Mike Stathis

We have backed this claim by a $50,000 challenge which remains active to this day (March 6, 2023).

If you think you or someone else has a better track record of having predicted the 2008 financial crisis, stock market, and economic collapse, simply escrow $50,000 into the account of a legal firm chosen by us and we will do the same. We will also hire a third-party management consulting firm to examine the written and oral arguments from both sides. Whoever wins will received the total amount held in escrow, or $100,000.

Contact us only if you are serious about submitting a challenge to this claim and you are willing to provide us with your source of funds as well as your identification credentials. We will followup with more details on this challenge. Otherwise, please do not waste our time.

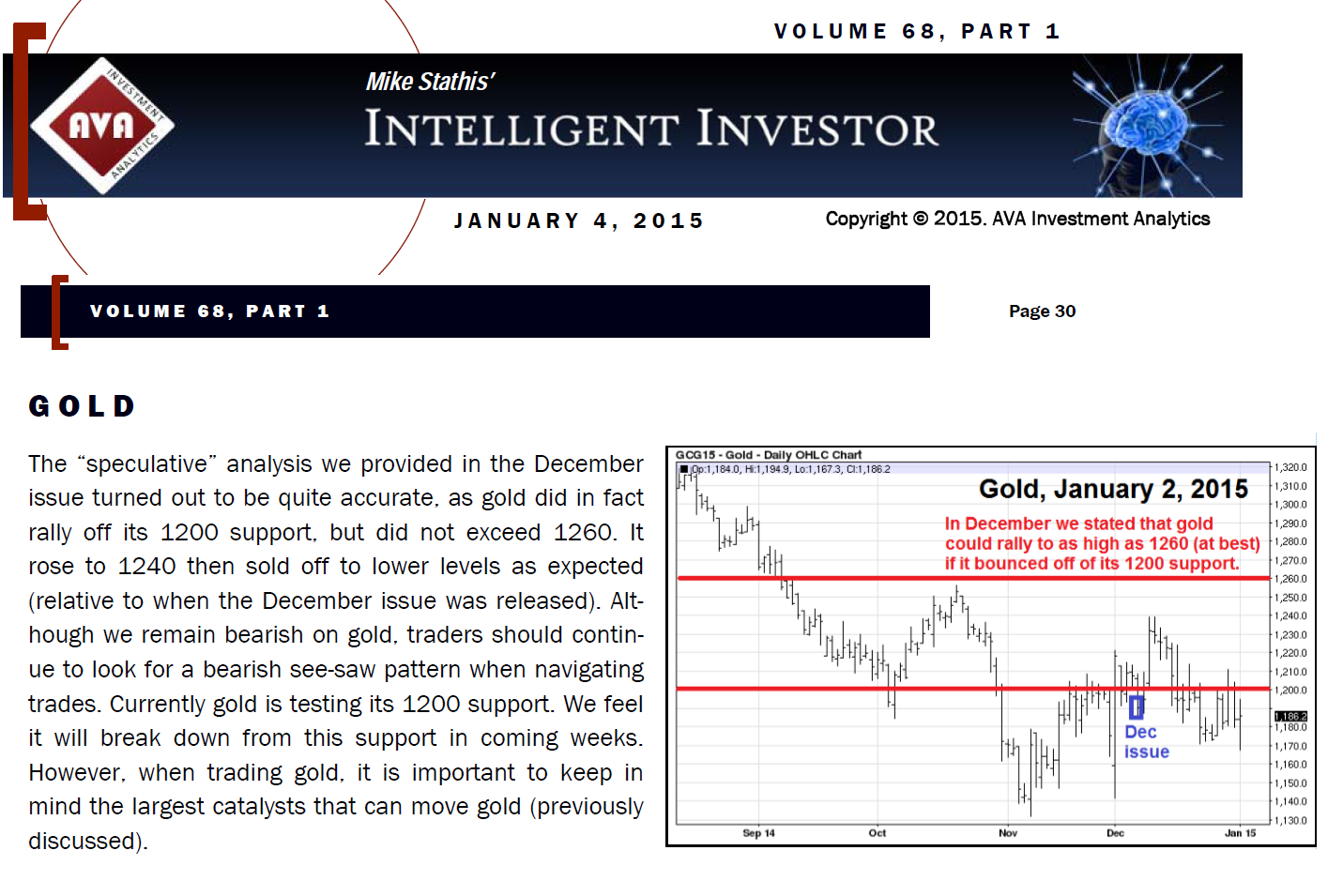

We believe there is no one in the world who can match the accuracy and insight of Mike's forecasts, which predicted the economic collapse, the stock market collapse, (with nearly perfect accuracy) the bottom in the residential real estate market, the major causes of the Financial Crisis of 2008 all before they materialized, enabling those who read his books and articles to make a fortune.

We also believe there is no one in the world whose pre-crisis work can match the comprehensiveness and prescient of Mike's analysis and discussions on America's most problematic and long-standing issues, such as the U.S. healthcare system, problematic consequences of free trade including U.S.-China trade, Wall Street fraud, illegal immigration, political correctness, and the wealth and income disparity. Remember, this book was published in 2006.

Based on his prescient analysis and recommendations provided in his two pre-financial crisis books, along with several articles published in the public domain during 2008 and 2009, investors who followed his analysis and recommendations were able to capture remarkable profits.

More details on Mike Stathis' Track Record on the 2008 Financial Crisis

Briefly, Mike's books and public domain publications enabled investors to:

1) Sell Stocks at the Market Top (2007) and Buy at the Bottom (March 2009)

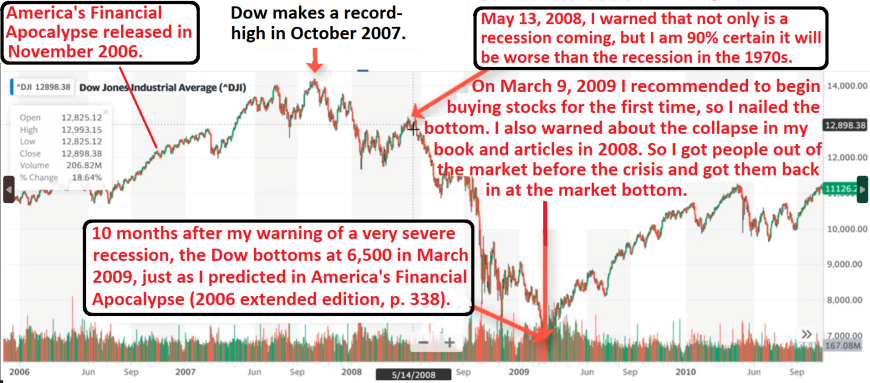

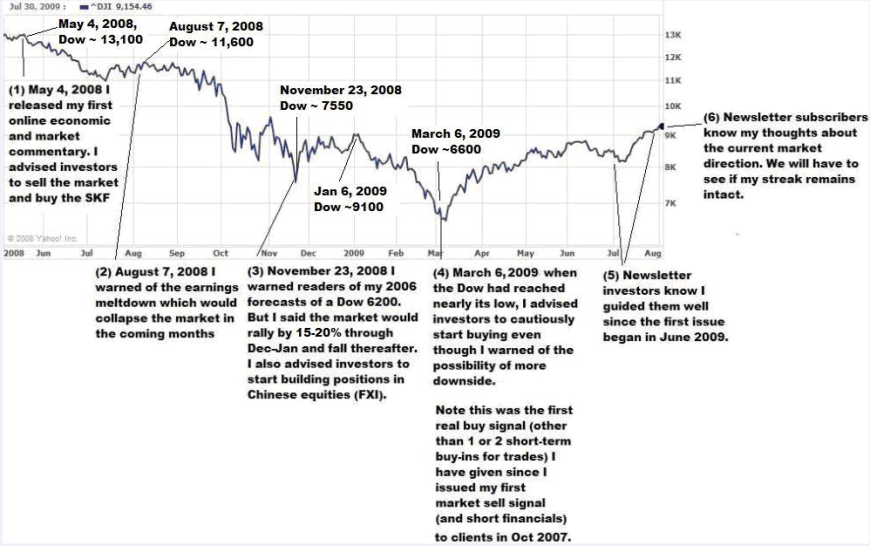

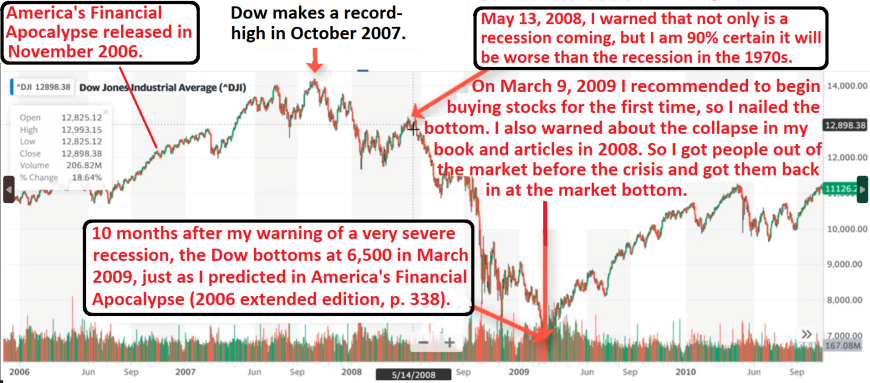

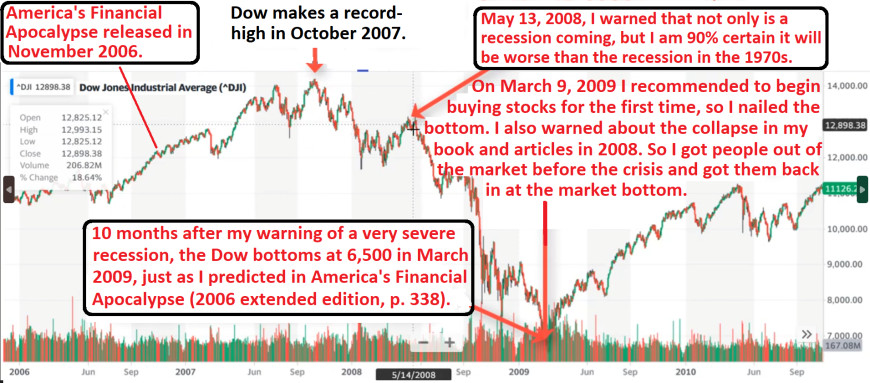

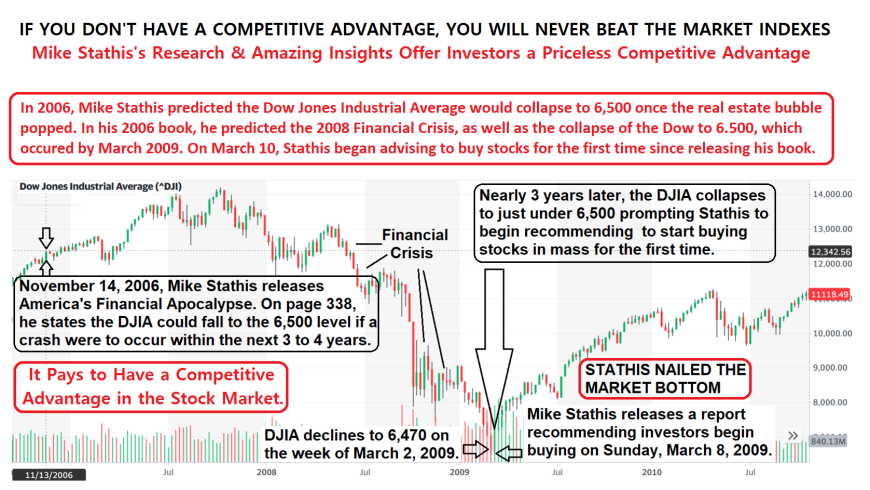

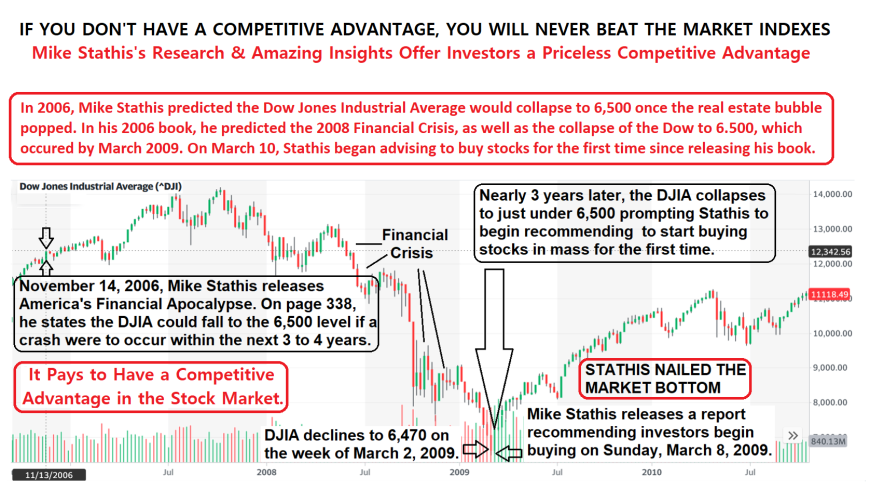

Mike's analysis and recommendations enabled investors to sell stocks towards the top (2007) and buy back at the exact market bottom (March 2009 at 6,500).

