after the Great Depression; 1949, 1955 and 2009. However, he missed the period of deflation during the dotcom recession in 2001. As well, deflation was present in late 2008 to early 2009. Missing these obvious deflationary periods also calls into question his credibility in my view.

“Allowing for minor, average-annual price-level declines in 1949, 1955 and likely 2009, the United States has not seen a major deflationary period in consumer prices since before World War II. The reason for this is the same as to why there has not been a formal depression since before World War II: the abandonment of the gold standard and recognition by the Federal Reserve of the impact of monetary policy -- free of gold-standard system restraints -- on the economy.” (p.21, paragraph 4)

“In the case of the United States, however, significant dollars are held outside the country, where shifting dynamics may have significant impact on U.S. inflation...” (p.25, paragraph 1)

“Separately, as reported by the Fed in its second-quarter 2009 flow-of-funds analysis, foreign holders of U.S. assets have something in excess of $10 trillion in liquid dollar-denominated assets that could be dumped at will into the global and U.S. markets. In perspective, U.S. M3 is somewhat over $14 trillion.” (p.25, paragraph 3)

What Williams fails to point out is that the majority of foreign-based dollar-denominated assets are held by America’s closest allies and the international banking cartel which owns the Federal Reserve.

Many people know that China is the number one holder of U.S. Treasuries. But most people do not realize that Japan (a very strong ally of the U.S.) is a very close second, followed by the UK (another very strong ally). Moreover, the UK has increased its holdings of U.S. Treasuries by 500% over the past 16 months, demonstrating it is committed to providing maximal support for the U.S. if needed.

Williams goes on to mention unsubstantiated claims regarding a new currency, although he does not state his source. While he might be referring to the proposed new currency that would unite Canada, the U.S. and Mexico under the North American Union, these plans have nothing to do with a means to fight or react to hyperinflation, but rather as a response to global trade. This adds further doubt regarding the credibility of his analysis and conclusions.

“Conspiracy theories of recent years have suggested the U.S. Government already has printed a new currency of red-colored bills, intended for some dual internal and external U.S. dollar system.” (p.33, paragraph 3)

Williams then discusses how “gold and silver would be primary hedging tools” for the worthless dollar. But once again he fails to mention the significance of dollar-oil link. He goes on to suggest that a global currency could utilize a gold standard. But this contradicts his premise that the Federal Reserve would not relinquish the fiat currency system.

“In a hyperinflation, gold and silver would be primary hedging tools that would retain real value and also be portable in the event of possible civil turmoil. At some point, the failure of the world's primary reserve currency will lead to the structuring of a new global currency system. I would not be surprised to find gold as part of the new system, structured in there in an effort to sell the new system to the public.”

It is clear to me that Williams is playing into the hands of conspiracy theorists who disseminate false information through ignorance, or for the purpose of pumping up and/or selling gold. Adding this conspiracy caveat broadens his appeal as a go-to guy for media interviews.

Conspiracy theorists spot a conspiracy to explain everything. While many conspiracies have validity, it is important to distinguish between career conspiracy theorists and those who determine a conspiracy is present after conducting independent research.

Williams does not list foreign currencies as a hedge against his hyperinflationary predictions. Rather, he states that foreign currencies would be “a plus.” This seems odd since he claims that hyperinflation will be largely restricted to the U.S.

“Having some funds invested offshore -- outside of the U.S. dollar -- would be a plus in circumstances where the government might impose currency or capital controls. I look at the Swiss franc, the Canadian dollar and the Australian dollar as currencies likely to maintain their purchasing power against the U.S. dollar.” (p.34, paragraph 5)

As one of the central arguments to support his prediction of hyperinflation, Williams points to the unfunded liabilities from the nation’s entitlements programs. Anyone who read America’s Financial Apocalypse (extended version) is likely to agree that I understand this issue at least as well as anyone who addresses it these days because I discussed it extensively well before it became a daily topic of concern.

As a result of the deficit in the entitlements, Williams estimates a 2009-GAAP deficit at around $9 trillion. However, this number arises from accounting for annual funding of the entitlements deficit, which (according to the deficit he reports) spans about 75 years. However, he counts these liabilities as they would appear on the annual budget deficit by assuming all future benefits and taxes will be held constant. Thus, he is assuming no changes will be made to these programs.

