Mike Stathis' 2008 Financial Crisis Track Record is Unmatched

As the only investment expert who predicted the financial apocalypse in detail, as documented in the 2006 release of America’s Financial Apocalypse (2006) and Cashing in on the Real Estate Bubble (2007), Mike was extremely effective helping investors navigate the real estate and banking crisis of 2008.

See here, here, and here (2008 Financial Crisis predictions).

Also check the following links to access some of the published material summarizing Mike's predictions on the 2008 financial crisis here, here, here, here, here, here, here, here, here, here, and here.

Finally, also check towards the bottom of this entry for more detail on Mike's 2008 Financial Crisis track record.

Mike also accurately predicted the bottom in U.S. median house pricing (he predicted the median house price would decline by 35% in his 2006 book) five years before the bottom was reached (documented in the 2006 extended version of America's Financial Apocalypse and in his 2007 book Cashing in on the Real Estate Bubble.

No one else in the world was able to make this prediction until the bottom was near. Mike made the prediction even before the financial crisis began.

Mike was also the only financial professional in the world to have identified enormous risks in General Motors, General Electric and Countrywide Financial two years prior to their collapse.

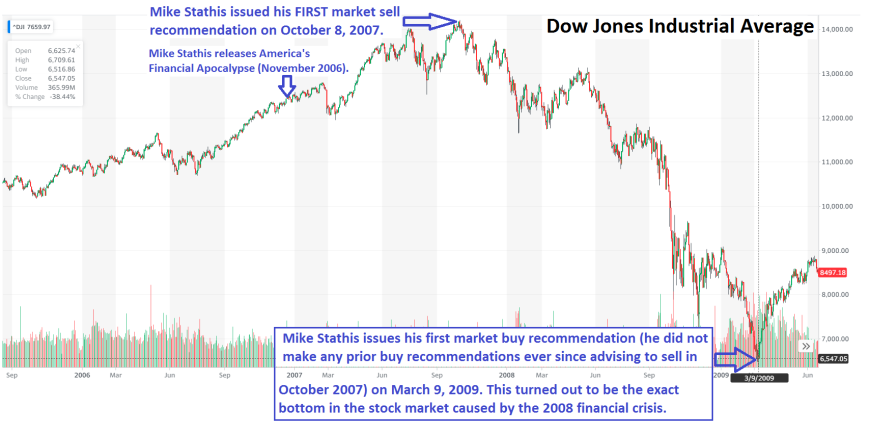

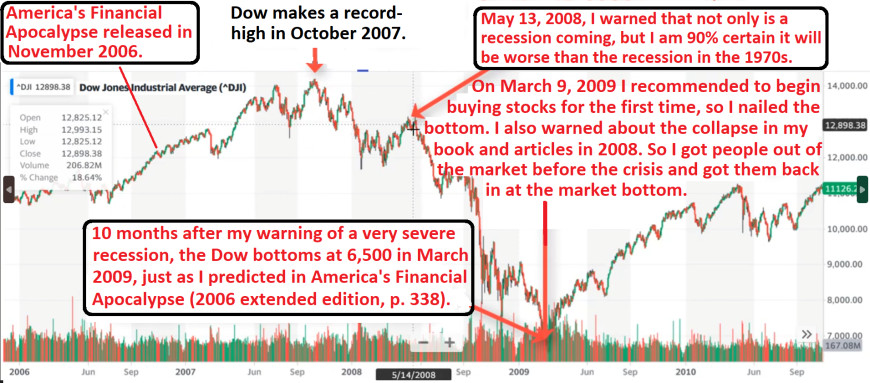

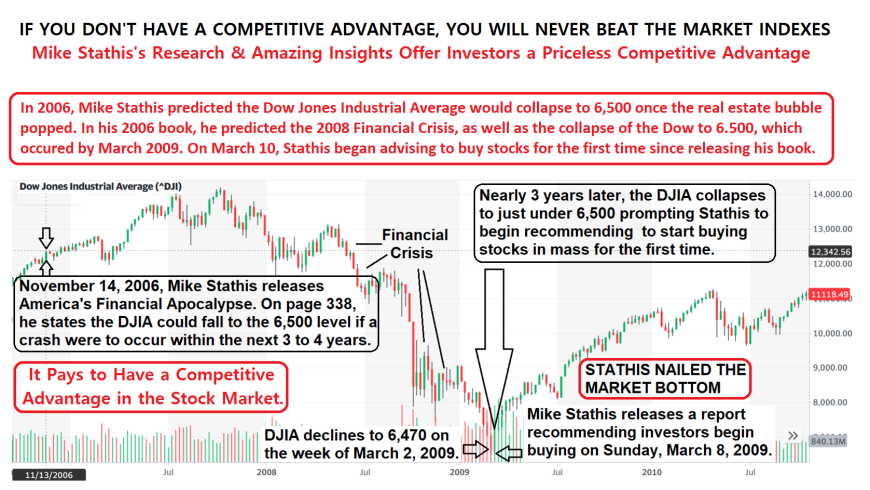

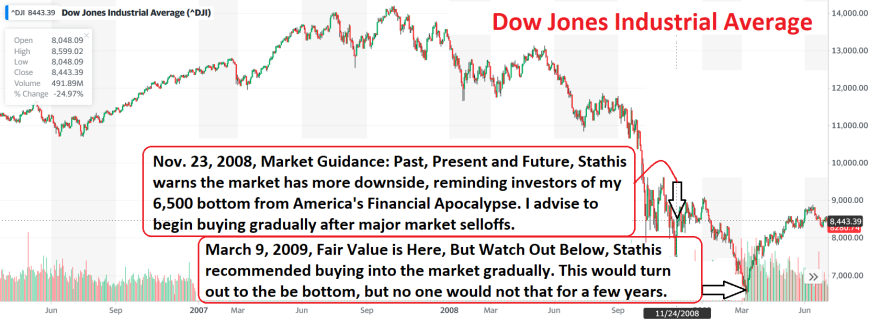

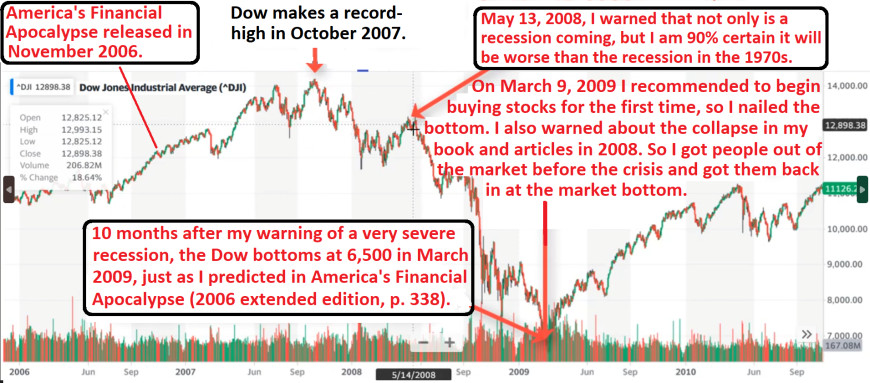

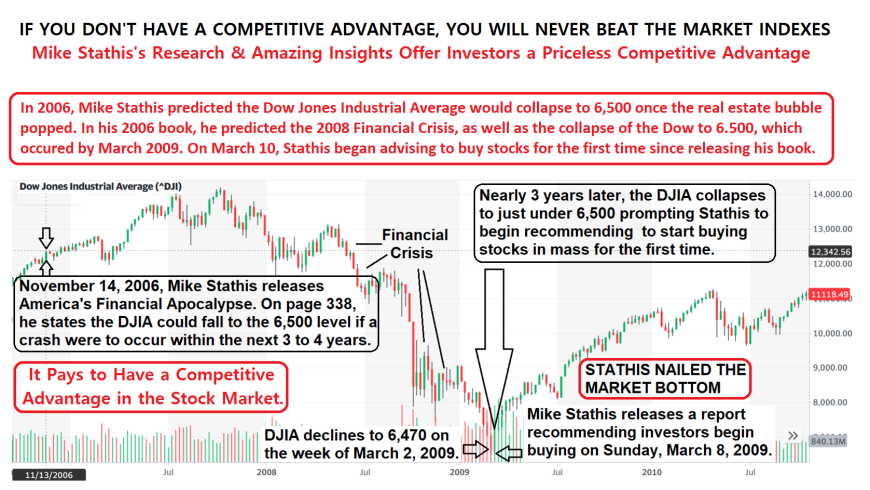

Moreover, he wrote of the possibility of a collapse in the Dow Jones to 6,500 as a result of the collapse in the real estate market two years before this bottom was reached (documented in the 2006 extended version of America's Financial Apocalypse).