2) Buy Alternative Assets after the Collapse (gold, commodities, Chinese funds)

>> See America's Financial Apocalypse (2006)

3) Invest in Demographics-Driven Sectors (drug and cruise ship stocks)

>> See America's Financial Apocalypse (2006)

4) Short Sub-Prime and Prime Mortgage Stocks (shown below)

>> See Cashing in on the Real Estate Bubble (2007)

5) Short Homebuilder Stocks (shown below)

>> See Cashing in on the Real Estate Bubble (2007)

6) Short Bank Stocks (shown below)

>> See Cashing in on the Real Estate Bubble (2007)

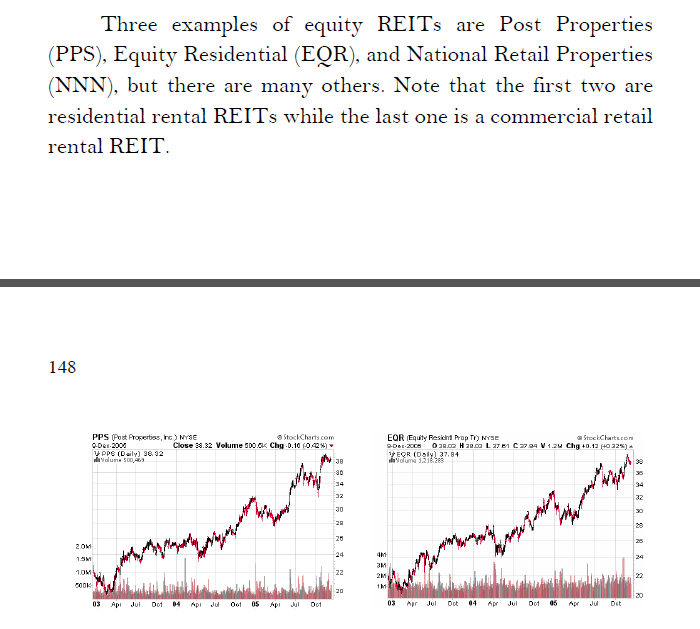

7) Buy REITs after the Bubble Popped

>> See Cashing in on the Real Estate Bubble (2007)

The following video summarizes some of the material found in the 2006 extended edition of America's Financial Apocalypse.

More details on Mike Stathis' Track Record on the 2008 Financial Crisis

Skeptics should conduct a careful and comprehensive investigation of Mr. Stathis' track record of having predicted the 2008 financial crisis and enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, here, and here.

*See below for more evidence backing this claim.

Furthermore, Mike is the ONLY person in the world to have predicted the extent of the collapse who ALSO turned BULLISH on the US stock market at the EXACT BOTTOM at 6,500 on March 9, 2009.

After getting investors out of the stock market well before the financial crisis began, and getting them back in at the very bottom, Mike went on to nail the majority of major stock market moves. Today, as of July 21, 2023, Mike's market forecasting remains as accurate as ever.

.png)

.png)

Mr. Stathis' Forecasting Track Record Since 2015

Mike Stathis Warned About the 2022 Bear Market Before it Began

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

Mike Shows You How to Make 100% in 2 Weeks and 200% in 6 months

Did You Own the Best Stock of 2016? Intelligent Investors Did

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

*See below for more evidence backing this claim.

Below are some charts showing just a few of his great forecasts.

1) Fundamental Analysis - Predicted Collapse of Facebook Before the IPO

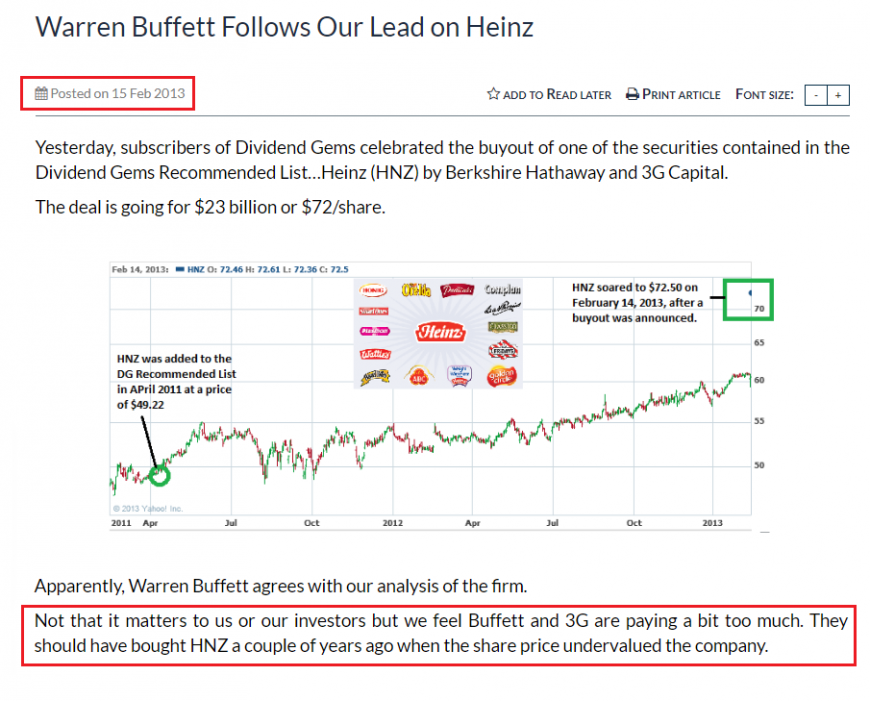

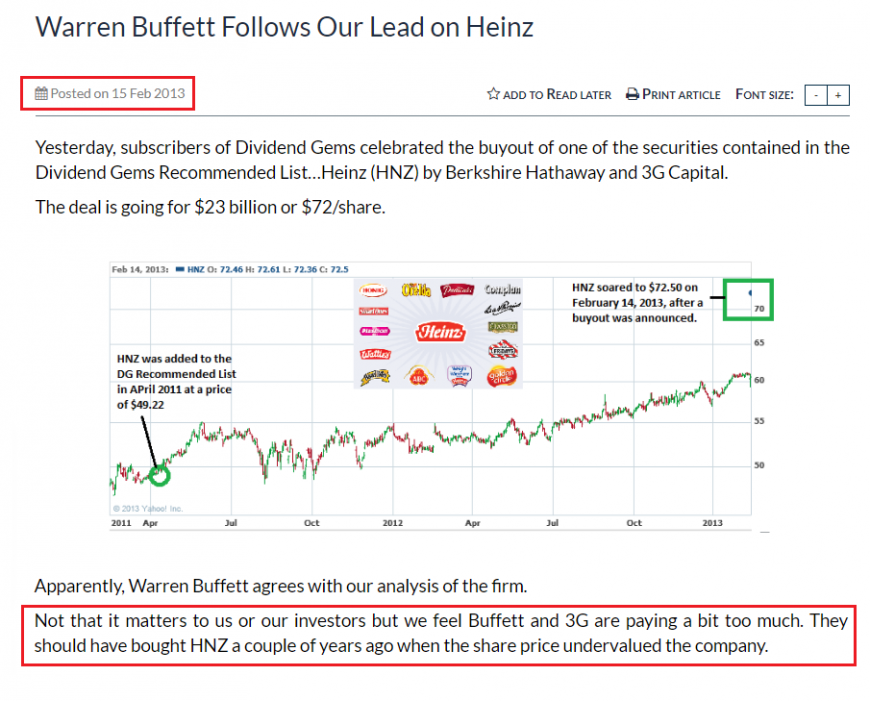

2) Fundamental Analysis - Recommended Heinz Before Buffett Got Involved

I also stated that Buffett paid too much for Heinz. A few years later Buffett's Berkshire Hathaway announced a $15.4 billion impairment charge.

3) Fundamental Analysis - Predicted JC Penny Bankruptcy

I warned JC Penny would eventually file for bankruptcy and recommended shorting it several times starting around $40 during a period when so-called "great investors" were buying it.

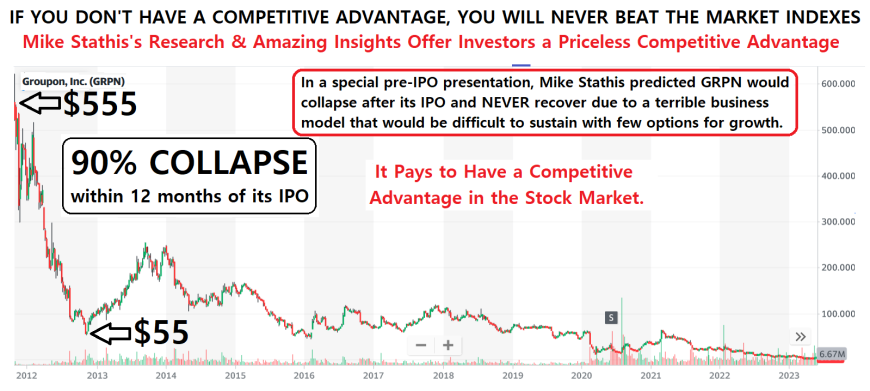

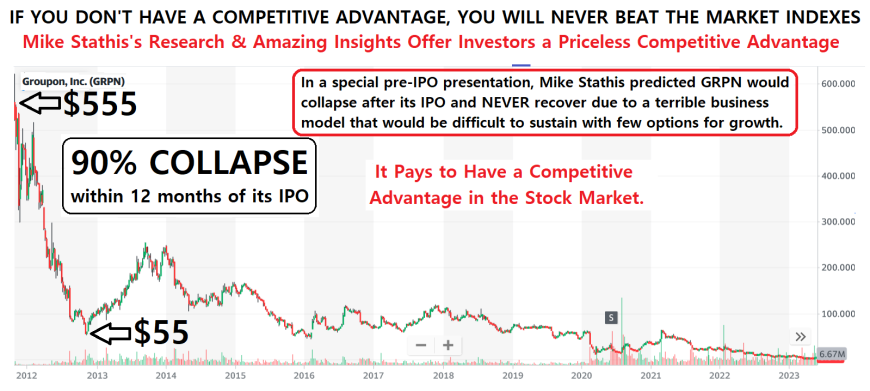

4) Fundamental Analysis - Predicted the Collapse Groupon Before the IPO

5) Fundamental & Macro Analysis - Warned About Alibaba (BABA) Collapse

I predicted the collapse in BABA during a time when Charlie Munger Was Buying it.

6) Fundamental Analysis - Recommended Netflix (NFLX) in 2008

I recommended to buy Netflix (NFLX) and short Blockbuster Video (BBI) in 2008 (Wall Street Investment Bible). And I have been mostly bullish on NFLX since then.

Blockbuster would file for bankruptcy a couple of years later.