I discussed the entitlements problem in America’s Financial Apocalyse. Bush removed GAAP accounting due to the argument that is not appropriate for governments because they can at any time decide to alter these agreements. However, I made the point that it would lead to tax increases and benefit cuts. These actions would add to the pain experienced during America’s Second Great Depression rather than a continuation of current entitlement benefits and tax rates, which as Williams suggests, will lead to hyperinflation.

“…the Bush Administration (as likely will continue to be the case with the Obama Administration) argued that unfunded Social Security and Medicare obligations should remain off the government's balance sheet, claiming that the government always has the option of changing the Social Security and Medicare programs. That said, there still is no political will in Washington to go public with the concept of eliminating or substantially cutting those programs.” (p.28, paragraph 2)

“Total federal debt and obligations at the end of the 2009 fiscal year on September 30th, likely were close to $75 trillion, or more than five times total U.S. GDP. The $75 trillion includes roughly $12 trillion in gross federal debt, with the balance reflecting the net present value of unfunded obligations.” (p. 28, paragraph 5)

Williams makes the wild assumption that politicians will refuse to make needed cuts to these programs. Thus, he is assuming that the political will to act with prudence will never materialize. If absolutely nothing is done to rein in these entitlement expenditures, of course the U.S. would face hyperinflation. But that’s like saying you’re going to get killed because you are standing in the exact spot in the street at the time when a truck is scheduled to pass through the exact spot you are standing 30 years from now. Unless you are insane, if you know the truck is coming, you will move out of the way. While Washington may be filled with criminals, they are not insane.

Washington realizes the entitlements are a big problem. While they have not yet offered any real solutions, changes will come regardless how much pain it will bring to tax payers and beneficiaries.

Even assuming the unlikely scenario that politicians will never make the needed changes, it would be impossible for hyperinflation to occur in the time frame Williams predicts, or between sometime in 2011 and 2014.

The only chance of seeing hyperinflation in the U.S. prior to around 2035 would be if Washington and the Fed wanted to create it intentionally by ignoring any changes to entitlements, all while continuing to print money. To assume this as a possibility would in my opinion require a heavy dose of hallucinogens, or else financial alignment with gold dealers and/or their associates.

While I addressed the possibility of the Fed intentionally creating a good deal of inflation (America’s Financial Apocalypse) in order to pay off the massive and rapidly growing national debt, there is a very big difference between large or even massive inflation and hyperinflation.

Yet, as I have discussed since the release of this book, gold does not protect one against inflation. Given that hyperinflation represents a different beast, namely a protracted and catastrophic economic crisis, gold would in fact serve initially to protect against a rapidly devaluing currency. However, I would not expect this relationship to hold long-term. As hyperinflation established itself as a trend, people of the nation would care more about obtaining food, water, guns and bullets.

Some might add that gold and silver would be used in a barter system, as Williams and other gold bugs have claimed. Williams even discusses that liquor would be used in America’s upcoming barter economy as the dollar becomes worthless.

“…Gold and silver both are likely to retain real value and would be exchangeable for goods and services. Silver would help provide smaller change for less costly transactions. One individual I met indicated that he had found airline bottles of scotch to be ideal small change in a hyperinflationary environment.” (p.33, paragraph 7)

“Other items that would be highly barterable would include bottles of liquor or wine, or canned goods, for example.” (p.33, paragraph 8)

When you are starving and food is scarce, would you really trade a loaf of bread, can of corn or beans for gold?

In such an apocalyptic scenario, I could see liquor being used for barter before gold and silver. But if liquor is likely to be used for barter, why not just stock up on cases of Jack Daniels rather than buy gold and silver?

Over the long term, alcoholic beverages are likely to retain their value better than gold. The only problem here is how to sell it legally when the dollar doesn’t collapse. If you don’t have a liquor license, you’ll be out of luck.

Perhaps if Williams was able to benefit financially by promoting liquor as a means of barter as the dollar became worthless, he might position it as a hedge against hyperinflation just as he has done with gold.