Finally, Mike was the only financial professional who was extremely bearish prior to the 2008 financial crisis who accurately predicted the details and impact of the crisis, but who also began recommending stocks at the market bottom (March 8, 2009).

Mike was interviewed by the Financial Crisis Inquiry Commission (FCIC) in 2011 but the investigators did not ask him to testify before the panel in order to prevent his words from reaching the public.

This is a monster story in itself and explains another reason why Mike has been completely black-balled by all media.

In the post-crisis period Mike has compiled the most accurate investment forecasting track record in the world covering equities active management, commodities, precious metals and forex trading and US and emerging market forecasts. He backed this claim with a cash guarantee for nearly a decade. This guarantee went as high as $1 million.

He has remained bullish since having nailed the 2009 financial crisis stock market bottom for most of that time. And he has successfully forecast nearly every major market selloff and market bottom since that time through January 2022.

See our track record links for evidence of this.

Mike Stathis is also unique in having recognized and identified tremendous investment opportunities in the capital markets during the post-crisis period. See our track record links for evidence of this.

The reader can examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, and here.

For research after the 2008 Financial Crisis see here, here, here, here and here.

Mike Stathis is the Leading Expert on the 2008 Financial Crisis.

This claim is backed by verifiable data that has been published by numerous sources, beginning with Mike's 2006 book America's Financial Apocalypse, his 2007 book Cashing in on the Real Estate Bubble, and his numerous articles (which he began writing in May 2008) and his investment newsletters and video presentations, which began in June 2009.

Blast From The Past - Mike Stathis Predicted The Real Estate Derivatives Meltdown In 2006

The first thing you might want to do before continuing is to watch the video on this page. CLICK HERE.

Take a look at Mike's financial crisis stock market forecasts and recommendations, published in his 2006 book, America's Financial Apocalypse (see the video below) as well as in several articles in the public domain in 2008 and 2009.

For a partial list of forecasts and investment recommendations from the 2006 extended version of America's Financial Apocalypse, click here.

The reader can examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis, enabling

investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, and here.

Ever since 2011, we have offered a $100,000 prize to the first individual who can demonstrate evidence of a financial professional who can at least match the track record (including published research videos and webinars) of Mike Stathis. We began with a $10,000 prize in 2009 and increased the amount as time passed.

For details, please see here, here, here, and here.

This prize/challenge expired on April 2021 because no one was successful in this challenge. We continue to believe we hold the leading investment analysis track record in the world (spanning the U.S. capital markets).

View Mike Stathis' Track Record here, here, here, here, here, here and here.

Mike Stathis holds the best investment forecasting track record in the world since 2006.

View Mike Stathis' Track Record here, here, here, here, here, here and here.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

This is the chapter that shows where Mike recommended shorting Fannie, Freddie, sub-primes, homebuilders, GM, GE, etc.

The first thing you might want to do before continuing is to watch the video on this page. CLICK HERE.

His track record Before the collapse can be found in:

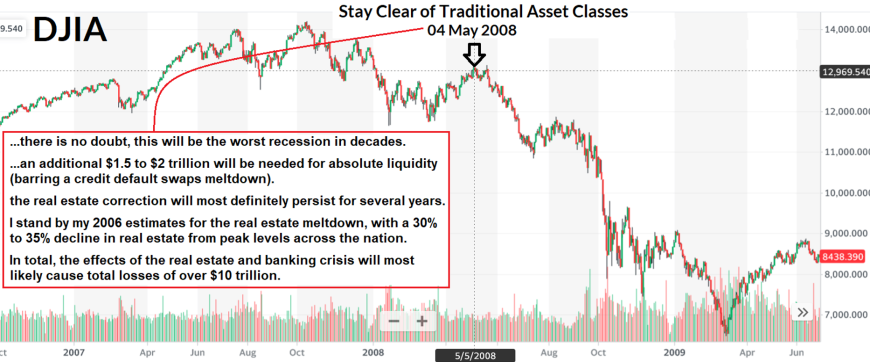

"Please do not forget that Washington through its rebate checks, and the Fed through its endless printing of money, have made their most desperate attempts to delay a recession. While they have failed in my opinion, the real severity is coming soon. Make no mistake about it, S&P earnings estimates for Q4 won’t even come close to estimates. By the time Washington reports the required (and laughable) 'two consecutive quarters of negative GDP' it uses to officially acknowledge a recession, it will be too late for investors who followed this herd mentality.”

