Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Dividend Gems Destroys the S&P 500 Index AGAIN

Published on June 13, 2011.

Last week, we showed how the Dividend Gems Recommended Securities List was holding up through the current market correction, from the time the May issue was released, through June 2.

The performance of our Dividend Gems was quite good, as it has been since the newsletter was released in February 2011. Let’s have a look.

- 29 securities in the DG Recommended List outperformed the S&P 500 Index.

- 4 securities in the DG Recommended List performed in line with the S&P 500 Index.

- 12 securities in the DG Recommended List underperformed the S&P 500 Index.

See here for the article.

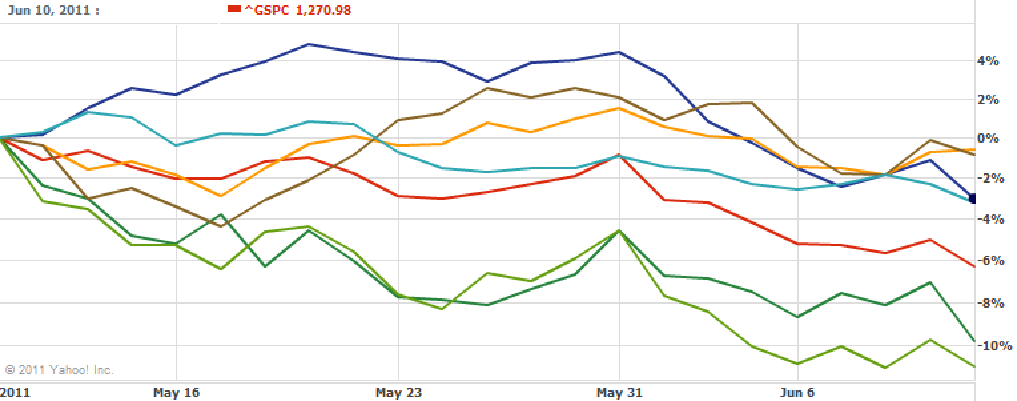

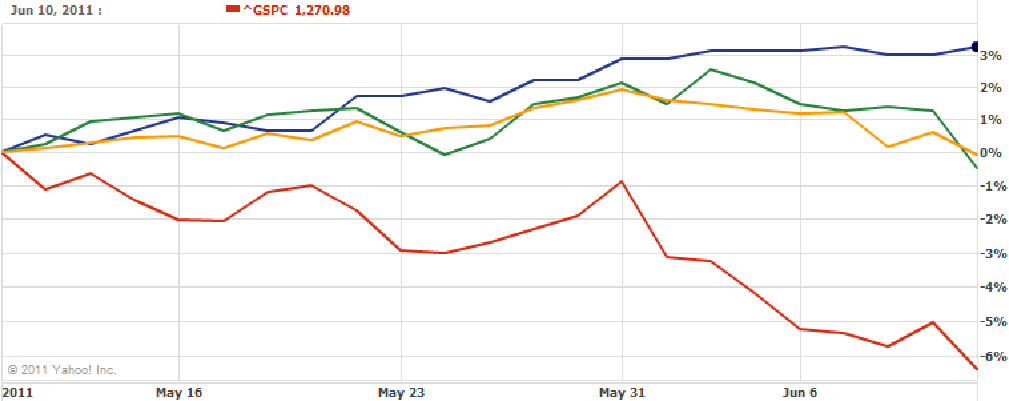

Here, we present a summary of the performance of the securities in the Dividend Gems Recommended Securities List since the May issue was released (May 9 through June 10, 2011; a full month) so you can see how our list performed versus the S&P 500 Index.

Out of the 45 securities in the Dividend Gems Recommended List,

- 34 outperformed the S&P 500 Index.

- 9 underperformed the S&P 500 Index.

- 2 performed in line with the S&P 500 Index.

Thus, the performance of the Dividend Gems Recommended Securities List over this period was quite spectacular.

In addition, of the 9 securities that underperformed the S&P 500, in the May issue, we either advised readers to trim/sell their positions, or cautioned that these securities are likely to be more bearish than others (applies to third chart, orange and brown; fourth chart, light green; sixth chart, dark green; and seventh chart, light blue).

In addition, for the 2 securities that matched the performance of the S&P 500, we advised readers to wait for a correction (first chart, dark blue), and we advised readers to trim their position (sixth chart, dark blue).

In other words, based on this guidance, 41 out of 45 securities from the Dividend Gems Recommended Securities List effectively outperformed the S&P 500 since the May issue was released.

Let’s have a look.