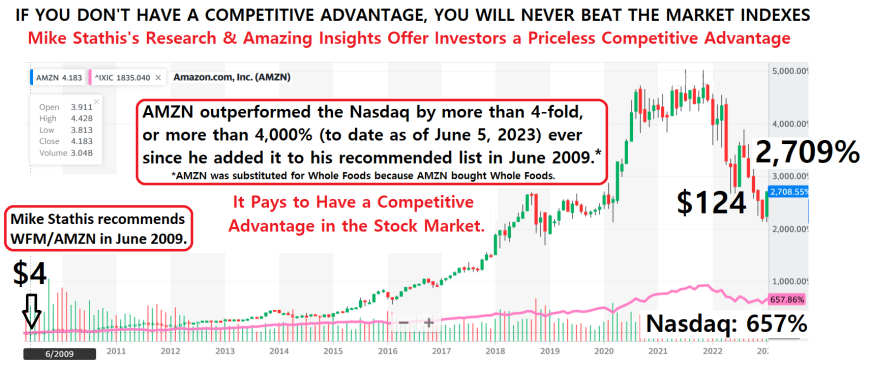

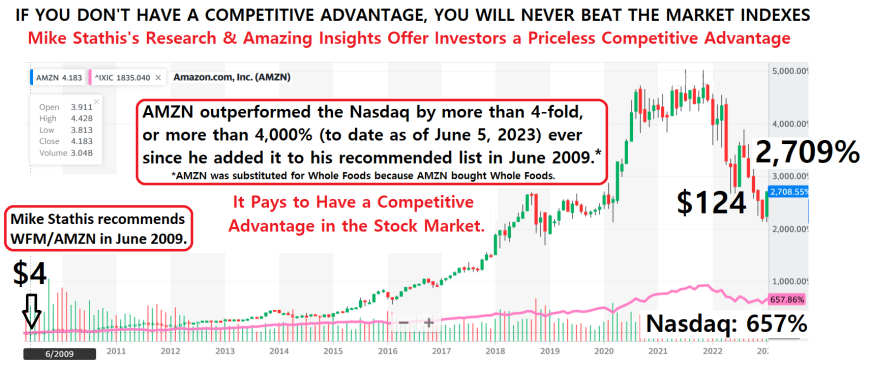

7) Fundamental Analysis - Recommended Whole Foods/Amazon Since 2009

I named Whole Foods (WFM) as my #3 Stock for Long-term Growth Since 2009.

Whole Foods (WFM) was bought by Amazon (AMZN) a few years later.

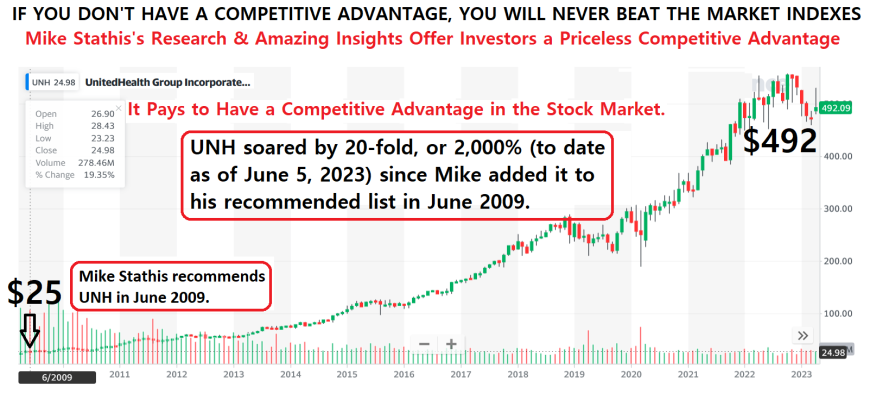

8) Fundamental Analysis - Recommended Unitedhealth (UNH) Since 2009

I named Unitedhealth (UNH) as my #2 Stock for Long-term Growth Since 2009.

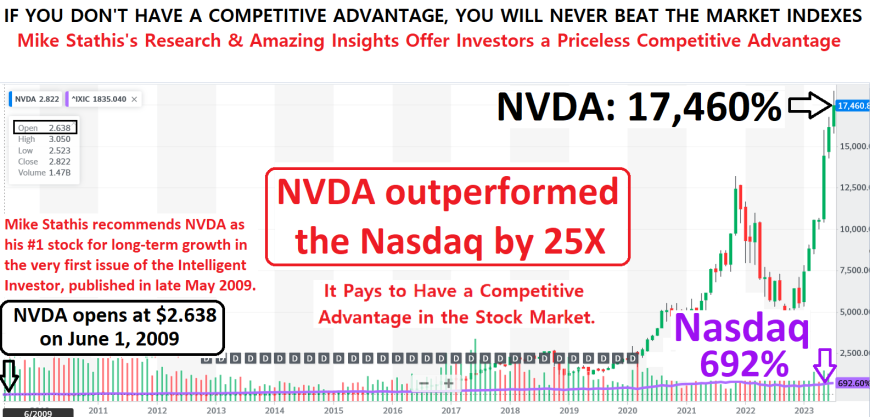

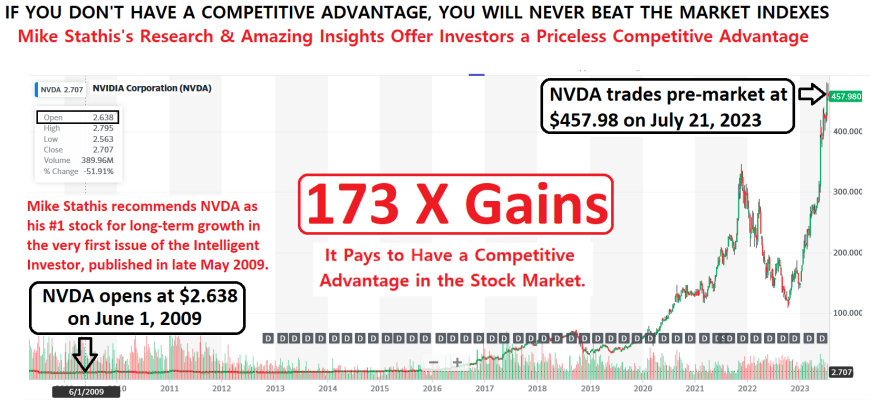

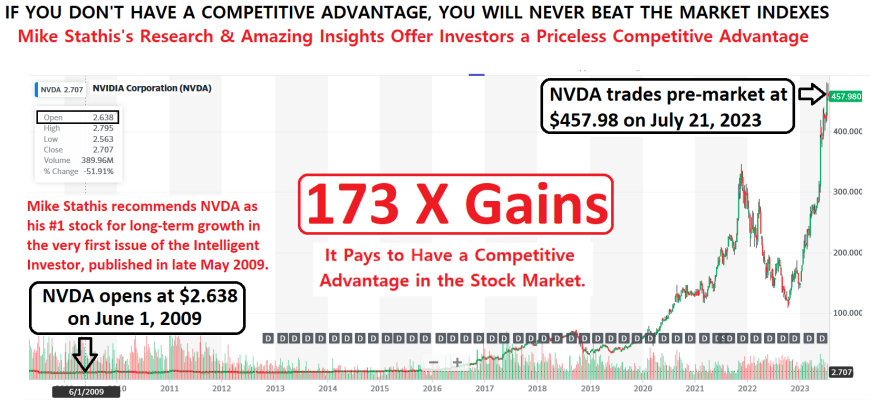

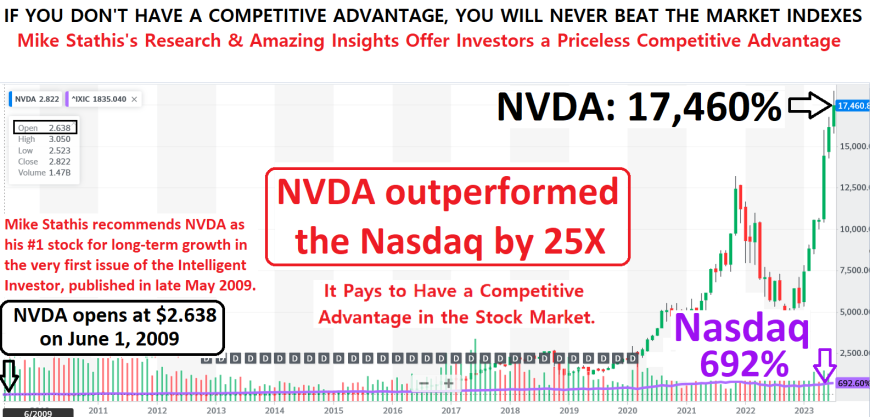

9) Fundamental & Macro Analysis - Recommended Nvidia (NVDA) Since 2009

I named Nvidia (NVDA) as my #1 Stock for Long-term Growth Since 2009.

10) Fundamental & Macro Analysis - Predicted Fannie Mae (FNMA) Bailout

I recommended to short Fannie Mae in my 2007 book (along with several sub-prime mortgage, bank, and homebuiler stocks),

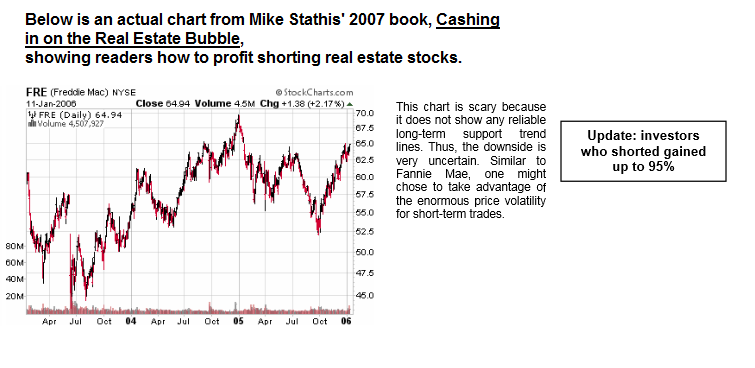

11) Fundamental & Macro Analysis - Predicted Freddie Mac (FMCC) Bailout

I recommended to short Freddie Mac in my 2007 book (along with several sub-prime mortgage, bank, and homebuiler stocks).

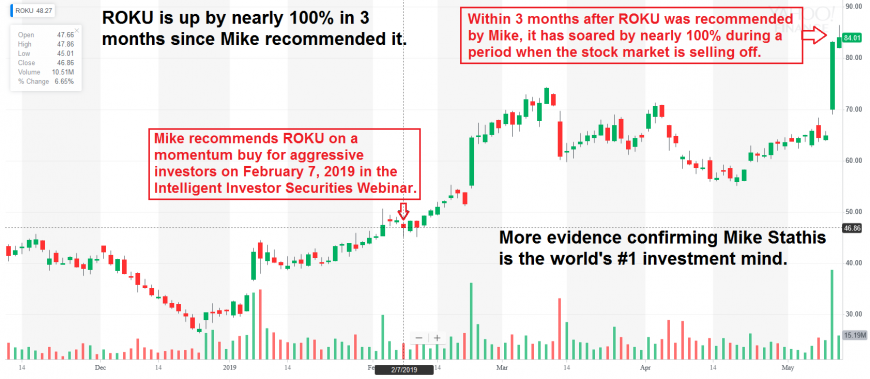

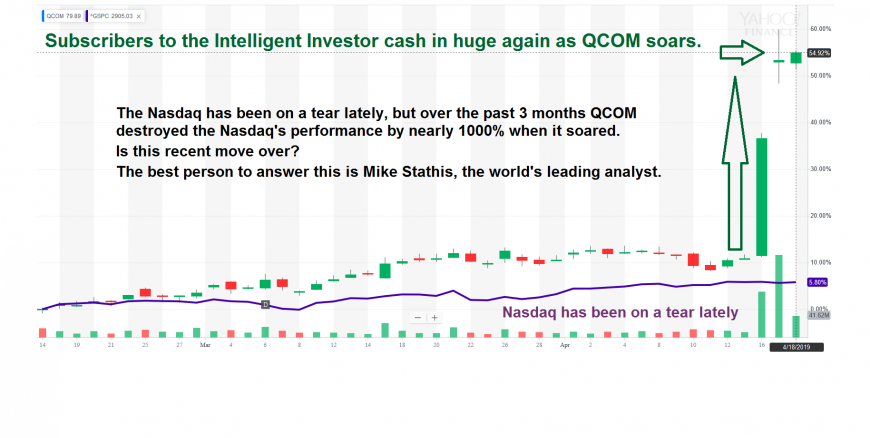

12) Fundamental & Technical Analysis - Qualcomm (QCOM)

An example of active management of securities on our Recommended List.