“Sure, it’s possible that we will see the market rally over the next couple of months. If so, you would be wise to sell. More aggressive traders might consider shorting it entirely once it tops out based on the 1-year resistance trend line."

September 2008

Payback is a BITCH (September 11, 2008)

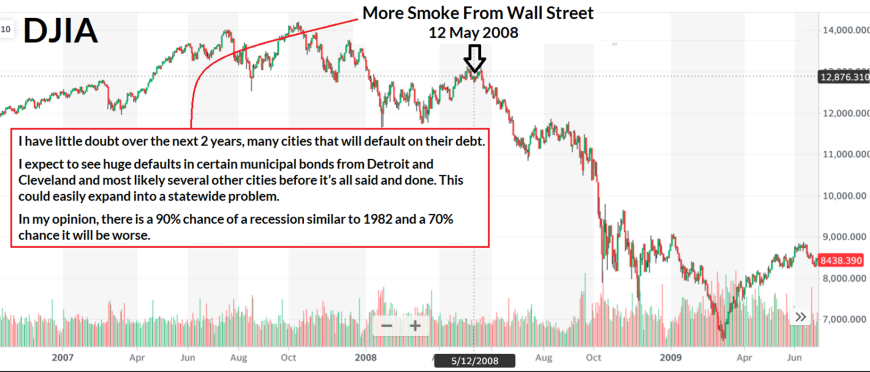

"And if you think Bernanke’s printing presses have an endless supply of ink and paper, just wait until the real crisis appears. So you had better get ready because it’s coming. It is virtually inescapable. And it’s going to cause devastation around the globe. Of course, I’m taking about the likely implosion of the CDS market."

"The bailout buffet won’t end with Fannie and Freddie. There’s a lot more where that came from because the “Fed’s food court” remains open, as does that of the U.S. Treasury. In fact, the autos are in the process of being bailed out with $50 billion in “loans.” I expect the airlines to also receive some form of a bailout as well."

Bailouts Disguised as Buyouts (September 15, 2008)

November 2008

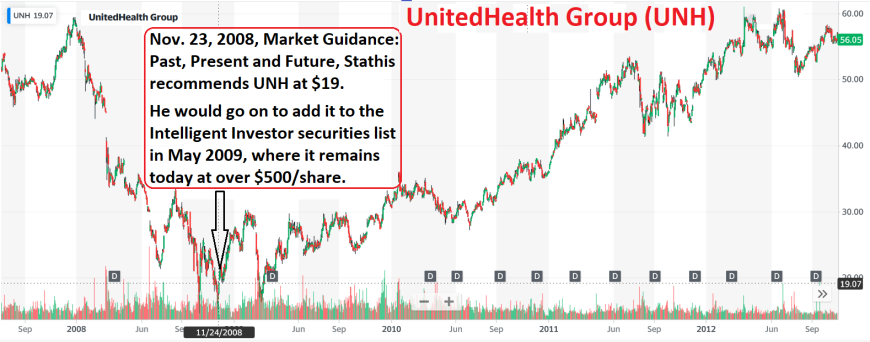

Market Guidance: Past, Present and Future (November 23, 2008)

March 2009

Fair Value is Here, But Watch Out Below (March 9, 2009)

Summary of Articles Published by Mike Stathis into the Public Domain Between 2008 and 2009.

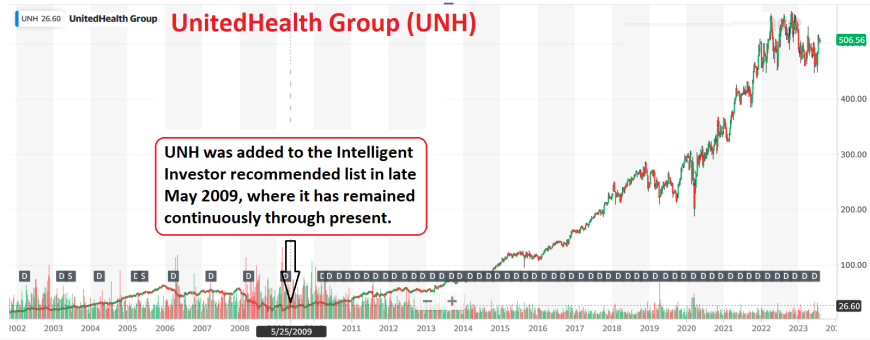

By May 2009, Mike had launched this website, AVA Investment Analytics and was preparing to release the first issue of his first research publication, the Intelligent Investor.