Williams fails to discuss is the fact that the U.S. serves as the food source for much of the world. Washington has already provided food for some 43 million Americans as a part of the various food stamp programs. Thus, if we can even stretch the limits of imagination to include a hyperinflationary situation in the U.S. (using the assumption that the Saudis got OPEC to severe the dollar-oil link and Washington refused to invade Saudi Arabia in response) food and water prices, while certain to skyrocket, would be subsidized by Washington. Thus, in a scenario whereby hyperinflation swept the nation, Americans would not be running around fighting for food and water. Even if this happened, I can’t see people willing to trade food for gold or even alcoholic beverages.

Williams goes on to make another critical error when he states that hyperinflation would be “largely a U.S. problem.” I suppose he is unaware of the importance and ubiquitous use of the dollar in global commerce and banking, as well as its firm position as the only currency accepted in the two largest oil futures markets.

“While the economic difficulties would have global impact, the initial hyperinflation should be largely a U.S. problem, albeit with major implications for the global currency system.” (p.4, paragraph 3)

Moreover, Williams seems to be unaware of what is happening in Europe. If hyperinflation has any possibility of occurring it will be in nations with their own currency detached from the Fed such as Russia. Europe, on the other hand, faces the risk of a long period of deflation, joining Japan’s long stretch.

Through his own admission, Williams seems to get many of his ideas from one particular book written by Ralph Foster, a gold and silver coin dealer who lives in the same area of California as Williams. This book discusses the collapse of fiat currencies since the 11th century. But Williams fails to mention that currencies backed by gold have also collapsed. Perhaps he has failed to make mention of this because he used Foster as his primary if not sole source of information on currencies. Foster deals in gold and silver coins. This makes him biased, and he stands to gain financially through his views.

Williams also fails to point out that during the Great Depression nations that left the gold standard recovered from the depression more rapidly than nations that continued to use gold to back their currency. It is likely that the reason for this was due to the fact that when severe economic conditions materialize, printing more money than dictated by gold reserves can help restore the economy.

However, if excessive amounts are printed and not withdrawn in a timely manner, instead of a deflationary depression, a hyperinflationary depression is a possibility, although not necessarily a certainty. Excessive currency printing can also lead to another asset bubble.

While hyperinflation is a possibility, it can only occur when additional elements of economic and/or political destabilization are present. Such elements are only seen in destabilized second or third world nations. And it certainly cannot occur with a currency that is linked to oil and other commodities.

In making these comparisons without factoring the uniqueness of the dollar is inaccurate and irresponsible in my opinion. Even with elements of severe economic destabilization, hyperinflation is highly unlikely to materialize in the U.S. due to the unique advantages offered by the dollar-oil link. However, certain politically destabilizing events could lead to hyperinflation, namely events that severe the dollar-oil link, but only if the U.S. did not have a means to definitively combat these actions with its military.

Ultimately, it’s not whether the dollar is backed by gold or anything else. What matters most are those who control the printing. Sure, the Fed has been criminally irresponsible. Sure, I would prefer a currency backed by something, although I’m not sure gold is the solution. But anyone who feels the Federal Reserve would willingly give up its control over monetary policy or impose activities that threaten to dissolve its power simply isn’t thinking straight.

In conclusion, the U.S. is likely to experience a significant amount of inflation in coming years. However, due to the dollar-oil link much of the globe is likely to experience a greater amount of inflation. We are seeing the early stages of this inflationary trend today.

Regardless whether you believe the U.S. will experience massive inflation or even hyperinflation, the best protection is oil and other commodities, not gold. But even oil and commodities will not keep rising forever, as many believe. These are facts that all credible investment professionals realize. The problem is that one rarely hears credible investment professionals pitching gold; the ones that do work for firms which deal in gold.

Everything in the universe runs in cycles. Some cycles are larger and longer than others. And the oscillations through each cycle are never exactly the same. That said, anyone who thinks they can predict macroeconomic events or even stock market corrections using Elliot waves and similar devices is very misguided. Such things are not that simple to predict. Once you understand the economics of commodities, gold and publicly traded corporations, you will be one step closer toward understanding how to position each asset within your investment strategy. But of course, there is much more to the picture than this.