This is indeed a very bold claim that we have not made lightly. We have devoted many years towards researching and documenting many of the best known research firms including the most presigeous Wall Street firms and we are confident that Mr. Stathis holds the top investment forecasting track record since he began formally publishing investment research which was in 2006.

This claim emcompasses all of Mike's research coverage, from equities analysis including distressed securities analysis, to commodities and precious metals forecasts and trading guidance, along with U.S. stock market and emerging market forecasts.

We backed this claim by a $1 MILLION guarantee.

We extended this challenge for many years and raised the initial $10,000 award to $1,000,000.

This challenge expired in April 2021 after no one came forward since we initially launched it in 2009.

Although this challenge is now closed, we are potentially willing to reopen it. And we will also consider lowering the amount of money involved, as long as you demonstrate that you are serious and you are willing to provide us with your source funds along with ID verification.

* See below for evidence backing this claim.

Evidence Backing Our Claims

Note that we have been publishing research for nearly two decades, so we have thousands of research papers, videos, webinars, and special presentations which we cannot possibly show or even fully summarize in this entry. Therefore, the following materials should be taken to reflect a broad representation of our research forecasts, insights, and guidance.

1. Mike Stathis has the best published track record on the 2008 financial crisis.

We are as confident today as we were back in 2009 that no one can match the accuracy, detail, and comprehensiveness of Mike's 2008 Financial Crisis forecasts and recommendations.

The reader can find out more about Mr. Stathis' credentials, experience, background, and his investment research track record here and here.

The reader can examine Mr. Stathis' unmatched track record of accurately predicting the 2008 Financial Crisis and enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, and here.

While Mike Stathis recommended to short an entire basket of the sub-prime stocks, he took things to a much higher level with one of the boldest calls in investment history.

The really amazing call he made was to also recommend shorting the prime lenders, Fannie Mae and Freddie Mac (GSEs), as well as the banks and homebuilders.

No one else recommended to bet against the GSEs until it was obvious they were in big trouble.

And no one else recommended to short ANY of these stocks (including sub-primes and banks) in a book.

Two years before the financial crisis, Mike already knew the GSEs would get hit hard.

Mike detailed his analysis in two books including his recommendation to short these stocks.

He also predicted the GSEs would be bailed out by taxpayers, which is exactly what happned.

Furthermore, he even predicted the collapse of the banks, hombuilders, GE and GM.

No one else in the world made those calls before the financial crisis.

And Mike he made this analysis available to the public in two books.

If the media had not banned Mike and his books, main street could have made a fortune by following the recommendations in Mike's books.

But this would have enabled main street to take money from Wall Street. And the financial media would never allow that because they are partners in crime with Wall Street.

Mike presented a detailed analysis of the real estate bubble in the 2006 extended edition of America's Financial Apocalypse here.

Meanwhile, in early 2007 Mike released another book focused on profiting from the real estate bubble after it popped. The title of this book is Cashing in on the Real Estate Bubble.

You can access the chapter which recommended shorting real estate-related stocks and banks here.

The following charts are just a few of the examples from the book.

See here. for the remainder of the charts, the analysis and recommendations.

You can read the exact material presented in this book (chapter 12) here.

See Mike Stathis is the leading real estate forecaster

Shorting the Sub-Primes Was Child's Play

Forget the sub-primes.

That was the easy call to make if you knew what was really going on.

Unfortunately, very few people knew what was really going on.

Virtually no one from Wall Street or the Federal Reserve had an idea.

The problems with the risky sub-prime mortgage stocks were known by many leading experts.

But still, NO ONE other than Mike Stathis advised people to short the sub-primes IN A BOOK.

Stathis also recommended to short the homebuilders, banks and even discussed that GE and GM would likely collapse.

It's important to keep in mind that once something is pubished in a book, you can't go back and change it if it goes the wrong way.

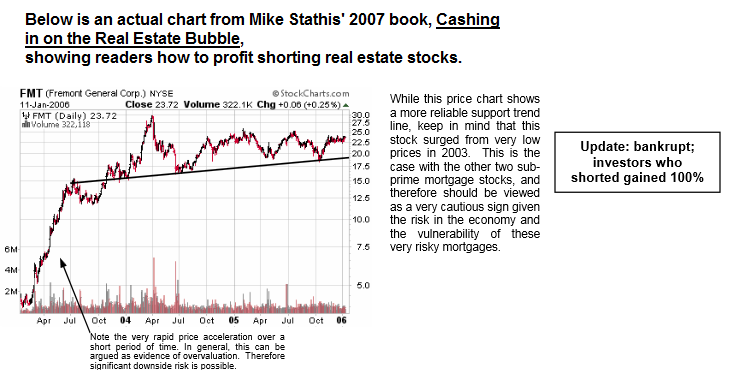

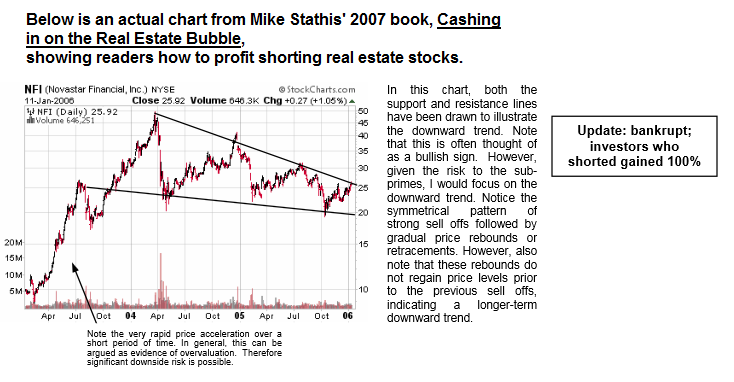

But Stathis was confident most sub-prime mortgage companies would go bankrupt once the real estate bubble popped. This is why he showed readers in his 2007 book, Cashing in on the Real Bubble how to profit from taking short positions in these stocks.

Sub-prime mortgages were packaged into what was essentially junk bonds. Because junk bonds have low credit quality during economic expansions, if you suspect that an economic contraction (recession) is on the way an easy call would be to short junk bonds (i.e. sub-prime mortgages) because defaults soar the most in junk bonds during recessions.

Despite this common sense logic, the media will never mention it because they prefer to create superheroes out of the fund managers who shorted the sub-primes.

Moreover, keep in mind that anyone can make a trade. And if it goes the wrong way, you can exit before it blows up and no one will know. If the fund managers were confident that the sub-primes would blow up, why weren't they in the media telling everyone about this "imminent" blow up? Instead, they waited for the trade to pan out. Then they disclosed their gains.

It's also important to note that these same fund managers have registered anywhere from terrible to modest performance since 2008. That means this guys benefited from a one-hit wonder and really have no clue how to perform well long-term.

Mike detailed the risks and problems with the sub-primes in his 2006 book, America's Financial Crisis.

In his 2007 book, Cashing in on the Real Bubble Mike actually recommended to short the sub-prime mortgage stocks, along with the homebuilders, and banks.

You can see for yourself here and here.

Again, he put his forecasts and insights in these books before the collapse. This is how confident he was.

Finally, imagine how many people from main street could have made a fortune if Stathis and his book had not been banned.

The Real Call Was Shorting Fannie Mae and Freddie Mac (GSEs)

Not a single fund manager so much as even thought about shorting Fannie Mae and Freddie Mac because these government-backed agencies were considered to hold only the best investment grade mortgages, or mortgages of high credit quality.

As well, they didn't short the banks or homebuilders.

And who else but Mike Stathis predicted that GE and GM would also collapse?

Mike Stathis understood the full extent of what was to unfold.

This is why he also recommended investors to short Fannie Mae and Freddie Mac (GSEs) in addition to the sub-prime mortgage stocks in his 2007 book, Cashing in on the Real Bubble.

Mike also accurately forecast the bottom in real estate (35%) in 2006 (the bottom was reached in 2011), the bottom in the Dow Jones (6500) in 2006 (the bottom was reached in March 2009) and much much more.

You can see for yourself here and here.

Mike Stathis' analysis of the MBS market and recommendations to short the sub-primes, GSEs, banks and homebuilders was one of the greatest investment calls in history.

Despite this fact, Mike remains unknown to the world as a result of him having been black-balled by all media upon trying to release his 2006 book, America's Financial Apocalypse.

The first two charts show the results of those who followed Mike Stathis' recommendations to short Fannie Mae and Freddie Mac in his 2007 book.

Also not shown are similar results for additional stocks he recommended to short such as the sub-prime mortgage stocks, homebuilders, and banks.

He even warned that General Electric and General Motors would get hit hard because he realized these companies had grown to become essentially consumer finance companies.

Check here, here and here for more evidence proving that Mike Stathis predicted the extent of the real estate bubble and resulting financial crisis with more insight and accuracy than anyone in the world.Note that this was just the "tip of the iceberg" as far as his predictions and insights.

The first two charts show the results of those who followed Mike Stathis' recommendations to short Fannie Mae and Freddie Mac in his 2007 book.

Also not shown are similar results for additional stocks he recommended to short such as the sub-prime mortgage stocks, homebuilders, and banks.

Please check the following links for Mike Stathis' 2008 financial crisis forecasts and insights which enabled investors to capture life-changing profits here, here, here, here, here, here, here, here, here, and here.

There were no books released at any time prior to for after the release of these books which remotely came close to pinpointing the details and accuracy of the events as they would later unfold. And this serves as just one of numerous illustrations.

Mike also accurately forecast the bottom in real estate (35%) in 2006 (the bottom was reached in 2011), the bottom in the Dow Jones (6500) in 2006 (the bottom was reached in March 2009) and much much more.

Mike also recommended buying REITs after the real estate bubble burst.

And he even provided some specific examples.

Finally, Mike also predicted the reverse mortgage boom in his 2007 book. As we know, reverse mortgages did in fact boom in years after the financial crisis.

Here we show his remarkable market forecasting track record and recommendations prior to during and just after the 2008 financial crisis published in his 2006 book, America's Financial Apocalypse as well as in several articles in the public domain in 2008 and 2009.

.png)

Proof That Mike Stathis Has The Leading Track Record On The Economic Collapse

Meanwhile, Stathis was black-balled by all media for trying to warn main street about the 2008 financial crisis despite holding the leading investment forecasting track record since 2006.

View more of Mike Stathis' Track Record here, here, here, here, here and here.

America’s Financial Apocalypse remains as the most accurate, comprehensive and insightful book 17 years after it was first published. Some might counter that's it's even more important than before because it detailed America's trade issues with China.

Others feel the need to release 2.0 versions of their book because they missed so much and got so many things wrong the first time.

Some financial professionals spend all of their time marketing.

Others spend all of their time doing research. In the end, the track record is the only thing that matters.

The following is only a PARTIAL LIST of accurate forecasts and insights from the extened edition of America's Financial Apocalypse (2006).

Because we do not have the time to go through the book and list more, if you feel there are some important additions to this list, please email us with your entry and page number.

In this book, Mike...

