About Mike Stathis

Mike Stathis is the Managing Principal of AVA Investment Analytics.

He is in charge of all investment research serving as the firm's chief investment strategist and head of equities research.

Mike Stathis is a(n)

Mike Stathis has advised

Mike Stathis has

Mike began his career in finance working for two major Wall Street firms (UBS and Bear Stearns) where he served in various capacities. Once he learned how Wall Street operated, he left to start his own firm and has been publishing buy-side investment research ever since. He originally launched his research and advisory firm with a focus on advising startups, early stage companies, and venture capital firms.

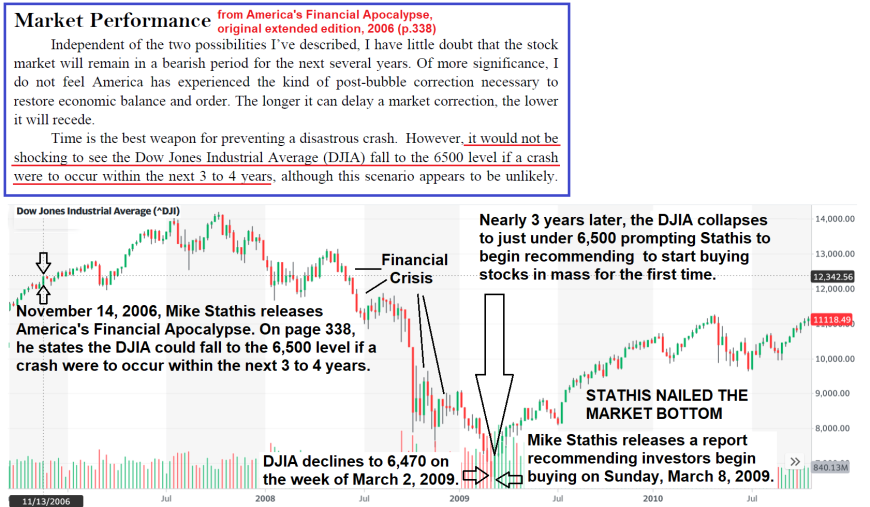

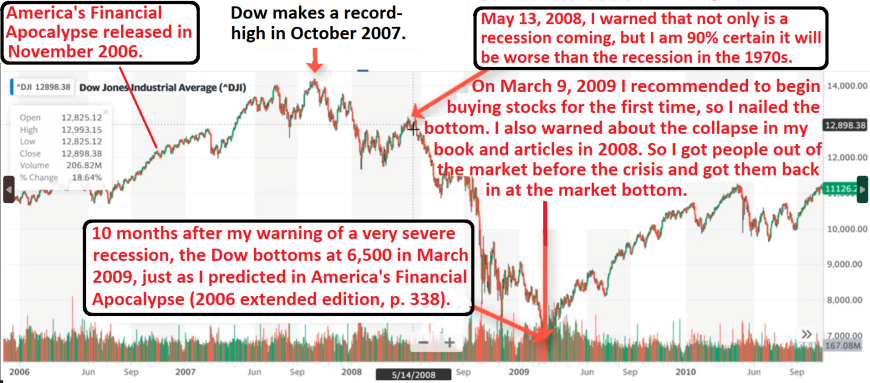

A few years later he was drawn back into the public markets when he realized a financial bubble of historic proportions threatened to collapse the U.S. economy and wreck havoc on the real estate, banking, and financial industries. This was when he completed the research for and wrote America's Financial Apocalypse which he was forced to rush into publication himself in late-2006 because no publisher would touch it.

Mike has been black-balled by all media since releasing America's Financial Apocalypse (2006).

As more of Mike's predictions materialized over time, the media intensified its ban on Mike in order to hide the truth from Americans and investors.

Based on extensive research, we believe this book to be the most accurate and detailed presentation of events leading up to the financial crisis and economic collapse. It's also perhaps the most comprehensive book written prior to the 2008 financial crisis detailing many of America's long-standing problems such as America's crisis in healthcare and the problems created by free trade.