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

For a more comprehensive look at Stathis track record, see here and here. Updates can be found here.

Do you know of anyone who warned about the possibility of Dow 6500 just.jpg) months before the collapse began, who also told the public to start buying at the bottom??

months before the collapse began, who also told the public to start buying at the bottom??

This shows Stathis is not an extremist, nor is he a doom and gloomer with a sales pitch, unlike the guys you see and read in the financial media.

Stathis knows WHEN TO SHIFT GEARS because he is a REAL Analyst and strategist, NOT A SALESMAN like the clowns plastered all over the media.

Stathis is the real deal and his track record proves it.

Already, with just these few forecasts, you aren't likely to find anyone else who can match his track record.

Here are just a few predictions made by Mike Stathis in this book.

America’s Financial Apocalypse remains as the most accurate, comprehensive and insightful book predicting a depression for the U.S. even nearly 6 years after it was first published in late 2006.

Others feel the need to release 2.0 versions of their book because they missed so much and got so many things wrong the first time.

Some financial professionals spend all of their time marketing. Others spend all of their time doing research. In the end, the track record is the only thing that matters.

The following is only a PARTIAL LIST of accurate forecasts and insights from America's Financial Apocalypse (2006).

Because we do not have the time to go through the book and list more, if you feel there are some important additions to this list, please email us with your entry and page number.

In this book, Mike...

(1) Predicted the collapse of the commodities bubble in 2008/2009 and told readers that would be the time to buy - Chapter 14

(2) Warned that the credit rating agencies were passing AAA ratings to risky mortgage debt – p. 219

(3) Warned of the lack of adequate regulatory authority over the MBS market positioned it for a massive collapse – p. 222

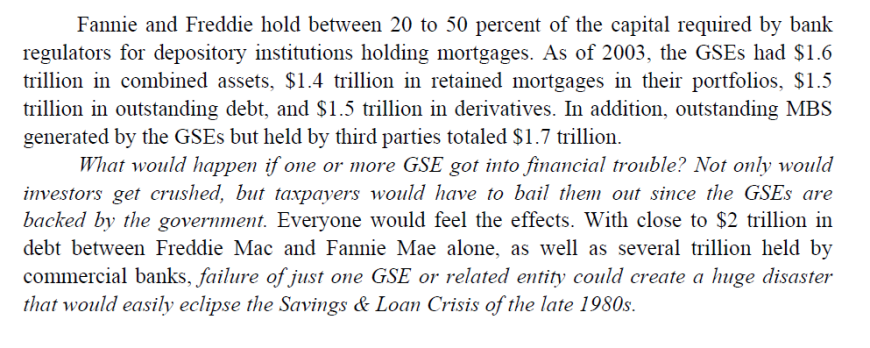

(4) Predicted a mortgage-related derivatives meltdown resulting in losses in the trillions of dollars – p. 221

(5) Predicted the banks would suffer due to the implosion of the MBS market – p. 223

(6) Warned that once the MBS market collapsed it would lead to a massive sell-off in global stock markets - p. 223

(7) Advised readers to short LEND, FRE, NFI, FMN, FRE, banks and homebuilders (Cashing in on the Real Estate Bubble)- Chapter 12

(8) Predicted that Fannie and Freddie would be bailed out by taxpayers – p. 221

(9) Predicted real estate prices would decline by 30%-35% on average (50-60% in certain regions) – p. 223

"I would estimate at its bottom, the deflation of the housing bubble will cause a 35 percent correction for the average home. And in “hot spots” such as Las Vegas, Northern and Southern California, and South Florida, home prices could plummet by 50 to 60 percent of their peak values." (Cashing in on the Real Estate Bubble) --pp. 67-8

(10) Predicted Dow 6000 - Chapter 16, pp. 336-342

(11) Warned that the collapse of the real estate bubble and stock market would lead to the “Poor Effect” – p. 201

(12) Provided exhaustive evidence of a massive real estate bubble ready to burst – Chapter 10 – the most exhaustive and insightful analysis anywhere

(13) Warned that GM and GE would also collapse due to the real estate implosion – p. 223

(14) Warned of the implosion of the ABS market – p. 223

(15) Presented irrefutable evidence there would be a depression – Entire Book

(16) Predicted there would be a "New Deal" – p. 346

(17) Warned about the entitlements tsunami that would lead to massive tax hikes -- Chapter 11

(18) Detailed "free trade" as America's #1 chronic macroeconomic problem - numerous chapters

