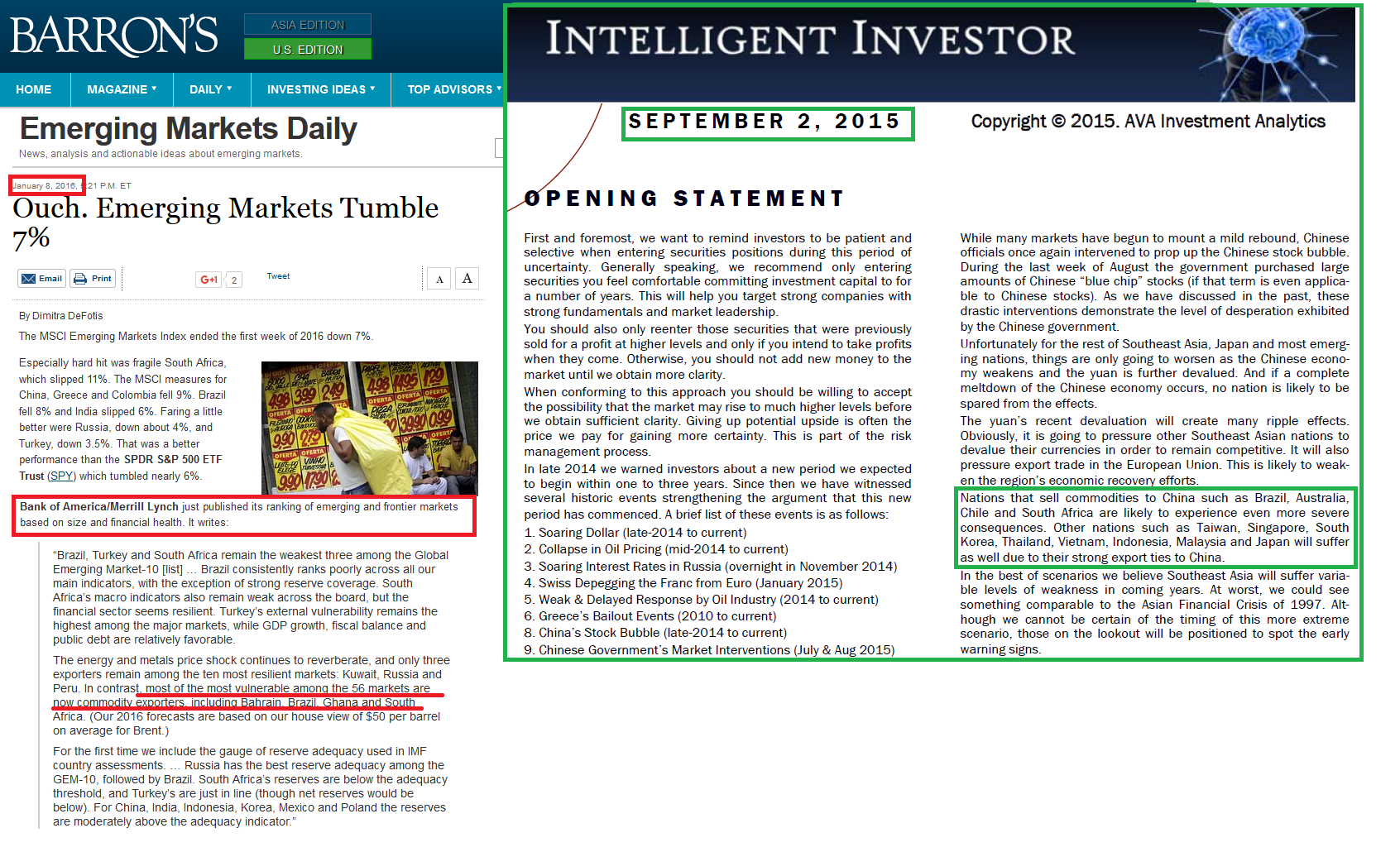

Along with his virtually flawless US stock market and emerging markets forecasting track record, his brilliant guidance in securities analysis, not to be underscored by this accurate forecasts in commodities, currencies and precious metals, (see here, here, here, here, here, here and here) Mike Stathis has also been accurately forecasting interest rate changes well in advance of the moves made by the ECB and Federal Reserve for several years now.