The book focused on the real estate bubble, problematic consequences of free trade, U.S. healthcare, macroeconomics including America's entitlements programs, manipulation of economic data, wealth and income disparity, open borders, and many other topics that were not being discussed.

There were no potentially inflammatory words or material in this book which might have caused publishers to avoid it.

Quite simply, Stathis sought to alert investors of what he believed would be an economic and financial collapse of historic proportions. And his forecasts proved to be correct.

Unfortunately for most investors, the publishing industry along with the media black-balled him and his book early on because he exposed the truth about Wall Street, corporate America, free trade, the toxic effects of the U.S.-China trade relationship, America's ridiculously expensive and ineffcient healthcare system, and much more.

In early-2007, Mike released a book that focused on showing investors how to capitalize on the bursting of the real estate bubble.

Despite his accomplishments and expertise, Mike continues to face a widespread ban by all media nearly two decades after having predicted the details of the 2008 Financial Crisis in his 2006 book, America's Financial Apocalypse.

Although he predicted the details of the 2008 Financial Crisis and stock market collapse in advance, the media continues to ban Mike while promoting con artists, amateurs, and broken clocks.

Mike goes to extensive lengths to demonstrate the criminal activities of financial media, including widespread discrimination against Gentiles through publication of countless articles and videos on this website to help investors understand that the financial media is the number one enemy of investors.

He also regards the promotion of financial misinformation and scams by so-called "influencers" and fake investment gurus littered across the Internet via various social media platforms as a deeply disturbing wave of criminal activity that, by and large remains unchecked.

Mike shares the honorable distinction of also having been banned by all so-called "alternative media" firms because he revealed the realities about precious metals and exposed the army of precious metals scam artists, for which the alternative media is closely aligned.

Mike was also one of the first experts to expose cryptocurrencies as a complete scam in 2013. He predicted that cryptocurrencies would be promoted to fleece users. he went on to explain the various scams involved with cryptocurrencies. He also chartacterized all cryptocurrencies as illegal platforms facilitating the transmission of illegal proceeds from drug trafficking, human sex trafficking, money laundering, and tax evasion.

Finally, Mike exposed FTX as a Ponzi scheme five months before it collapsed.

The accuracy of Mike's research has positioned him as one of America’s top financial experts.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble (2007).

Check here to download Chapter 10 of America's Financial Apocalypse (2006 original extended ed).

The following video is one of many summarizing Mike's analysis and predictions from his two books that predicted the 2008 Financial Crisis.

The accuracy of Mike's research has positioned him as one of America’s top financial experts.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble (2007).

Check here to download Chapter 10 of America's Financial Apocalypse (2006 original extended ed).

Mike has written the following books:

At least one of Mike's books has been used in graduate business schools as a required text for completion of the MBA program.

Mike holds a Bachelor of Science degree in chemistry and a minor in mathematics, as well as a Master’s of Science in biophysics and biological chemistry. He was a National Science Foundation Research Fellow at the University of California, Berkeley where he performed research in solid state chemistry and physics. He has also performed chemistry research in oil, as well as alternative energy (theoretical aspects of solar and hydrogen fuel).

In addition to having taught general chemistry laboratory, Mike also taught a university course on biotechnology which he created from scratch.

Mike's investment expertise spans several industries, but his technology focus within the public and private markets is in healthcare, including healthcare IT, and biopharmaceuticals.

In addition to being one of the world's best securities analysts,

Mike Stathis is also THE world's best market forecaster.