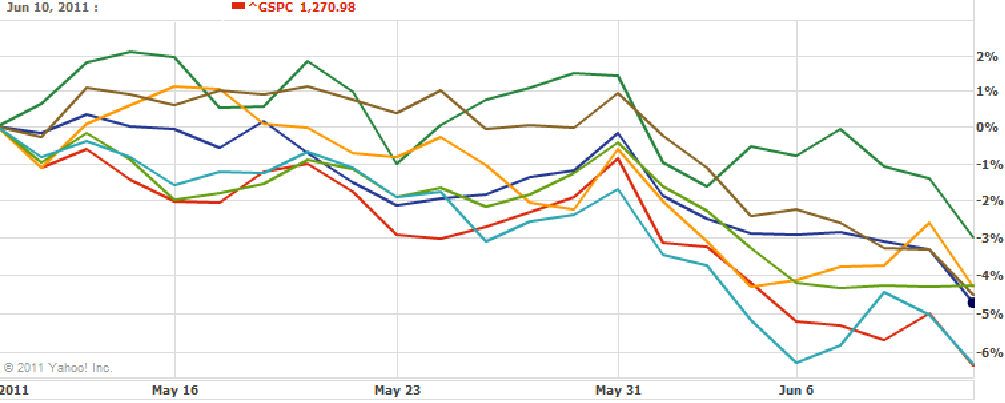

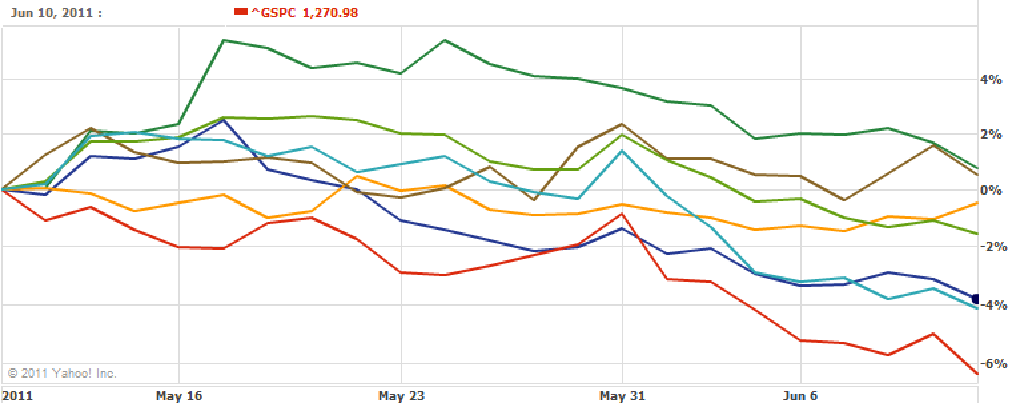

(In May issue, we warned that the light blue security above was overvalued and we provided a better alternative - light green security above)

(In May issue, we advised to trim down on the orange security and advised against buying the brown security due to overvaluation, above)