(19) Addressed healthcare as the second biggest long-term problem faced by America and detailed the problems - Chapter 7

(20) Recommended gold and silver - Chapter 17

(21) Advised investors to trade the volatility of gold rather than buy and hold – p. 381

(22) Advised investors to invest in oil trusts as a way to deal with the high volatility of oil - Chapters 17 and 18

(23) Recommended going to cash and waiting for the disaster - Chapter 17

(24) Mentioned the possibility that the Fed would intentionally create massive inflation in order to pay off the huge national debt – p. 362

(25) Provided a generic asset allocation for conservative, moderate and aggressive investors – in each case, Cash was the #1 asset (so they would be able to buy after the market crashed). p. 383

Other assets recommended were oil trusts, gold, silver, Chinese funds (note my warning that China’s economy would correct, indicating a time to buy below), healthcare, TIPS, Dollar hedge with the euro – p. 383

(26) Predicted an inflationary depression followed by brief periods of deflation if things got really bad (we experienced deflation during Q4, 2008) -- Chapters 16 and 17

(27) Discussed effective ways to manage risk – pp. 376-385

(28) Detailed how the government manipulates economic data (GDP, inflation, unemployment) and WHY - Chapter 11

(29) Explained how gold was a hedge against deflation, not inflation – pp. 360-362 -- he followed up on this in detail to help the sheep who are being taken by the gold bugs despite the fact that he forecast gold to soar to above $1400 and perhaps $2000 in this book.

(30) Explained how America today (2006) shared many similarities to pre-depression America – Chapter 16, pp. 343-346

(31) Warned of the possibility of China dumping U.S. Treasuries or using this threat for economic (such as unfair trade and currency manipulation) and political leverage pp. 308-309, 312

(32) Explained how corporate America is destroying the middle class – Chapter 12, pp. 322-325, 257-262

(33) Detailed America’s two-decade period of declining living standards – pp. 243-248

(34) Explained how the SEC permits legalized insider trading via corporate executives and corporations – pp. 255-256

(35) Proved how the economy under Bush was a disaster and was set to implode – Chapter 15

(36) Explained how the SEC is useless and serves as a partner in crime with Wall Street – Chapter 12

(37) Explained how the dollar is backed by oil and how the Saudis have a huge amount of control of the fate of the U.S. economy, pp. 310-311

(38) Predicted that most baby boomers would never be able to retire due to the stock market collapse – Chapters 8 and 13

(39) Exposed the myths and discussed the real problems with Social Security – increased dependence and loss of buying power – Chapter 8

(40) Exposed the fraud behind the for-profit college system

(41) Detailed America's wealth and income disparity (the media only started talking about this in 2010)

Blast From The Past - Mike Stathis Predicted The Real Estate Derivatives Meltdown In 2006

You will not find any other professional even attempt to forecast and analyze so many things.

The amazing thing is that Stathis’ success rate is so high.

The real pros know when to reverse directions.

They also know when you should just stay out of the market altogether.

And they realize that risk management is critical.

Have a look at what Stathis has to say about some of these so-called experts.

They don't dare to respond they know well they know he has no agendas, and his insights are well beyond theirs.

Stathis does research and analysis for a living.

He doesn't spend his time marketing to sheep. Never forget that.

The so-called experts spend their entire day blogging or being interviewed on TV.

Real experts don't do that; not if they want to form an accurate track record.

They are either doing research, or advising clients.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.

Who Is Mike Stathis? Mike Stathis is one of the leading investment minds in the world today and holds the best overall investment forecasting track record since 2006. Since 2010, we have backed that c...

For those who reside in the United States who would like to purchase our research or Membership but do not want to use PayPal or a credit card, we are now accepting Chase QuickPay. In order to send f...

Boot Camp Series 1 Sessions 8 & 9: NAV, Sentiment, Behavioral Finance, Bond Bubble? Topics of discussion include the following: Warnings about NAV The power of interpreting sentim......

Mike will be holding a live webinar early this evening.

It is a fact that Mike Stathis holds the leading investment forecasting track record in the world since the inception of his published research (late 2006) through 2016. As of January 1, 2016, we are......

Membership Resources Lite Membership Cost (one year) is $499 Premium Membership Cost (one year) is $699 All Members receive unrestricted access to all articles, videos, and audios pu...

Mike Stathis' 2008 Financial Crisis Track Record is Unmatched As the only investment expert who predicted the financial apocalypse in detail, as documented in the 2006 release of America’s Fina...