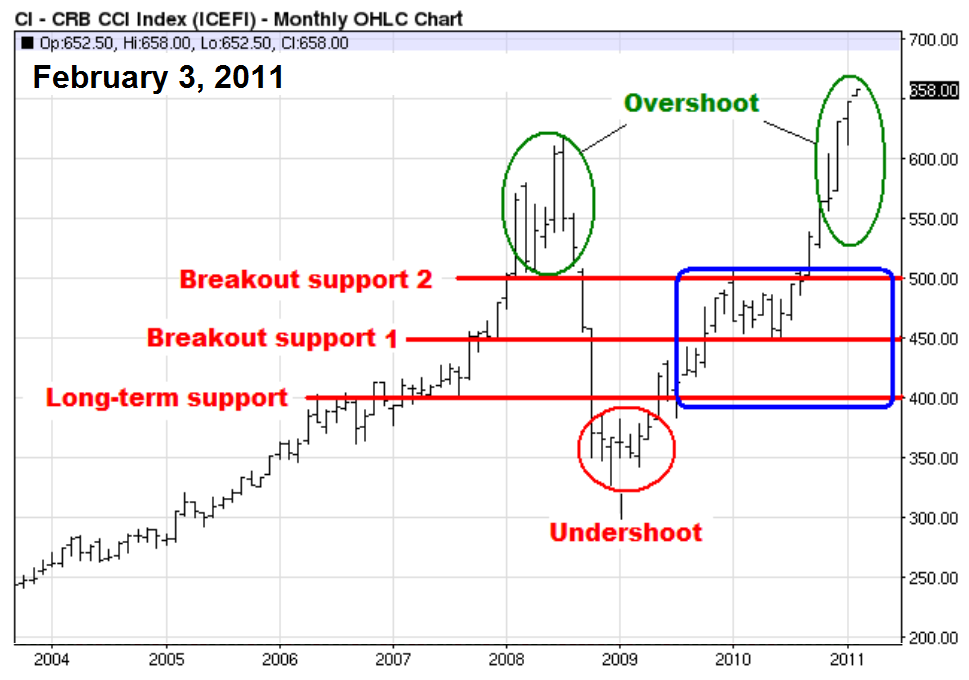

(1) Predicted the collapse of the commodities bubble by 2008/2009, and told readers that would be the time to buy - Chp. 14

(2) Warned that the credit rating agencies were passing AAA ratings to risky mortgage debt – p. 219

(3) Warned of the lack of adequate regulatory authority over the MBS market positioned it for a massive collapse – p. 222

(4) Predicted a mortgage-related derivatives meltdown resulting in losses in the trillions of dollars – p. 221

(5) Predicted the banks would suffer due to the implosion of the MBS market – p. 223

(6) Warned that once the MBS market collapsed it would lead to a massive sell-off in global stock markets - p. 223

(7) Advised readers to short LEND, FRE, NFI, FMN, FRE, banks and homebuilders (Cashing in on the Real Estate Bubble)- Chp. 12

(8) Predicted that Fannie and Freddie would be bailed out by taxpayers – p. 221

(9) Predicted real estate prices would decline by 30%-35% on average (50-60% in certain regions) – p. 223

"I would estimate at its bottom, the deflation of the housing bubble will cause a 35 percent correction for the average home. And in “hot spots” such as Las Vegas, Northern and Southern California, and South Florida, home prices could plummet by 50 to 60 percent of their peak values." (Cashing in on the Real Estate Bubble) --pp. 67-8

(10) Predicted Dow 6500 - Chp. 16, pp. 336-342

(11) Warned the collapse of real estate and stock market would lead to the “Poor Effect” – p. 201

(12) Provided exhaustive evidence of a massive real estate bubble ready to burst – Chp. 10 – the most exhaustive and insightful analysis anywhere

(13) Warned that GM and GE would also collapse due to the real estate implosion – p. 223

(14) Warned of the implosion of the ABS market – p. 223

(15) Presented irrefutable evidence there would be a depression – Entire Book

(16) Predicted there would be a "New Deal" – p. 346

(17) Warned about the entitlements tsunami that would lead to massive tax hikes -- Chp. 11

(18) Detailed "free trade" as America's #1 chronic macroeconomic problem - numerous chapters

(19) Addressed healthcare as the second biggest long-term problem faced by America - Chp. 7

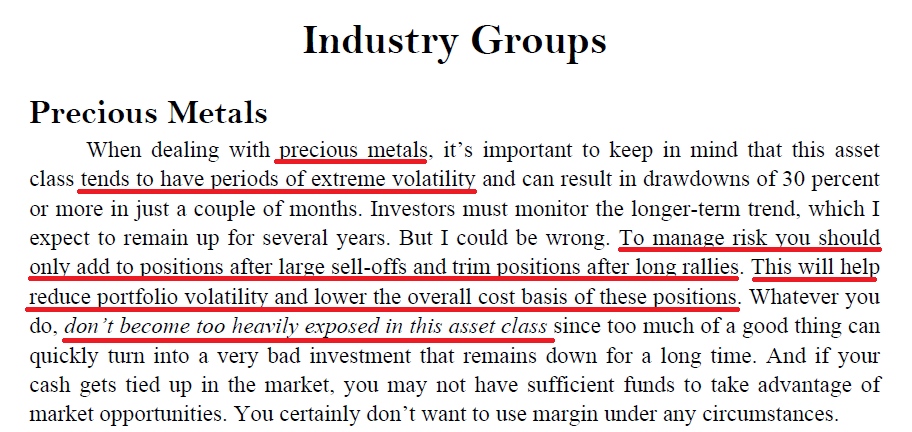

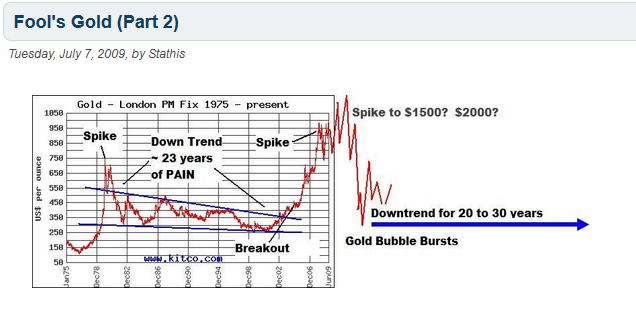

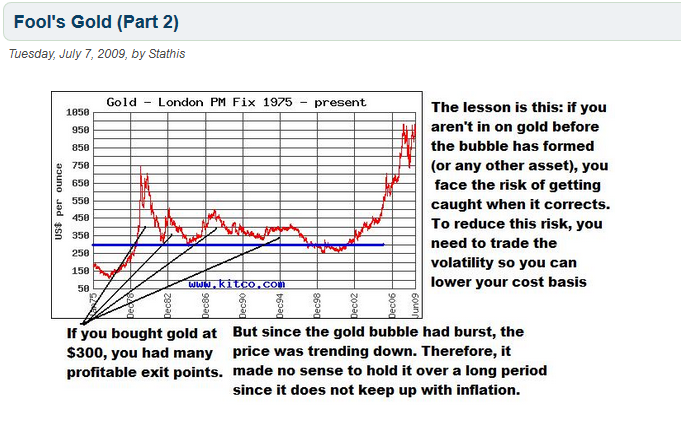

(20) Recommended gold and silver - Chp. 17

(21) Advised investors to trade the volatility of gold rather than buy and hold – p. 381

(22) Recommended oil trusts as a way to deal with the high volatility of oil - Chp. 17 and 18

(23) Recommended going to cash and waiting for the disaster - Chp. 17

(24) Mentioned the Fed might create massive inflation to pay off the huge national debt – p. 362

(25) Provided a generic asset allocation for conservative, moderate and aggressive investors – in each case, Cash was the #1 asset (so they would be able to buy after the market crashed). p. 383

Other recommended assets: oil trusts, gold, silver, Chinese funds (note I warned China’s economy would correct, indicating a time to buy below), healthcare, TIPS, dollar hedge with euro – p. 383

(26) Predicted an inflationary depression followed by brief periods of deflation if things got really bad (we experienced deflation during Q4, 2008) -- Chp. 16 and 17

(27) Discussed effective ways to manage risk – pp. 376-385

(28) Detailed how the government manipulates economic data (GDP, inflation, unemployment) - Chp. 11

(29) Explained how gold was a hedge against deflation, not inflation – pp. 360-362 -- he followed up on this in detail to help the sheep who are being taken by the gold bugs despite the fact that he forecast gold to soar to above $1400 and perhaps $2000 in this book.

(30) Explained how America today (2006) shared many similarities to pre-depression America – Chp. 16, pp. 343-346

(31) Warned of the possibility of China dumping U.S. Treasuries or using this threat for economic (such as unfair trade and currency manipulation) and political leverage pp. 308-309, 312

(32) Explained how corporate America is destroying middle class – Chp. 12, pp. 322-325, 257-262

(33) Detailed America’s two-decade period of declining living standards – pp. 243-248

(34) Explained how the SEC permits legalized insider trading – pp. 255-256

(35) Proved how the economy under Bush was a disaster and was set to implode – Chp. 15

(36) Explained how the SEC is useless and serves as a partner in crime with Wall Street – Chp. 12

(37) Explained how the dollar is backed by oil and how the Saudis have a huge amount of control of the fate of the U.S. economy, pp. 310-311

(38) Predicted most baby boomers would never be able to retire due to the stock market collapse – Chp. 8 and 13

(39) Exposed the myths and discussed the real problems with Social Security – increased dependence and loss of buying power – Chp. 8

(40) Exposed the fraud behind the for-profit college system

(41) Detailed America's wealth and income disparity (media only began talking about this in 2010)

(42) Provided a rough asset allocation guideline (via table) showing specific sectors relative to the type of investor (e.g. conservative, moderate and aggressive). - Chp. 18

(43) Recommended trading the volatility in gold and silver via ETFs - Chp. 17

(44) Discussed how to protect against inflation and deflation - Chp. 18

(45) Discussed investment opportunities in healthcare, alternative healthcare, oil, alternative energy, precious metals and emerging markets - Chp. 17 & 18

(46) Predicted the rental market boom that would occur once the real estate bubble popped and the recovery began (Chp. 10)

(47) Predicted the boom in reverse mortgages after the real estate bubble popped and the recovery began (Chp. 10)

(48) Exposed the for-profit college scam (pp. 53-4, 325)

(49) Uncovered the derivatives risks to real estate and was the first person in the world to discuss CDS, CMOs, CLOs, MBS and ABS.

Has there ever been another investment book like this? Probably not.

Mike Stathis Foresaw the Problems With US Trade Policy Back in 2006

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

You Will Lose Your Ass If You Listen To The Media

Mike Stathis holds the best investment forecasting track record in the world since 2006.

View more of Mike Stathis' Track Record here, here, here, here, here and here

2. Mike Stathis is the world's leading stock market forecaster.

First, we begin by summarizing Mike's spectacular market forecasting track record from the 2008 Financial Crisis period.

.png)

.png)

Not only has he since kept his research clients in the market the entire time, he has also accurate forecast nearly every major market selloff since 2008 (as of 2023).

.png)

.png)

Note that in late-2014 and increasingly in mid-2015, Mike began advising clients to raise net cash on rallies in preparation of large stock market selloffs.

.png)

Mr. Stathis' Forecasting Track Record Since 2015

Mike Stathis Warned About the 2022 Bear Market Before it Began

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

Mike Shows You How to Make 100% in 2 Weeks and 200% in 6 months

Did You Own the Best Stock of 2016? Intelligent Investors Did

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

Mr. Stathis' Forecasting Track Record Between 2008 and 2014

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

Stathis Nails The Dec 2014 Market Selloff With Stunning Accuracy

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Excerpts Of The October 2014 Economic And Securities Supplement Audio 2

Who Do You Think Nailed the Latest Market Selloff AGAIN?