As a result of Stathis' accurate interest rate forecasts, his institutional clients and others who might have access to interest rate swaps and other dervivatives linked to interest rate changes have been able to make a killing.

Of course there are many other ways investors who do not have access to interest rate derivatives could have profited. And if you do not know how you could have profited, you are following the wrong sources.

Mike's interest rate forecasts are unmatched by those of every other analyst and economist in the world. This is a fact.

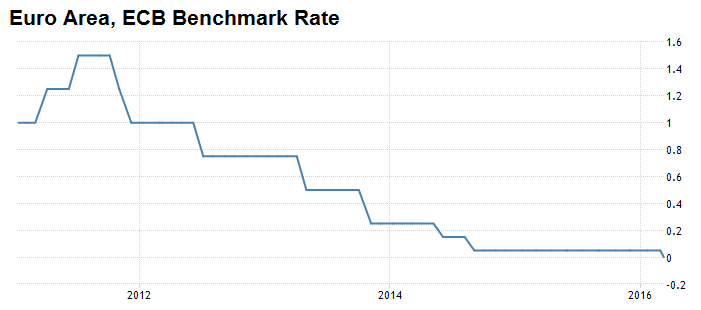

As you will recall, Stathis first warned of deflation in Europe in a research publication released in 2010. He was the first analyst in the world to make this forecast.

In early 2011, he released a detailed research report on this topic.

.png)

Based on his concerns of deflation in Europe, Mike predicted that Europe would need much lower interest rates.

In 2011, Mike concluded that if the central bank failed to slash rates sufficiently in a timely manner, the rate cuts would not be effective. See here.

Thereafter, Mike went on to predict that the ECB would launch quantatative easing based on its failure to lower rates in a timely manner. Moreover, he accurately predicted the ECB would boost its QE program several months before it did.

Next, in 2014 when the entire Wall Street gang and every academic economist were predicting the Federal Reserve would begin raising interest rates by late-2014 or early-2015, Stathis stated that rates would be raised by late-2015 based on his assessment of the global economy.

By early 2015, Stathis insisted there would be no rate hike in March, June or even October. He was certain that the Fed's first rate hike in nearly a decade would come late-2015 or early-2016.

Shortly thereafter, Stathis pinpointed December to be the month of the first rate hike. He was the only person in the world who made such a forecast. Meanwhile, everyone else was insisting on a rate hike in summer or fall.

By October 2015, when the consensus of economists and analysts had concluded that rates would average 1.62% by the end of 2016, Stathis insisted that was a ridiculous notion. He stated that the Fed would be able to raise rates in 2016 by no more than 50 basis points. However, Stathis also stated that an increase of 50 basis points in 2016 would be "aggressive."

Once rates were raised in December 2015 (just as Stathis forecast), economists and analysts were still looking for short-term interest rates to average around 1.42% by the end of 2016. In contrast, Stathis continued to insist this would not be possible unless the Fed's intent were to push the US economy into recession. He again emphasized that rates would be raised by 25 to 50 basis points in 2016.

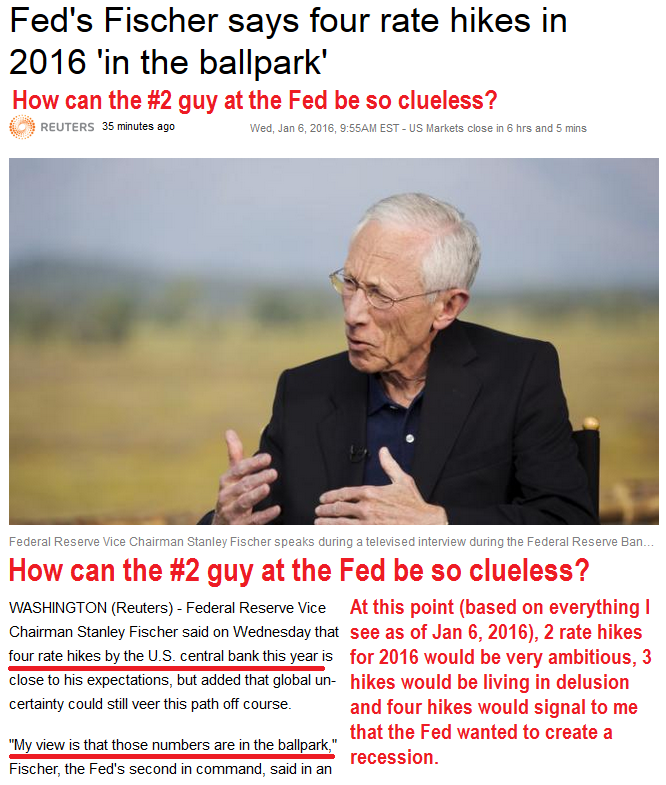

Shortly after the Fed raised rates in December 2015, many Fed officials stated that rates would be raised four or more times in 2016.