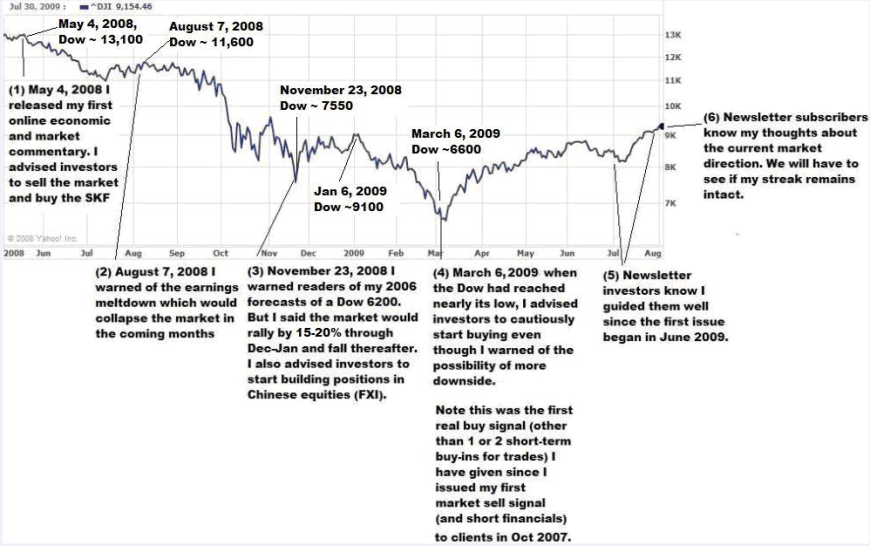

Below you will see his track record on the 2008 Financial Crisis.

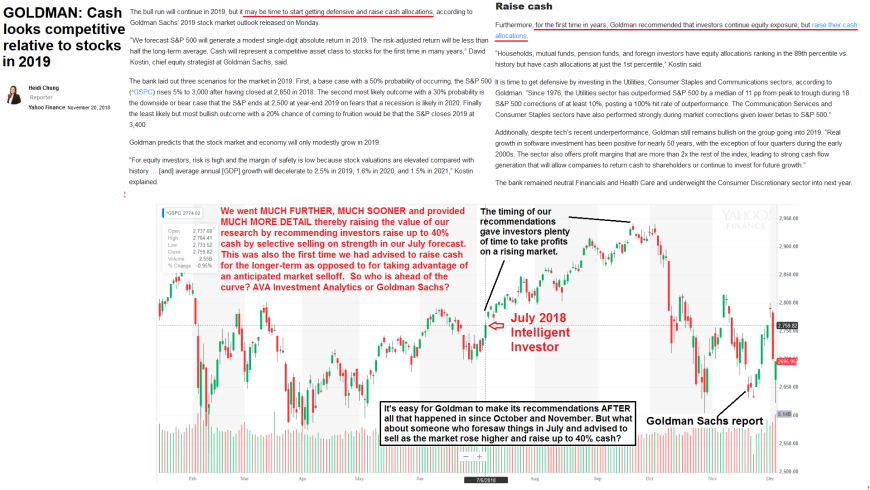

Since that time he has accurately predicted most of the major moves in the market (see Intelligent Investor track record).