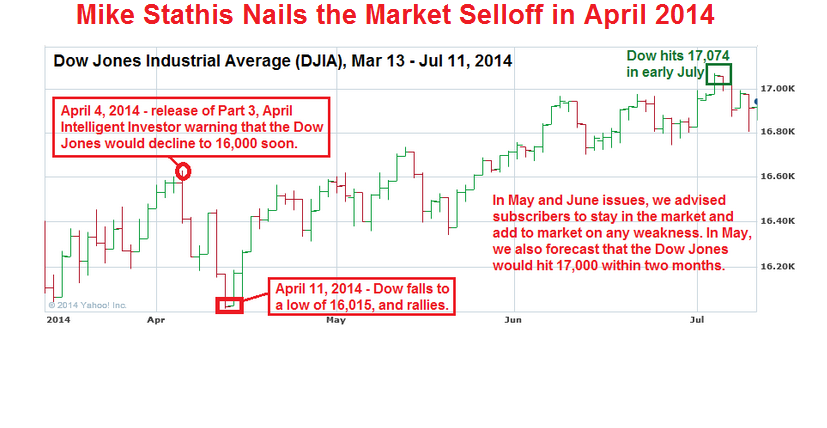

Stathis Nails the Market Correction in April 2014

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

Stathis Nails the Gold & Silver Trade Again

We Predicted The Market Selloff Yet Again

More Proof Wall Street Research Is Useless

ANOTHER Security From Our Recommended List Gets Bought Out

We Predicted The Market Correction AGAIN

Does AVA Investment Analytics Have Insider Information?

We Pin-Pointed the Past Two Market Tops And Bottoms

Does AVA Investment Analytics Have Insider Information?

4-Day Gains of 30% for 2011 and 2010 Performance

Another Huge Winner in a Few Weeks

Newsletter Stock Recommendation Soars More Than 25% in Just 3 Days

Can a Book Serve as a Crystal Ball?

Since The Market Lows, Only One Man Continues To Shine

Mike Stathis' Near-Perfect Market Forecasting Record

Another Security from the Intelligent Investor Soars

How to Short Stocks: Critical Lessons from the Intelligent Investor

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Mike has a long history of identifying stocks that would deliver amazing long-term growth.

Mike is also one of the world's leading distressed securities analysts.

Mike's breadth of skills can also be seen by his uncanny ability to determine the fate of distressed securities. Mike might be the world's leading distressed securities analyst.

The remarkable thing about this is that he is able to make very accurate determinations without having access to crucial data available only to large investment firms.

This is absolutely unheard of.

For instance, at the bear minumum, prudent distressed securities analysis requires the analyst to have access to a Bloomberg terminal and credit ratings research from all three of the major credit rating firms. There are additional services that are needed as well such as Refinitiv and Factset portals. These resources are too costly to justify the monthly expenditure.

And when you are Mike Stathis, you don't need these fancy services.

Mike has accurately predicted numerous bankruptcies over the years. In contrast, as of July 21, 2023, we can think of not a single company for which he had predicted would go bankrupt that failed to do so. Some of the bankruptcies Mike has predicted include Eastman Kodak, Bombay Company, Circuit City, Blockbuster Video, Sears, Radio Shack, JC Penny, BonTon, Steinmart, Tuesday Morning, and Bed, Bath and Beyond, to name a few.

In contrast, Mike has successfully forecast the turnaround of an even larger numger of distressed companies, enabling research clients of the Securities Analysis & Trading Webinar Series to capture huge gains. Some of the stocks Mike accurately predicted a turnaround include Circuit City (a few years before it went bankrupt it was distressed but recovered nicely), Signet Jewelers, Bed, Bath and Beyond (several years before it filed for bankruptcy the stock was distressed but it made a nice recovery), Tupperware (several years before it filed for bankruptcy the stock was distressed but it made a nice recovery),

Below is a summary of the evidence supporting this claim.

First, we cannot forget about Mike's recommendations from the 2008 Financial Crisis. Below we see how Mike recommended to short Fannie Mae and Freddie Mac in his 2007 book, Cashing in on the Real Estate Bubble.

Please see claim #2 above for additional equities forecasts from the 2008 Financial Crisis period.

Not long after the 2008 financial crisis and soon after Mike advised investors to begin buying into the stock market (March 10, 2009. This would turn out to be the exact bottom.

On May 27th 2009 we released the first issue of the AVA Investment Analytics newsletter (Volume 1, June 2009) now known as the Intelligent Investor.

In this first volume, Mike discussed his top three stocks for long-term growth.

Note that prior that time (May 2009) and since then, Mike has NEVER come out with another list of top stocks for long-term growth.

The point here is that we are not cherry-picking his results.

That is, we only have one of these lists. We don't have two, three or more lists of stocks for long-term growth for which we selected the best results.

So now let’s have a look at this list and see how it has performed.

As you can see (below) from page 31 from Volume 1 of the Intelligent Investor (published May 27, 2009) Mike's number one stock for long-term growth was Nvidia (NVDA).

His number two stock for long-term growth was UnitedHealth (UNH).

And his number three stock for long-term growth was Whole Foods (WFMI).

In Summary, in the first issue (June 2009) of the Intelligent Investor, Mike published his top 3 stocks for long-term growth:

#1 - Nvidia (NVDA)

#2 - UnitedHealth (UNH)

#3 - Whole Foods (WFMI, later changed to WFM)

Nvidia (NVDA)

First, let's examine how Mike's #1 pick for long-term growth, Nvidia (NVDA) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

It's important to note that NVDA has remained on Mike's securities recommended list every month since he first added it in Volume 1, June 2009.

Once you adjust the share price for stock splits, Mike added NVDA to his recommended list at a price of less than $3/share in 2009.

At a current price of just under $400, you can see that shares have increased by 135-fold since 2009, representing gains of nearly an incredible 135,000%.

Over the same time period, the Nasdaq did quite well. But the Nasdaq's 692% gains pale in comparison to NVDA's 17,460%.

UnitedHealth (UNH)

Next, let's examine how Mike's #2 pick for long-term growth, UnitedHealth (UNH) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

Although Mike recommended UNH less than a year earlier at roughly $14/share and called it a once in a lifetime buy, he had not yet begun to publish his investment research.

Once he began publishing his research he added UNH to his recommended list in Volume 1 of the Intelligent Investor although shares had nearly doubled and were selling for just under $30.

At a current price of just under $500, simple math shows that UNH share price grew by 20-fold delivering 2,000% returns since Mike added it to the list.

And while the Dow Jones Industrial Average and S&P 500 Index (the appropriate benchmarks) performed extremely well over that time frame, the Dow's 305% and S&P's 384% returns pale in comparison to UNH's 2,000% returns.

Whole Foods/Amazon (WFM/AMZN)

Finally, let's examine how Mike's #3 pick for long-term growth, Whole Foods (WFMI) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

At the time Mike added WFMI to his list in 2009, shares were selling for roughly $20.

Because Amazon (AMZN) bought Whole Foods a few years later, the standard way to track this performance is to replace Whole Foods (WFMI) with Amazon (AMZN).

Adjusted for stock splits, AMZN was selling for roughly $4 in June 2009.

At a current price of around $124/share (June 2023), this means AMZN share price grew by 31-fold, delivering cumulative returns of 31,000%.

This was of course much better than the Nasdaq's ~650% returns over the same time period.

Netflix (NFLX)

If you had read the Wall Street Investment Bible, you would have been convinced to buy Netflix (NFLX) at $3.

He also recommended investors take a short position in Blockbuster Video (BBI) in the same book.

Blockbuster Video would go on to file for bankruptcy a few years later while Netflix (NFLX) soared.

Mike continued recommending NFLX for the long-term due to his analysis and understanding of the industry, the company, and management.

Bed, Bath and Beyond (BBBY)

Over the past several years leading up to the bankruptcy of BBBY, Mike identified several buying opportunities stating that although he was not confident the company would be around in ten years, he felt it was "okay for now as long as you have an exit strategy." Mike's recommendations enabled investors to capture up to 150% in BBBY in at least two occassions.

By late 2022, Mike was warning investors against buying BBBY even for a trade because he felt the company could easily enter a liquidity crisis which would result in insolvency (bankruptcy).

Just as he has done so many times in the past, Mike was able to spot short-term opportunities while pointing to long-term risks. But once the companies fundamentals declined below a critical threshold, Mike recognized it and steered investors away from the stock.

See Mike Stathis Predicted Another Bankruptcy: Bed, Bath & Beyond (BBBY)

Facebook (FB)/Meta (META)

Just over one year before Facebook's IPO, Mike wrote an article which was made available to the public explaining why he was confident Wall Street was orchestrating a pump-and-dump for Facebook's IPO.

Take a look at the results. As usual, Mike was right. Shares of Facebook collapsed immediately upon entering the public markets. After four months, Facebook shares had collapsed by nearly 60% before staging a comeback.

Facebook's comeback after its collapse is a story Mike is open to discuss upon request by research subscribers.

See Goldman Sachs and the Facebook Pump and Dump

See Shorting & Short Squeeze Case Studies

Take a look at the results of Facebook within a couple of months of its IPO.

.png)

Mike Stathis was warning about Alibaba (BABA) before Charles Munger started buying it.

He specifically told investors to avoid the stock. Mike had been warning about the dangers and risks of U.S.-listed Chinese stocks years before it was discussed in the media.

Meanwhile, the "legendary investor" Charles Munger was buying Alibaba (BABA) while praising the company and the Chinese government.

See Charlie Munger's BABA Blunder. Mike Stathis Warned About BABA Well in Advance (Part 1)

See Charlie Munger's BABA Blunder. Mike Stathis Warned About BABA Well in Advance (Part 2)

See Bill Miller Bought Alibaba (BABA) as a "Great Value" Stock in 2022

Groupon (GRPN)

The next two charts illustrate the results of Mike's pre-IPO research presentation of Groupon.

In this presentation Mike discussed why the business model was flawed and why the stock would collapse after its IPO, never to recover due to limited growth options.

He recommended to short the stock.

See Shorting & Short Squeeze Case Studies

.png)

.png)

.png)

Mike Stathis Predicted Sears' Bankruptcy Many Years Ago

See Shorting & Short Squeeze Case Studies

Radio Shack (RSH)

.png)

.png)

Bon Ton (BON)*

See Shorting & Short Squeeze Case Studies

.png)

.png)

.png)

* Mike would later predict the bankruptcy of BonTon in the Securities Analysis & Trading Webinar Series.

Safeway (SWY)

See Shorting & Short Squeeze Case Studies

See ANOTHER Security We Recommended to Short Collapses

Mystery Stock #2 was Safeway (SWY)

Patriot Coal (PCX)

See Shorting & Short Squeeze Case Studies

We recommended investors to short PCX because we expected a collapse due to financial issues along with problems with the coal mining industry. Mike concluded that he felt PCX could potentially face bankruptcy.

.png)

.png)

MAKO Surgical (MAKO)

See More of Our Research Lands HUGE Payouts: Today MAKO

See Shorting & Short Squeeze Case Studies

Mike warned of a collapse in shares of MAKO Surgical (MAKO), followed by a strong rally up to around $30 (MAKO did collapse and later rallied just as forecast, and was bought out by Stryker).

.png)

.png)

GameStop (GME)

See Shorting & Short Squeeze Case Studies

DIVIDEND GEMS TRACK RECORD

Dividend Gems Has Destroyed the S&P 500 Performance Since the Beginning of 2022

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Dividend Gems Subscribers Are Treated To Yet ANOTHER HUGE BUYOUT - Kraft

Dividend Gems Scores Another Huge Winner

Dividend Gems Scores ANOTHER Huge Payday

Warren Buffett Follows Our Lead On Heinz

Did You Own The BEST PERFORMING Stock In 2011? WE DID

Dividend Gems Destroys The S&P 500 Index AGAIN

Dividend Gems Holds Up As The Stock Market Collapses

Dividend Gems Continues To Smash The S&P 500 Index

Dividend Gems Outperforms Again

Dividend Gems Shines As The Market Corrects

The Impressive Performance Of Dividend Gems

As far as we are aware, Mike Stathis holds the leading investment forecasting track record since he began publishing research in 2006.

We put our money where our mouth is by backing this claim with as much as a $1,000,000 guarantee. See here.

This claim emcompasses all of Mike's research coverage since he began formally publishing research in 2006, from equities analysis including distressed securities analysis, to commodities and precious metals forecasts and trading guidance, along with U.S. stock market and emerging market forecasts.

Therefore. the materials in sections 1 through 3 from above should be used as a basis for this claim.