As subscribers to our research are already aware, Stathis called this nonsense (check the video at the end of this article).

Below is an excerpt from the January 2016 Dividend Gems Opening Statement.

"The main point is that rates are almost certain to remain low from a historical perspective for longer periods than most economists and analysts estimate. In fact, vice chair of the Fed, Stanley Fischer recently stated that he believed rates would be raised somewhere around four times in 2016. In our opinion, based on what we see in the global economy today, if rates were raised in the US four times, each by at least 25bp in 2016, it could be instrumental in causing a recession.

As we have previous stated in the Intelligent Investor and Market Forecaster, based on the current macroeconomic landscape, we believe short-term interest rates in the US are likely to remain under 3% through 2020 and may not even reach 2.5%. We also believe a 50bp increase in rates for 2016 would be quite aggressive given the current US and global macroeconomic environment."

Recently, Mike forecast that the Fed would not raise rates during its March meeting. When the Federal Reserve met on March 16, 2016, not only did officials decide against a rate hike, Fed Chair Yellen stated that rates would probably only be raised by a total of 50 basis points in 2016.

This is exactly what Stathis has been forecasting for several months (between 25 and 50 basis points for 2016).

Also read Mike Shows You How Clueless The IMF Is

If you used Mike's interest rate forecasts to purchase interest rate swaps or other derivatives, you would have made a windfall.

Once again, Mike Stathis continues to demonstrate why he remains as the sharpest investment mind on earth.

Remember, this is the same man who has been banned by ALL MEDIA.

Instead, the media airs con men, broken clocks, blabbering idiots and other useless mouth pieces, most of which happen to be Jewish. Remember, according to the media, their experts (most of which happen to be Jewish) are "really smart guys" and "great investors." Yea, right. If you believe this, you have been scammed. Track records folks...track records.

If you don't already know why the media airs these chumps, you obviously haven't been paying attention to Mike's articles and videos exposing this huge media scam.

.png)

Again, Mike Stathis holds the #1 investment forecasting track record in the world since 2006.

And he is the only person in the world to have ever linked that claim with a monetary guarantee."

Also read Mike Shows You How Clueless The IMF Is

No one has even dared to challenge this claim despite our (previous) $100,000 guarantee or our (new) $1,000,000 guarantee.

.png)

Also read Mike Shows You How Clueless The IMF Is

The Jewish media crime bosses prefer to simply ignore those who speak the truth and threaten to expose them as the best way to hide the scams from the public.

In contrast, the Jewish media crime bosses continuously promote Jewish con men and clowns who have terrible track records as a way to enrich them all while steering the audience to their sponsors, most of which are Jewish Wall Street and related firms. Figure it out folks. It's not rocket science.

.png)