Why Would Williams Issue this Hyperinflation Warning?

I cannot say for certain. Williams has spent a good deal of his life reporting changes to economic methodology. A good deal of his efforts have focused on inflation. Thus, he is an inflationist. Recalculating inflation data based on previously used methods is not something that requires much expertise. It’s little more than book keeping. And it certainly does not qualify you as an investment or market strategist.

Alternatively, perhaps Williams is trying to create drama because he knows his scare tactic will generate media attention. As I have previously discussed, the media makes a huge amount of money from gold ads. Williams’ induction into the gold bug club has provided him with media exposure he would have otherwise not received. Thus, he has benefited from boosting his exposure.

I want you to keep Mr. Williams’ report in a filing cabinet so you can learn firsthand the importance of documenting track records, because hyperinflation simply isn’t going to happen; not in the U.S. anyway. You should also write down similar statements made by Faber, Schiff and others.

In closing, if all of these gold dealers and other gold bugs really believe hyperinflation is inevitable in the U.S., you need to ask them the following two questions.

(1) Why are gold dealers spending tens of millions of dollars on ads, PR and endorsements trying to convince you to buy it if it’s going to the moon? Why don’t they just hoard it for themselves?

(2) If Williams, Schiff or Faber really believe hyperinflation is a certainty, ask them if they are willing to place a large bet with me, you or anyone else. It would be the easiest money I ever made. Of course they don’t need to risk losing money on such a bet. All they need to do is keep the sales pitch up. Doing so will land them money regardless where gold prices head.

Responsible financial professionals who hold a bias for a particular investment should be willing to debate with qualified and credible experts with opposing views instead of going up against bozos they are faced with in the media. If this were done, the mission of most of these individuals would be threatened, as their goal is not to be right, but to sell you greed and fear because this represents a guaranteed return on their investment. Unfortunately, many investors are on the buying end of this sales pitch and do not have the luxury of fattening their wallet by selling delusions of hyperinflation and gold as the investment solution.

I predict that Williams will continue to update his reports for many years to come as he awaits the appearance of a hyperinflation ghost that will never materialize. Other gold hacks are likely to follow with their own revisions and excuses. Either way, two things are certain to me.

(1) Gold dealers will come out of this as winners because they get paid regardless where the price of gold heads.

(2) Once the gold bull market ends, many people will be stuck holding the bag, as they wait and hope for gold to recover. Eventually many of the sheep will end up selling at a loss after waiting for many years with no recovery in gold prices.

Although I have discussed the importance of the dollar-oil link on numerous occasions, many people still seem to underestimate its critical role in the U.S. economy. Because people instinctively side with numbers more than rationale, the flooding approach has served to misguide Main Street. I have warmed many times that Main Street will only have itself to blame for losses if they pay attention to the media.

My views have been banned by the media and virtually the entire Internet, which has further served to diminish my voice.

Why have I been banned?

You see, the Internet crowd is much like the broadcast and print media. They have financial agendas. On the Internet, much of what you come across are followers. These followers preach the same thing they hear and read elsewhere. Some of these followers have fallen into the trap of believing something based on the number of people that have written it, similar to the effect that occurs when many people keep saying the same thing over and over.

Many more of these followers are simply trying to make money by promoting the delusions of gold as a form of currency and claims of imminent hyperinflation. If they aren’t in the business of selling gold directly, they are either aligned with these individuals or else they are making money from gold ads. As a result, they refuse to allow an open and free exchange of viewpoints regarding gold, hyperinflation or anything else associated with their sales pitch. This explains why you rarely see a balanced view of gold and other issues.

It’s all about money; money that comes from you and goes to them. This is the reality. If you do not yet understand how the game is played, I strongly advise you to wake up because this is the way things have always been. And it’s not going change because it represents a gravy train for those involved in this deceit. The only way to combat this exploitation is through rationale. Only through rationale will you be able to side-step the trap.