Over the years Mike has made some amazing macro calls, such as his detailed research predicting the rise of China two decades ago, followed by it's downfall several years ago, the rise of India sveral years ago, the rise of Brazil followed by difficult times after 2011, the deflationary decade in Europe and many other accurate calls. Much of Mike's emerging market macro calls are actually embedded within his Emerging Markets forecasting research which is part of the Market Forecaster.

Unfortunately, we just have not had sufficient time to documents his EM forecasting track record, but the accuracy of forecasts is very high.

As well, the insights on the emerging markets provided by Mike are extremely valuable and almosty always in advance of the street. For instance, Mike warned about the dangers of U.S. listed Chinese stocks as early as 2017, well before Wall Street was talking about the risks.

Mike also predicted two Chinese stock market bubbles several years ago and warned investors when too exit before the bubble popped.

More Proof that Mike Stathis Is a Much Better Investor Than Warren Buffett

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

COMMODITIES, CURRENCIES & PRECIOUS METALS FORECASTER

WTI & Brent Crude:*

Henry Hub Natural Gas:*

Gold & Silver:*

Mike Stathis Nails The Gold And Silver Trade Again (Oct - Nov 2015)

Guess Who Nailed The Most Recent Gold Trade AGAIN

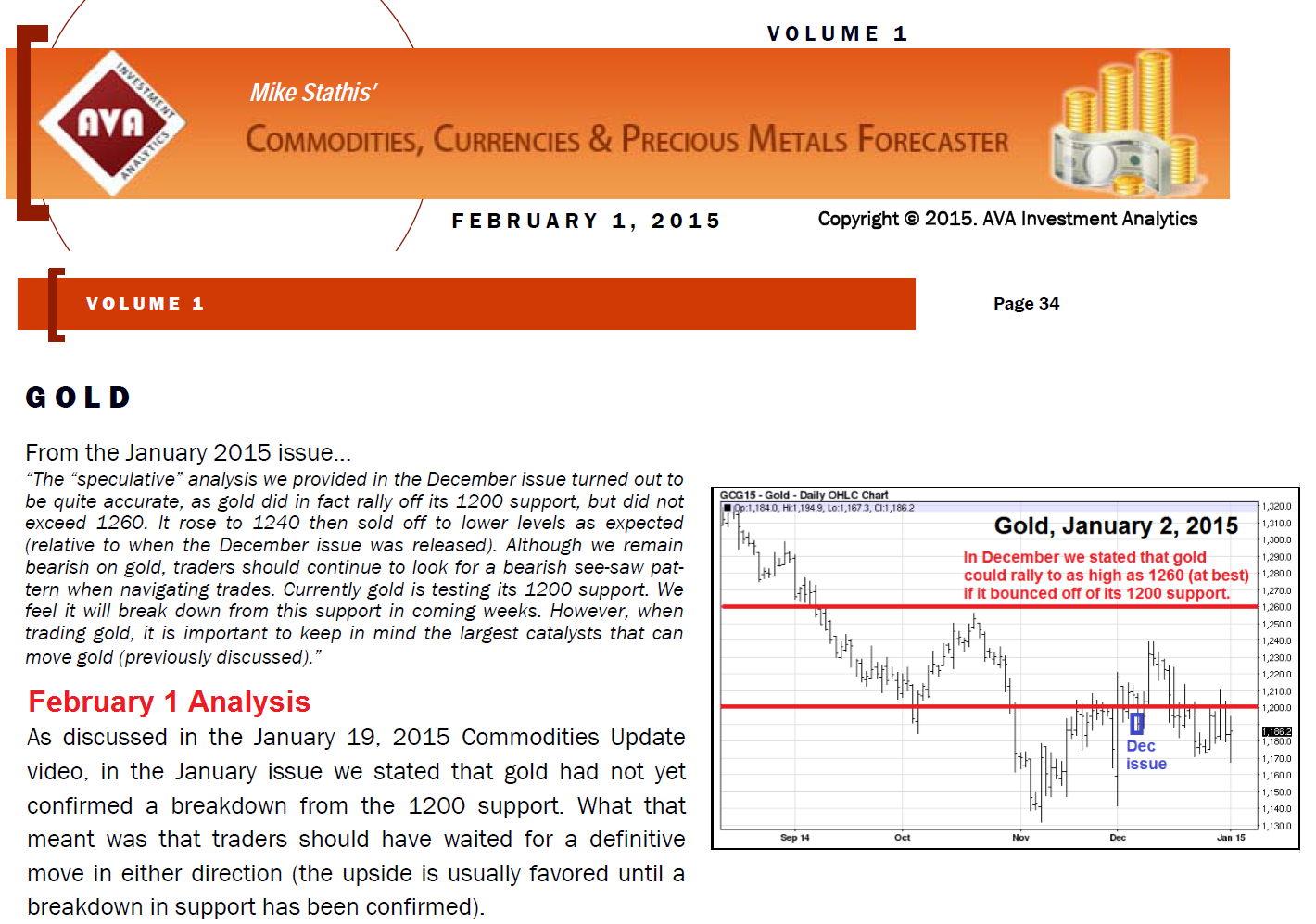

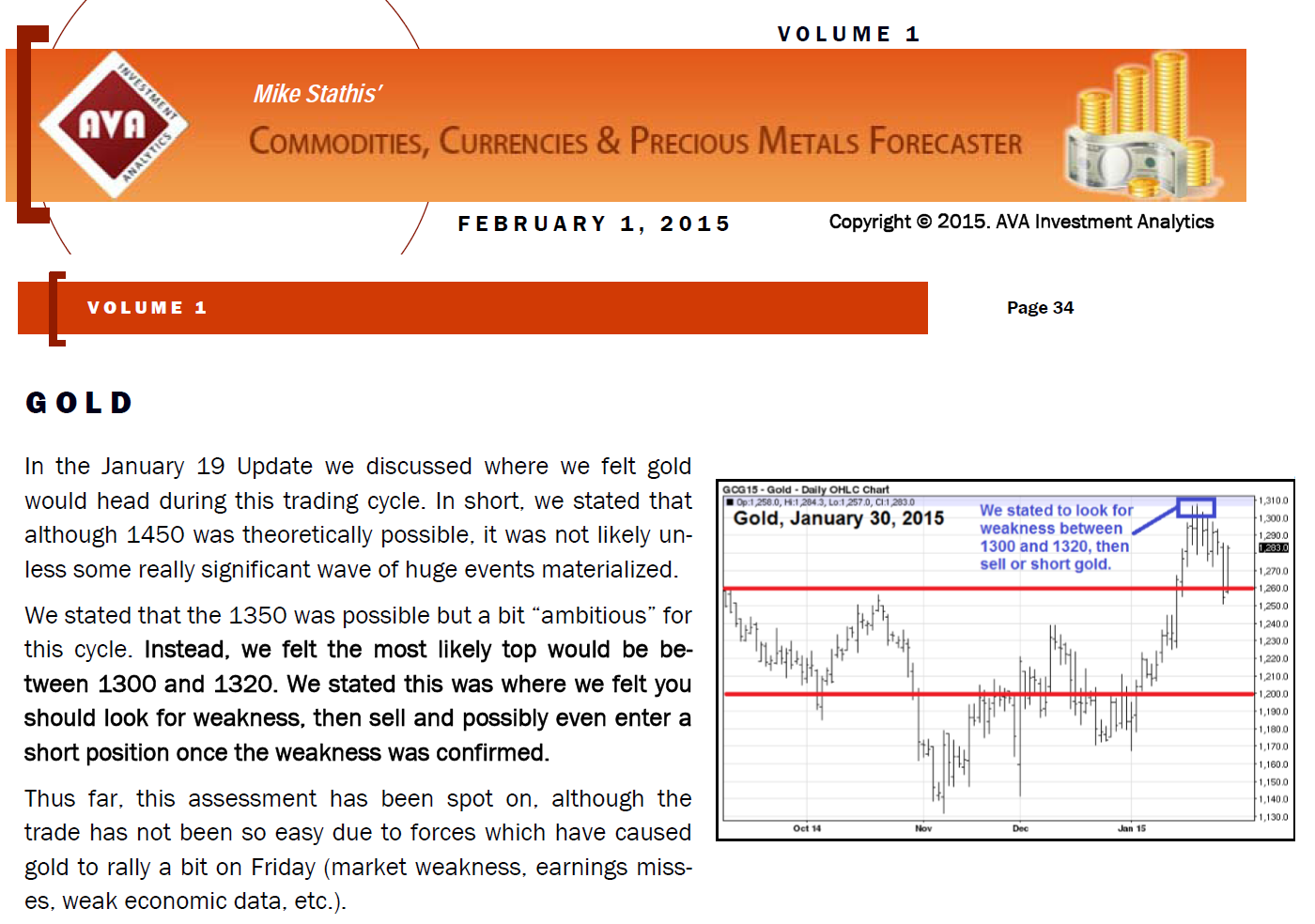

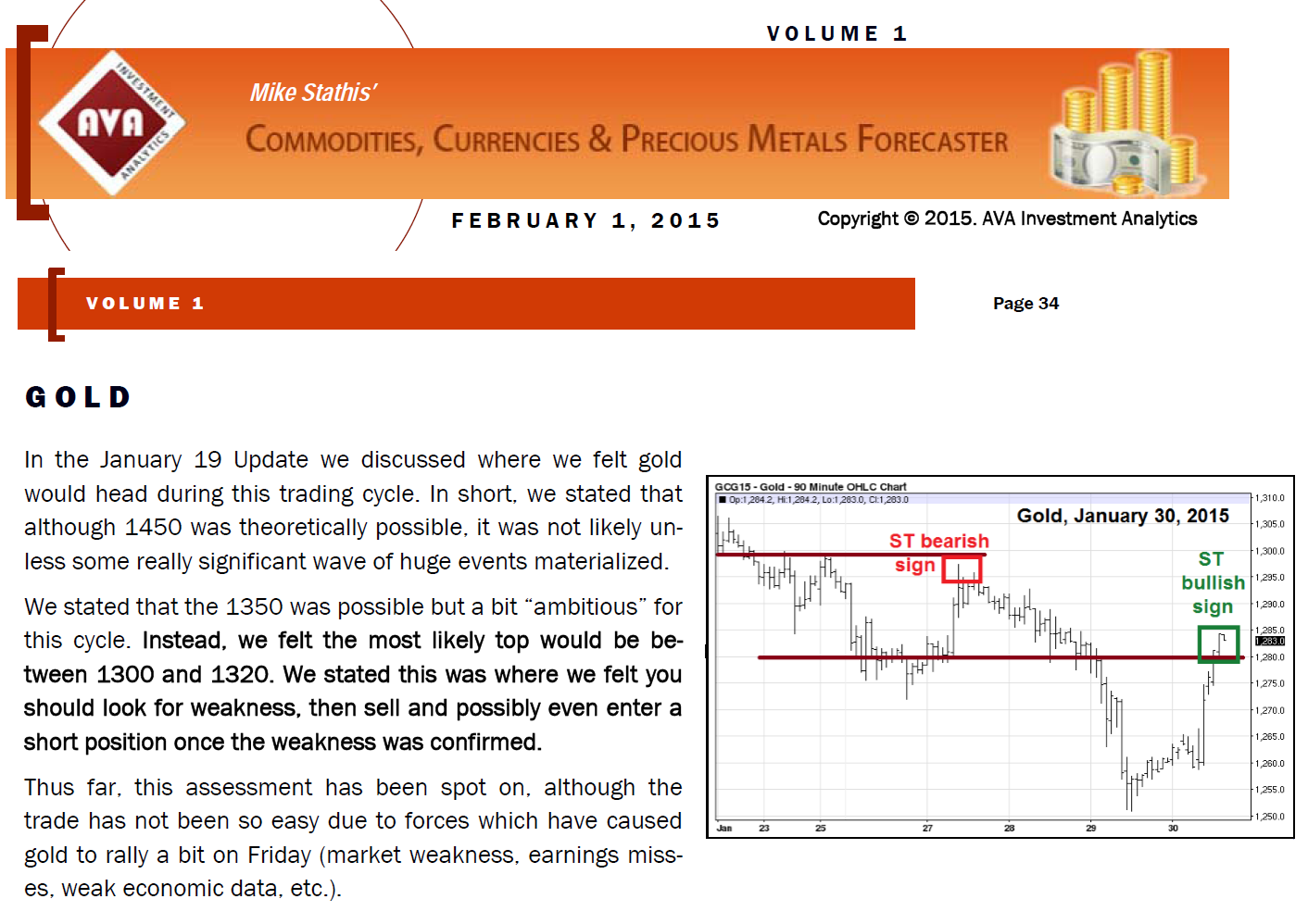

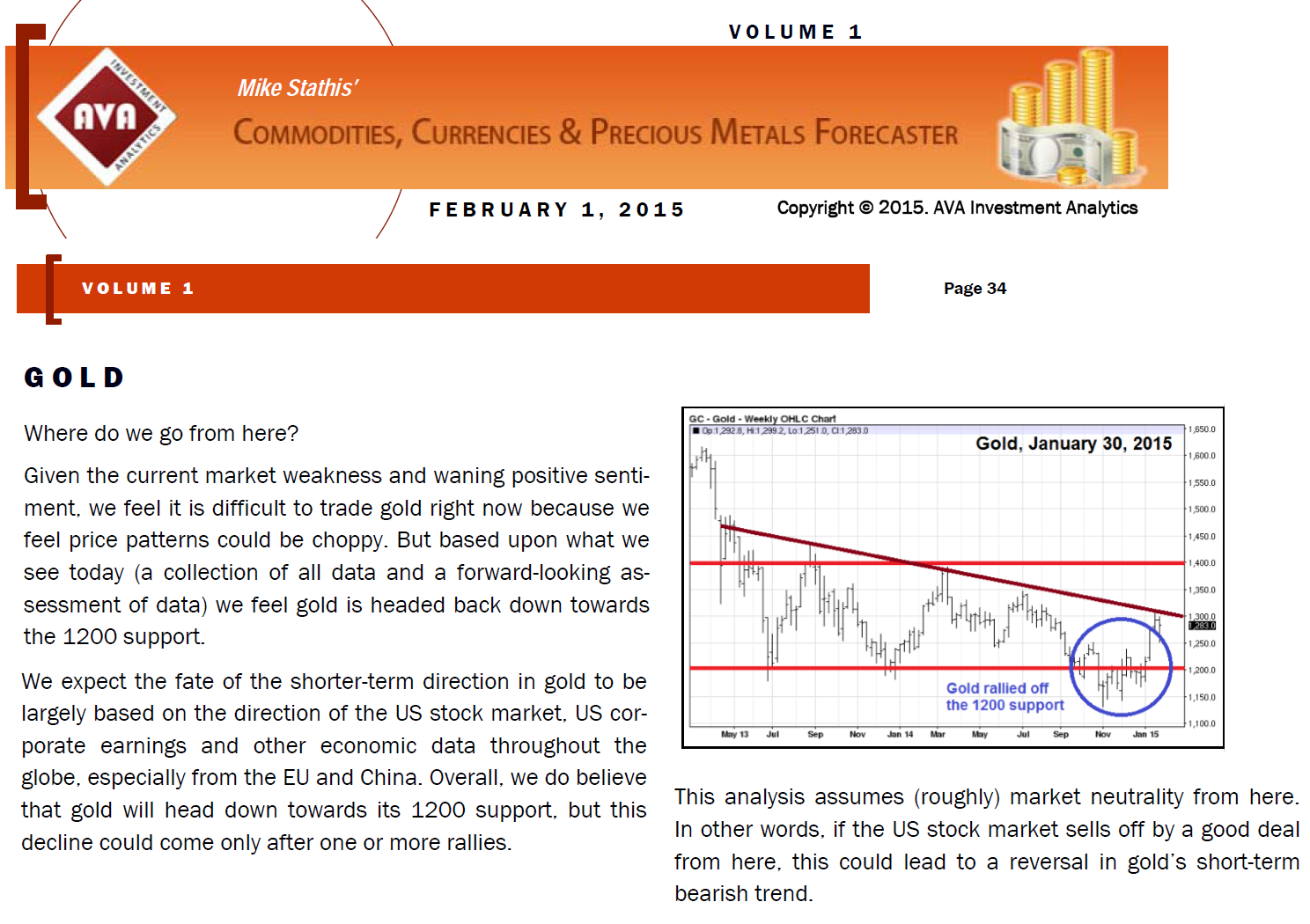

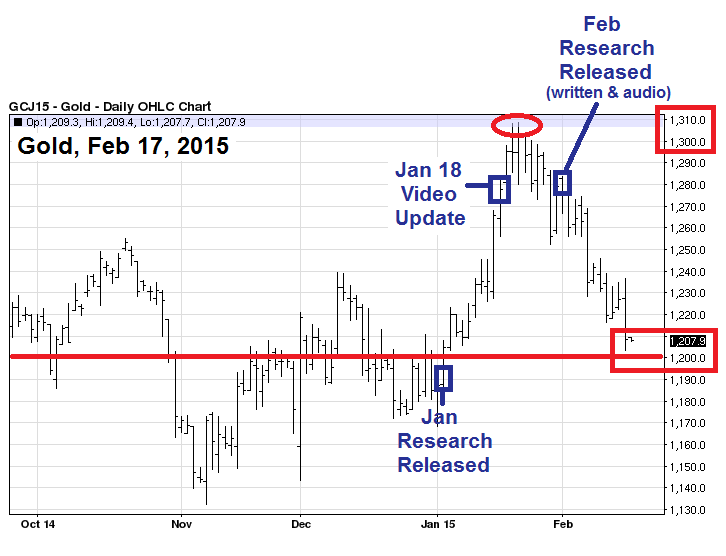

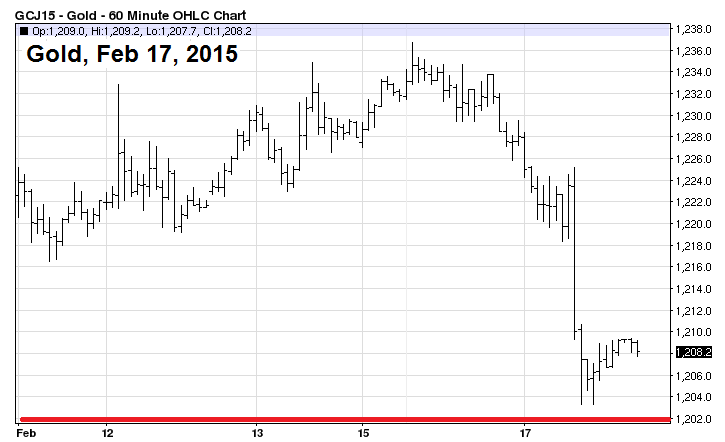

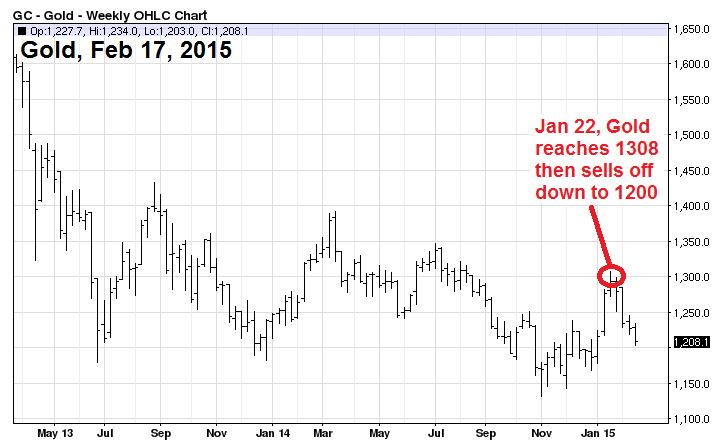

Mike Stathis Nails The Latest Gold & Silver Trade (Jan-Feb 2015) Updated

Stathis Nails The Gold & Silver Selloff AGAIN - Jul - Sep 2014

March 25, 2013 Gold Analysis & Forecast

The REAL Precious Metals Expert Shows You How it's Done

Stathis Nails the Gold & Silver Trade AGAIN

August 2012 - We Nailed The Gold Breakout

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Gold & Silver

.png)

.png)

.png)

We Nailed The Gold Breakout - August 2012

.png)

.png)

Gold Analysis & Forecast From March 25, 2013

August 2013 Gold & Silver Forecast