__________________________________________________________________________________________________________________

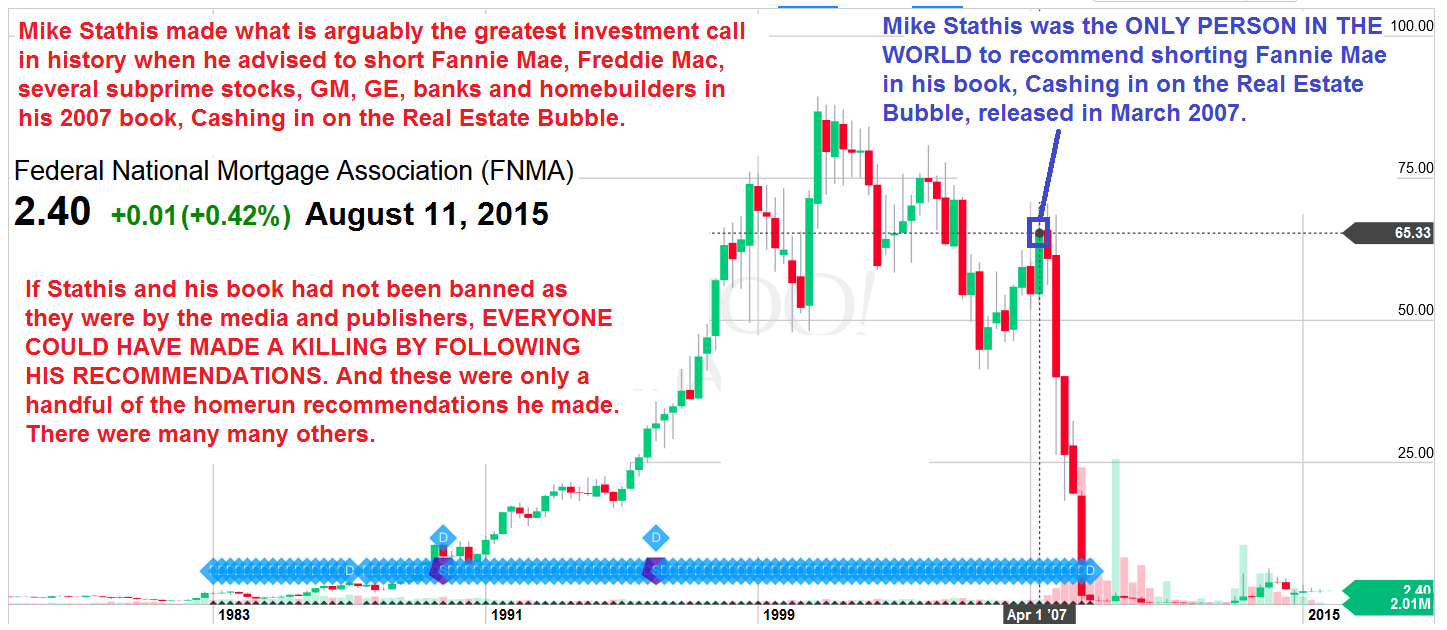

Mike Stathis holds the best investment forecasting track record in the world since 2006.