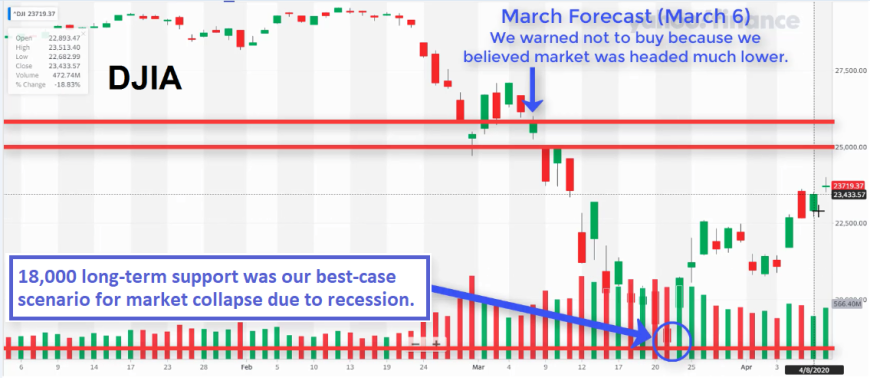

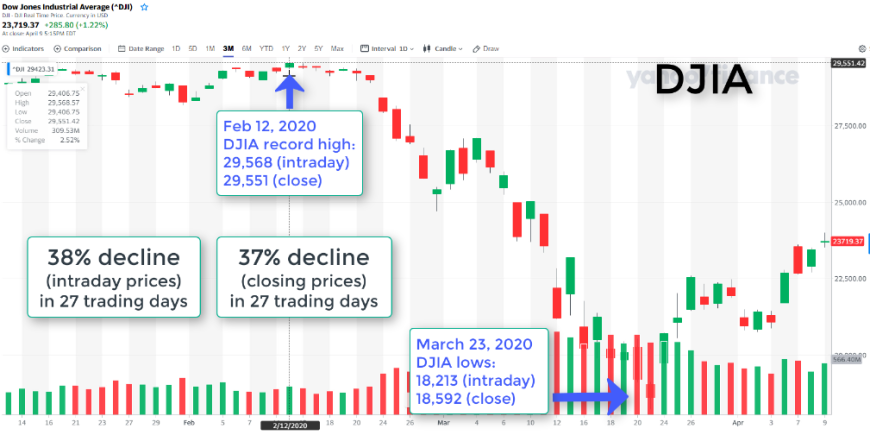

Stathis also predicted the March 2020 Coronavirus market lows in advance.

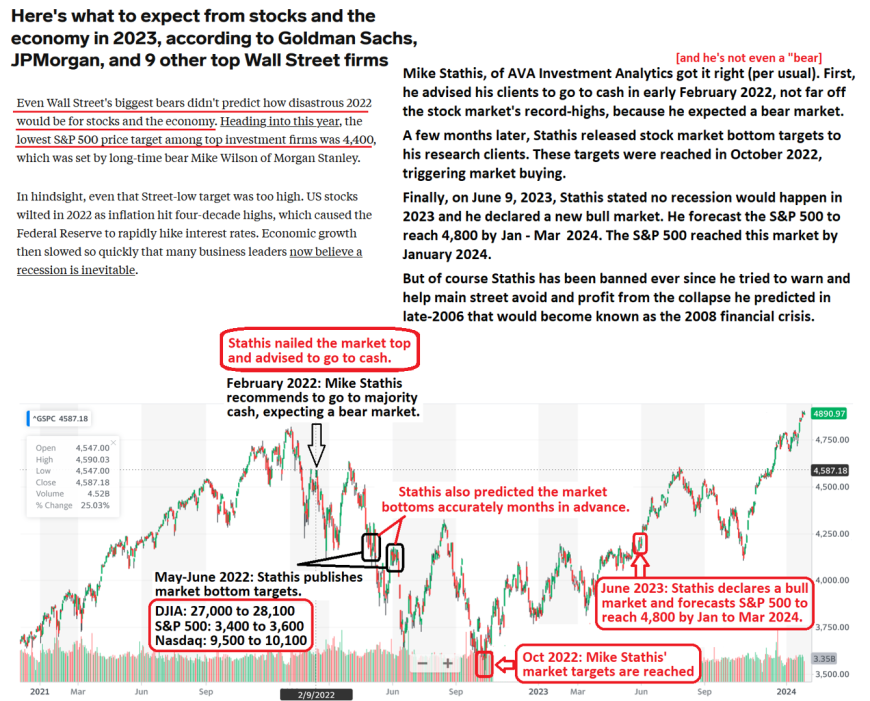

And he nailed the market top in 2022 and advised to go to cash.

He also nailed the bottom a few months later.

And he nailed the bull market highs as of January 2024.

For updates to our research, subscibe to the Intelligent Investor.

The information from the chart above was taken from monthly forecasts from the Intelligent Investor from January 2022 to June 2023.

The following video summarizes some of the material found in the 2006 extended edition of America's Financial Apocalypse.