In the future, I would like to advise the SEC and CFTC to work with Congress to establish new laws requiring publishers of economic and financial material to disclose all payments and other arrangements that offer some type of benefit from related sources, much as the current law requires for securities promotion and analyst research.

One could argue that those who receive compensation from promoting gold are held to current securities laws since gold is now a tradable security in the form of ETFs. In fact, depending on how severe the gold bull market blows up, we could see a wave of gold bugs being penalized by the SEC down the road.

Virtually every gold bug who publishes material on the economy, gold and other related topics is receiving financial compensation and/or promotion leading to compensation for pumping gold and scare tactics of hyperinflation. In my opinion, this is misleading and unethical, if not illegal.

I encourage you to spread this article around so Main Street can see the flip-side of the gold picture.

Have a look what Kitco's own senior gold analyst had to say about this article. Click here.

I invite you to join other subscribers who wish to become great investors, as they learn how to navigate the financial landmines that promise to be commonplace for years to come. The best way to achieve this difficult task is to subscribe to one of our investment newsletters.

.png)

To see what you get with AVAIA Membership, check the Membership Resources, including 10 Special Bonuses being offered.

Click here to sign up and submit payment

Can anyone offer adequate evidence that there is someone who is a better market and overall investment forecaster than Mike?

So why does the media continue to BAN Stathis?

.png)