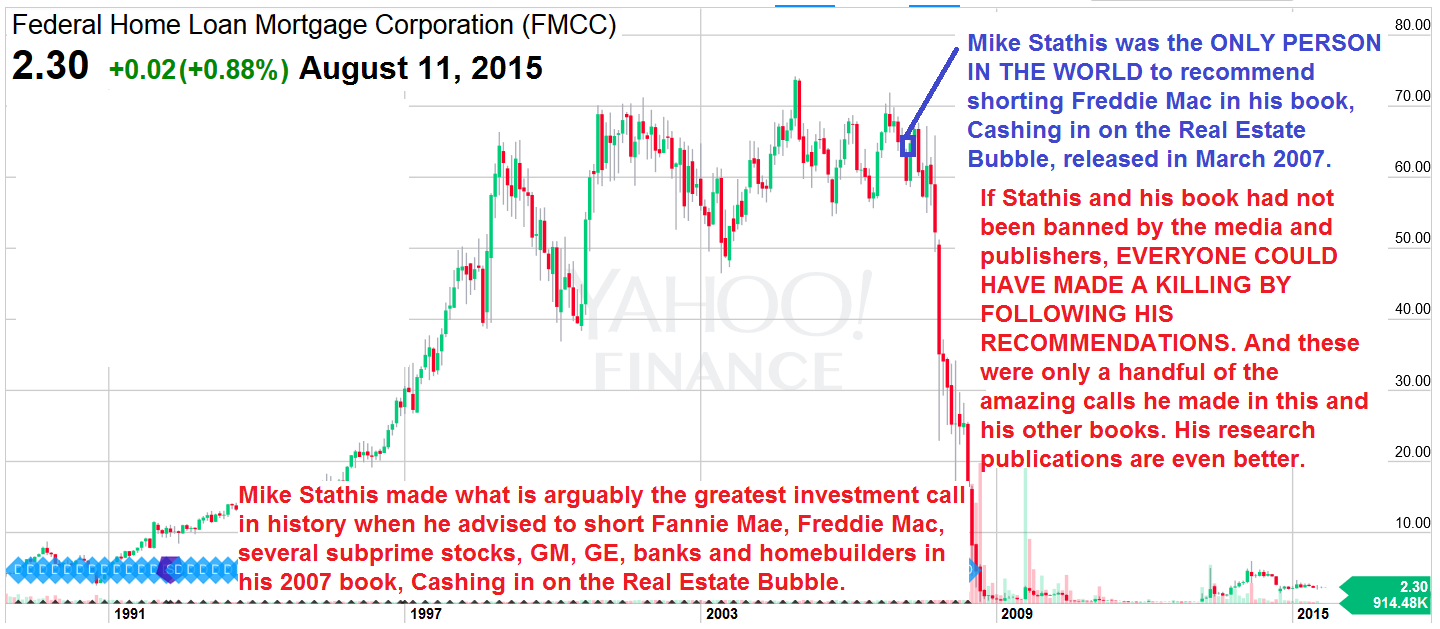

This is the chapter that shows where Mike recommended shorting Fannie, Freddie, sub-primes, homebuilders, GM, GE, etc.

So why does the media continue to BAN Stathis?

.png)

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

.png)

.png)

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.

Opening Statement from the January 2016 Dividend Gems Originally published on January 18, 2016 Weakness in commodities pricing continues to cause the global stock markets to selloff due to d...

Here we offer more evidence that no one in the world came remotely close to Mike Stathis in predicting the exact details of the financial crisis. What is truly shocking as much as it is unfortun...

Opening Statement from the January 2016 CCPM Forecaster Originally published on January 3, 2016 We have been discussing our forecast of a December 2015 rate hike of 25 bp for more than one y...

Opening Statement from the December 2015 Intelligent Investor Originally published on December 9, 2015 (pre-market) A growing consensus of lower oil prices for a longer period has sparked a...

Opening Statement from the November 2015 Dividend Gems Originally published on November 15, 2015 For several years we have been discussing our view that the US is not likely to enter into a...

Opening Statement from the October 2015 Dividend Gems Originally published on October 18, 2015 Due to the high level of market risk, most of our recommendations from the September issue were...

Opening Statement from October 2015 Intelligent Investor Originally published on October 7, 2015 Review of the Past 12 Months First, let’s summarize our assessment and guidance from...

Opening Statement from the October 2015 CCPM Forecaster Originally published on October 4, 2015 On September 18th the Federal Reserve announced its decision to keep interest rates unchanged...

Opening Statement from the September 2015 CCPM Forecaster Originally published on August 30, 2015 China and Yuan Devaluation Two days after reporting a huge decline (8.3%) in exports for t...

Opening Statement from the August 2015 CCPM Forecaster Originally published on August 2, 2015 As we have been discussing in the Intelligent Investor, it is very important period to pay clos...

The following audio represents another small portion of a presentation discussing global economics from Video 1 of the July 2015 Intelligent Investor.* *The July issue contained a written section...

Opening Statement from the July 2015 CCPM Forecaster Originally published on July 5, 2015 Alert traders were rewarded on June 28/29 after Greece rejected the troika’s bailout terms. T...

Recently we added the December 2014 Global Economic Analysis and Forecast to the Member 2015 Video Folder. I also have decided to add two additional audio supplements which were part of the or...

The December 2014 Global Economic Analysis and Forecast which was originally provided to subscribers of the Intelligent Investor and Market Forecaster on December 14, 2014 has just been added to the M...

Opening Statement from the May 2015 issue of Dividend Gems First published on May 17, 2015 for subscribers to Dividend Gems Our suspicions of an improvement in Q1 earnings has come to fruiti...

Opening Statement from the May 2015 CCPM Forecaster First published on May 3, 2015 for subscribers to the CCPM Forecaster We see no material changes in the global economy relative to the past few...

Opening Statement from the March 2015 CCPM Forecaster First published on March 1, 2015 for subscribers to the CCPM Forecaster After soaring for months, the dollar has recently experienced s...

America’s Financial Apocalypse remains as the most accurate, comprehensive and insightful investment book predicting a depression for the U.S. even nearly ten years after it was first published...

Opening Statement from the January 2015 Intelligent Investor (Part 1) First published on January 4, 2015 for subscribers to the Intelligent Investor For some time now we have been emphasizing th...

Opening Statement from the December 2014 Intelligent Investor (Part 1) First published on December 5, 2014 for subscribers to the Intelligent Investor Despite persistent and widespread clai...