Mike Stathis is Arguably the Top Investment Analyst and Market Forecaster

We believe Mike Stathis has the best published investment research track record since 2006.

See here for additional evidence.

For more than a decade, Mike backed these claims by guarantees that rose to $1 million.

Mike also holds the leading track record on the 2008 Financial Crisis.1

Check the article link below for an overview of Mike's 2008 Financial Crisis track record.

Mike Stathis' Track Record on the 2008 Financial Crisis

Check this video to understand why Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

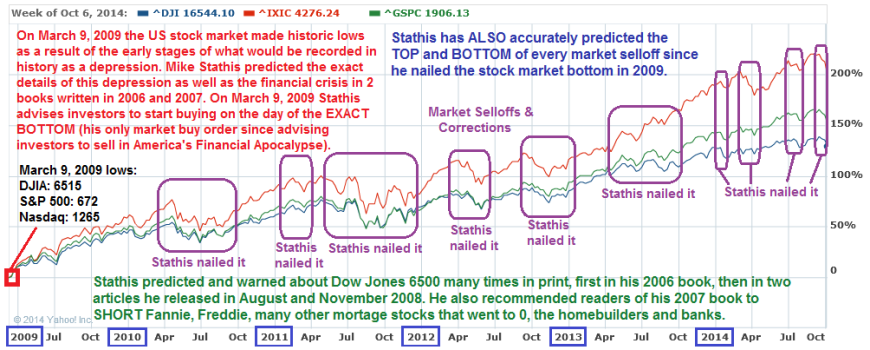

The following charts summarize Mike's U.S. market forecasting track record through the end of 2014.

We have additional content showing his track record since then.

These summary charts are supported by the links below, including here.

The following links were taken from the Market Forecaster, which is one of our monthly research subscription services focused on providing forecasts and investment strategies for the U.S. equities markets and select emerging markets (China, India, and Brazil).

MARKET FORECASTER TRACK RECORD

Mike Stathis Warned About the 2022 Bear Market Before it Began

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

Mike Stathis Nailed the Stock Market Top and Bottom AGAIN (May 2019)

More Proof Mike Stathis is the Top Investment Analyst in the World

Another Example Proving Mike Stathis is the World's BEST Market Forecaster

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

Stathis Nails The Dec 2014 Market Selloff With Stunning Accuracy

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Who Do You Think Nailed the Latest Market Selloff AGAIN?

Stathis Nails the Market Correction in April 2014

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

Market Guidance: Past, Present And Future (also America's Financial Apocalypse)

A Lesson In Market Forecasting

Where Is The Stock Market Headed?

We Pin-Pointed The Past Two Market Tops And Bottoms

We Predicted The Market Correction AGAIN

Mike Stathis' Near-Perfect Market Forecasting Record

Since The Market Lows, Only One Man Continues To Shine

AVAIA Market Forecast And Recommendations SPOT ON, AGAIN

We Predicted The Market Selloff Yet Again

Mike Stathis' 2008 Financial Crisis Track Record is Unmatched

Mike is the only investment expert who predicted the 2008 Financial Crisis and economic collapse in detail, as documented in the release of America’s Financial Apocalypse (2006) and Cashing in on the Real Estate Bubble (2007).

See here, here, and here (2008 Financial Crisis predictions).

Also check the following links to access some of the published material summarizing Mike's predictions on the 2008 financial crisis. [1] [2] [3] [4] [5] [6]

Additional detail on Mike's 2008 Financial Crisis track record may be found towards the end of this page. 1

1 Mike Stathis holds the leading track record on the 2008 Financial Crisis. He backed this claim with monetary guarantees of up to $1 million since 2010.

Those who followed the advice in Mike's books and his research were positioned to make a fortune from the 2008 Financial Crisis.

See here, here, and here for proof.