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

__________________________________________________________________________________________________________________

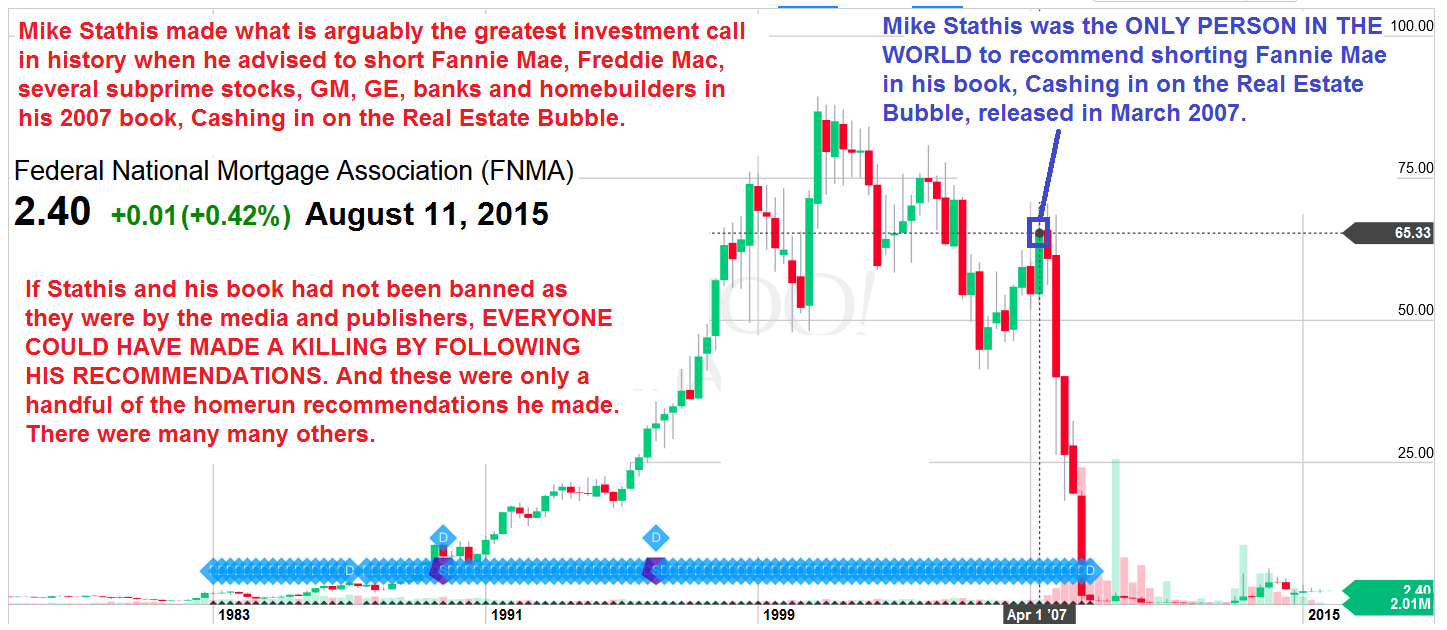

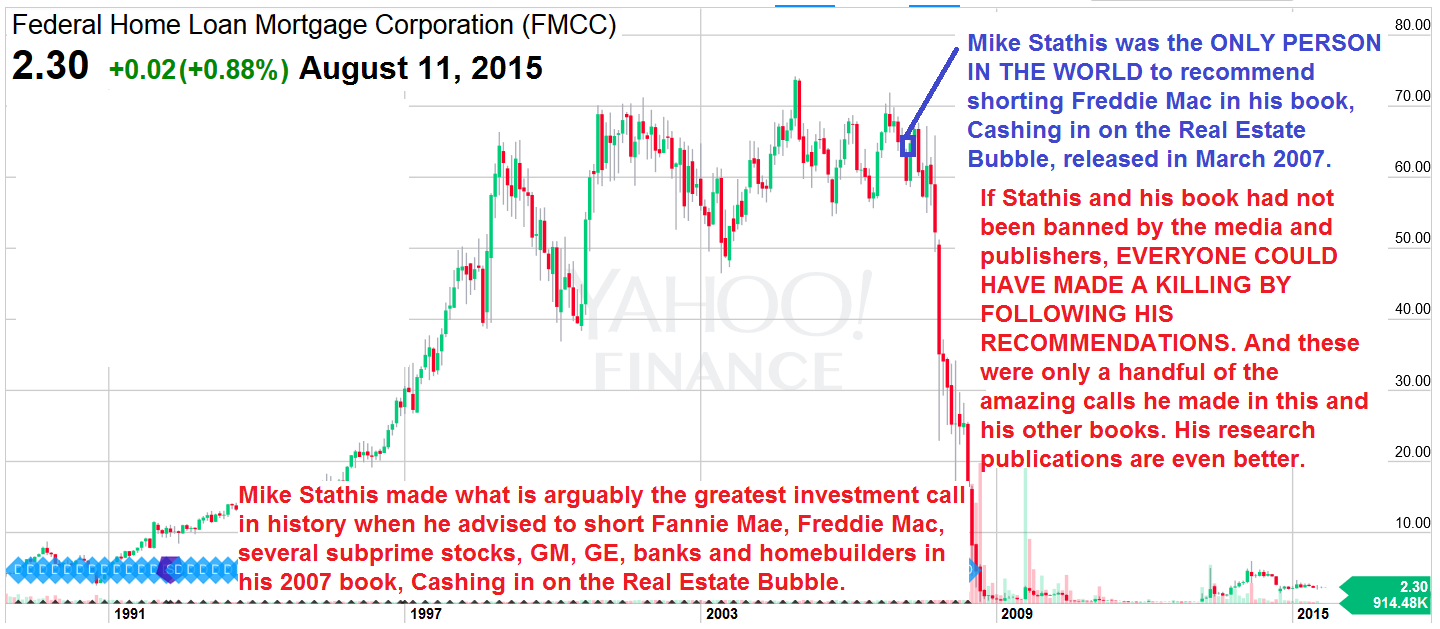

Mike Stathis holds the best investment forecasting track record in the world since 2006.

This is the chapter that shows where Mike recommended shorting Fannie, Freddie, sub-primes, homebuilders, GM, GE, etc.

.png)

.png)

References:

[10] /article_details-154.html

[12] /article_details-484.html

[13] http://www.businessinsider.com/marc-faber-gold-is-never-going-below-1000-an-ounce-2009-11

[14] /article_details-341.html

[15] /article_details-689.html

[16] /article_details-687.html

[17] /article_details-335.html

[18] /article_details-254.html

[20] /article_details-689.html

[21] http://money.cnn.com/2010/06/09/news/companies/simmons_gulf_oil_spill.fortune/index.htm

[22] http://money.cnn.com/2010/06/16/news/companies/matthew_simmons_bp.fortune/index.htm

[23] /article_details-589.html

[25] /article_details-668.html