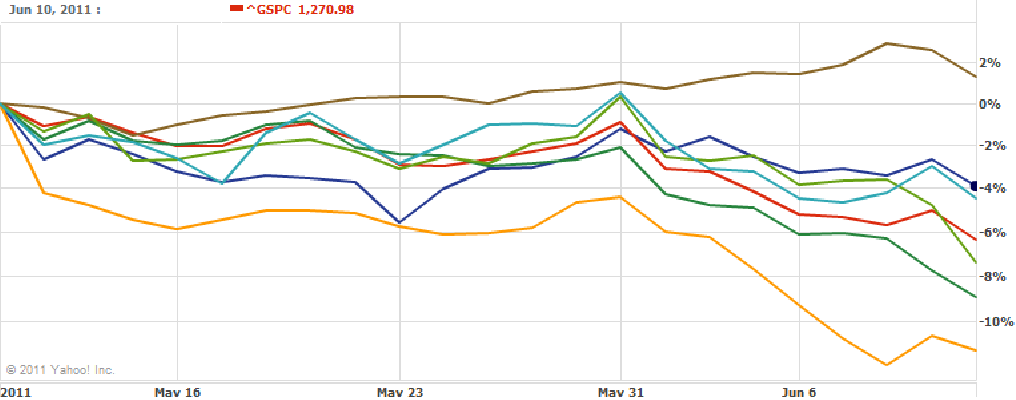

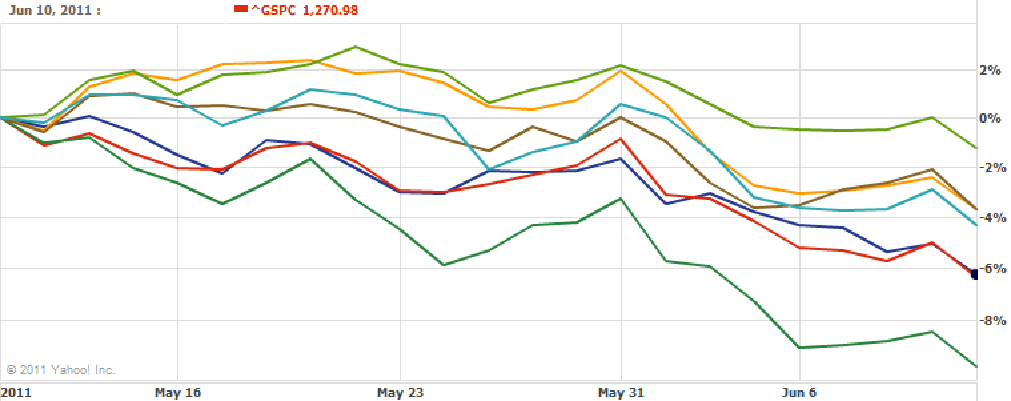

(In May issue and previous issues, we warned that the light green security was significantly overvalued)

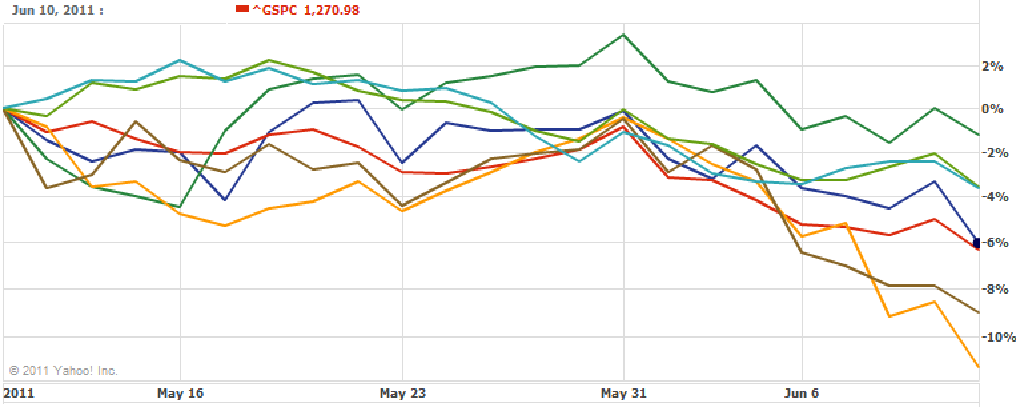

(May issue advised to trim down on the dark blue security above; advised to wait for a correction before buying the dark green security above)

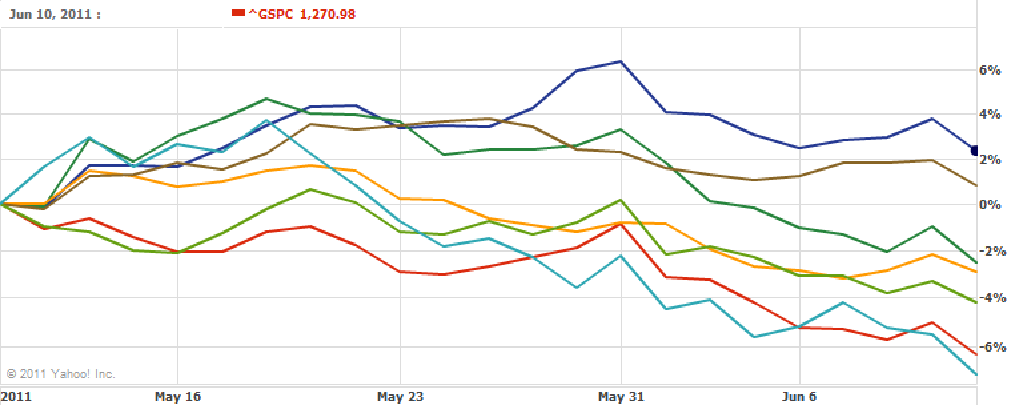

(In May issue, we advised readers to trim down their position on the light blue security above)

That’s what you call Amazing Performance.

But you shouldn’t think that these securities are high-risk. In fact, the risk is relatively low according to our methodology. And if you're wondering about our ability to measure risk, take a good look at the track record of our Chief Investment Strategist, Mike Stathis.

When screening for each security, we look for the best risk-adjusted returns, with a certain maximum allowed risk. In fact, the entire list of 45 securities has an average rating of “Good,” with excellent being the highest rating and “Average” being the rating for the average security on the S&P 500 Index.

Finally, the average dividend yield of the Dividend Gems Recommended Securities List is over 5.20% versus just 2.00% for the S&P 500 (as of June 13, 2011).

Higher returns and lower risk?

That’s the name of the game.

And that’s what Dividend Gems offers readers.

If you're ready to avoid losses, recognize and manage risk, make money and learn to become a much improved investor...