Mike Stathis Accurately Predicted the Bottom in U.S. Median House Prices

He predicted the median house price would decline by 35% in his 2006 book) five years before the bottom was reached (documented in the 2006 extended version of America's Financial Apocalypse and in his 2007 book Cashing in on the Real Estate Bubble. No one else in the world was able to make this prediction until the bottom was near. Mike made the prediction even before the financial crisis began.

Mike Stathis Warned About GM, GE and Countrywide Financial Before 2008

Mike was also the only financial professional in the world to have identified enormous risks in General Motors, General Electric and Countrywide Financial two years prior to their collapse. Moreover, he wrote of the possibility of a collapse in the Dow Jones to 6,500 as a result of the collapse in the real estate market two years before this bottom was reached (documented in the 2006 extended version of America's Financial Apocalypse.

He was Bearish Before the 2008 Financial Crisis, but Became Bullish in 2009

Mike was the only financial professional who was extremely bearish prior to the 2008 financial crisis who accurately predicted the details and impact of the crisis, but who also began recommending stocks at the market bottom (March 8, 2009).

He Exposed the Wrongful Seizure of Washington Mutual in 2008

He Was Contacted by the Financial Crisis Inquiry Commission (FCIC)

His Track Record Has Remained Consistently Accurate (estimated 85% accuracy rate)

In the post-crisis period Mike has compiled what we believe as the most accurate investment forecasting track record in the world, covering equities active management, commodities, precious metals and forex trading, and US and emerging market forecasts.

He backed this claim with a cash guarantee for nearly a decade.

This guarantee went as high as $1 million.

He has remained bullish since having nailed the 2009 financial crisis stock market bottom for most of that time. And he has successfully forecast nearly every major market selloff and market bottom since that time through January 2022.

See our track record links for evidence of this.

Mike Stathis is unique in having recognized and identified tremendous investment opportunities in the capital markets during the post-crisis period.

See our track record links for evidence of this.

The reader can examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, and here.

For research after the 2008 Financial Crisis see here, here, here, here and here.

COVID Pandemic Stock Market Collapse (early 2020)

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

GREAT INVESTMENT RETURNS REQUIRE A COMPETITIVE ADVANTAGE

> Do you have a competitive advantage to help you beat the market indexes?

> If not, you stand no chance of beating the indexes in the long run.

We Have the Competitive Advantage Investors Need

> Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #1

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #2

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #3

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #4

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #5

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #6

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #7

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #8

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #9

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #10

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #11

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #12

Mike Has Forecast Bull and Bear Markets in China, India, and Brazil With Very High Accuracy

China (the following summary should be taken as a rough guide until exact dates have been confirmed)

2006 (Oct): Mike recommended Chinese stocks to take advantage of China's unfair trade practices in his book America's Financial Apocalypse (AFA).

2008 (May): Mike warned the financial crisis he wrote about in AFA expected would not spare Chinese stocks.

2008 (Nov): Mike recommended Chinese stocks.

2014 (Nov): Mike predicted a bubble in the Chinese stock market was forming.

2015 (Jan): Mike warns Members and Research Clients about a bubble in Chinese stocks and warns about a massive blowup in a few years.

2015 (late spring): Mike recommended to sell Chinese stocks because he expected the bubble to burst.

2016 through 2017: Mike recommended FXI (Chinese H share large cap ETF).

2017: Mike discusses transparency issues with Alibaba.

2018: Mike warned of lasting problems in the Chinese economy and becomes defensive.

2019: Mike remains defensive on Chinese equities, but manages to accurately guide investors in and out of FXI for excellent gains numerous times.

2021: Mike warns of a massive historic economic collapse in China.

2021: Mike issues several warnings regarding Alibaba.

2022 (Feb): Mike issues several warnings regarding Alibaba.

2022 (May): Mike releases a special report (The China Report) forecasting real estate and financial crisis along with long-term forecasts.

2023: Mike remains very cautious on Chinese stocks, forecasting more downside.

2024:

India (coming)

Brazil (coming)