Opening Statement from the November 2014 issue of Dividend Gems First published on November 17, 2014 for subscribers to Dividend Gems Over the past several months economic headwinds from aro...

Opening Statement from the October 2014 Intelligent Investor (Part 1) First published on October 5, 2014 for subscribers to the Intelligent Investor As expected, the commodities market cont...

Opening Statement from September 2014 Intelligent Investor (Part 1) First published on September 2, 2014 for subscribers to the Intelligent Investor It is of no surprise that economic data f...

Opening Statement from August 2014 Intelligent Investor (Part 1) First published on August 4, 2014 for subscribers to the Intelligent Investor As expected, the “Iraq trade” has...

Opening Statement from June 2014 Dividend Gems First published on June 17, 2014 for subscribers to Dividend Gems Over the past several years we have discussed that the IMF has had a tendency...

Normally, these libertarian goofballs lack sufficient knowledge to put forth an argument in support of their pro-fascist views. By now you probably know who the libertarian goofballs are...the Peter S...

Today, Detroit's emergency manager announced a plan for the city to emerge out of bankruptcy. Throughout Detroit's solvency crisis, investment pundits and other hacks and lackeys have spread rumors an...

You have probably heard what the clowns in the media have said about the economy. Unfortunately, the media is littered with misguided salesmen like Peter Schiff, Mark Faber and other gold deal...

Last month we reminded readers about the earnings weakness we have been discussing since early in the year. Specifically, we felt that the second half of 2013 would be met with greater than expected w...

Originally published on November 4, 2013 (November 2013 Intelligent Investor, Opening Statement Part 1) As previously discussed, the recent sell off in bonds has been due to the outlandish response...

In mid-September, the Federal Reserve decided not to begin tapering as we predicted. As you will recall, we have been warning readers since May that the US economy was weakening. This was in contrast...

In this video, Mike discusses an aspect of the Fed’s recent decision to hold off on scaling back on its bond-buying program that you probably have not heard or read about.

The emerging markets have continued to weaken along with Europe, as the US economy and stock market gain more momentum. India was the first of the three major emerging markets we cover to show weak...

Although we have seen some noteworthy earnings disappointments for Q2, this has been overshadowed by overall impressive results as well as upbeat estimates for Q3 and even Q4. In short, the US stock m...

July 2013 Intelligent Investor (Part 1) Opening Statement Originally Published on July 7, 2013 The correction in the commodities bubble continues, as overall global demand continues to...

We just published a brief update discussing how recent developments have altered our US and emerging markets forecast, along with trading guidance. This video presentation is available to subscriber...

Recently I wrote an article discussing reasons for the retreat in gold pricing. As I have done countless times in the past, I pointed out the common myth held by gold bugs that gold protects against i...

Hell, someone had to do it.

Originally published in the August 2012 Intelligent Investor, Part 2 As detailed in many issues of this publication for some time now (as well as in America’s Financial Apocalypse), the U.S. go...

The large wealth and income inequality in the U.S. has continued to widen for nearly three decades. Over the past few years the disparity has become even larger. For instance, the top 1% of income ear...

Although poverty rates have been high in the United States for over a decade, they have increased appreciably since the economic crisis. As first detailed in America's Financial Apocalypse and discuss...

Originally published in the September 2012 Intelligent Investor Each year, Washington spends money to provide a variety of services. Ideally, Washington should only spend as much as it takes...

Fiscal cliff negotiations turned out to be a disaster. As you will recall, the fiscal cliff referred to automatic expiration of numerous tax breaks and expenditures. It was meant to serve as an econom...

As the Fed continues with quantitative easing, commodities continue to sell off as expected. This makes sense if we consider the primary force driving commodities right now is the global economic slow...

Last Friday the Labor Department reported that non-farm payrolls grew by 155,000 jobs last month, slightly below November's level. Last Tuesday marked the commencement of Q4 earnings, with Alcoa meeti...

I have been discussing the adverse impact of U.S. trade policy on America’s working and middle-class for several years now. I began this discussion in America’s Financial Apocalypse. As m...

Little has changed since we released the last monthly publication. The global economy continues to weaken. Europe is sinking deeper into recession and even Germany is now most likely headed for a cont...

Based on the performance of several stocks considered to be very reliant on the outcome of the election, it appeared that Wall Street had determined at least a few weeks ago that President Obama would...