(see video below)

August 19, 2013 Commodities Update

Stathis Nails The Gold & Silver Trade AGAIN

The REAL Precious Metals Expert Shows You How It's Done

.png)

.png)

.png)

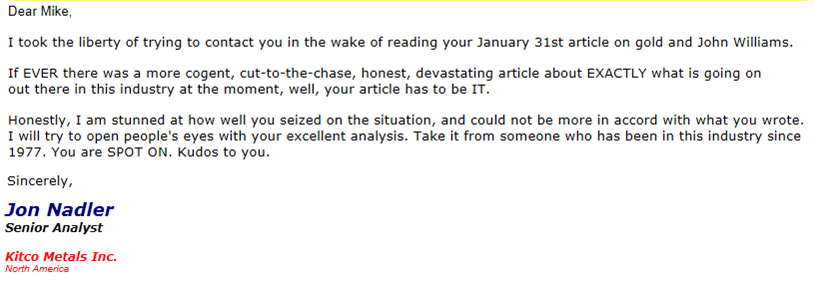

Take a look at the article that caused the head gold analyst working for one of the largest gold dealers to praise Stathis.

The following article is one of many written by Mike that have reached legendary status.

Dismantling John Williams' Hyperinflation Predictions

Real experts will tell you that precious metals should be traded in order to exploit the price volatility. This is the most prudent manner by which to minimize risk because it enables one to lower the overall cost basis and increase liquidity. The top investors in the world agree on this. It is a fact. Anyone who tells you anything different is either lying or misinformed.

Unfortunately, the vast majority of individuals who are yapping away in the media (mainstream and alternative) are liars and idiots.

Of course, anyone who read Mike Stathis' remarkable 2006 book, America’s Financial Apocalypse knew these facts in advance. But the gold dealers and their paid promoters did not want you to know these facts because if you knew the truth you would not buy physical gold and silver.

Maybe now you are beginning to see why every gold pumper and gold dealer is doing their best to avoid mention of Stathis, despite the fact that he holds the number one investment forecasting track record in the world since 2006. Think about it.

.png)

Emerging Markets Forecasts:**

Revisiting the June 12, 2013 EM Forecast

Note that our emerging market forecasts are just as accurate as our US market forecasts but we just have not had enoughh time to create and post excerpts showing our spectacular accuracy. We hope to devote more time for this task in the future.

The following list contains only a tiny portion of accurate forecasts and predictions made by Mike Stathis (verified by published research):

1. Collapse of Brazilian Economy (2012 - 2015, and bearish trading guidance for EWZ)

2. Collapse of Petrobras (2014)

3. Collapse of Latin America (2013)

4. Outperformance of India (late 2013-2015)

5. Collapse of Greece 2009 (May)

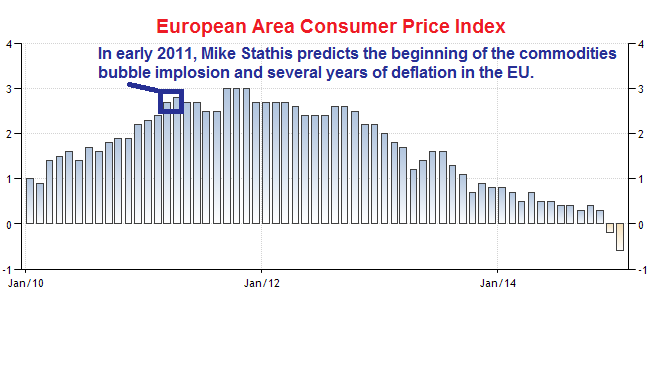

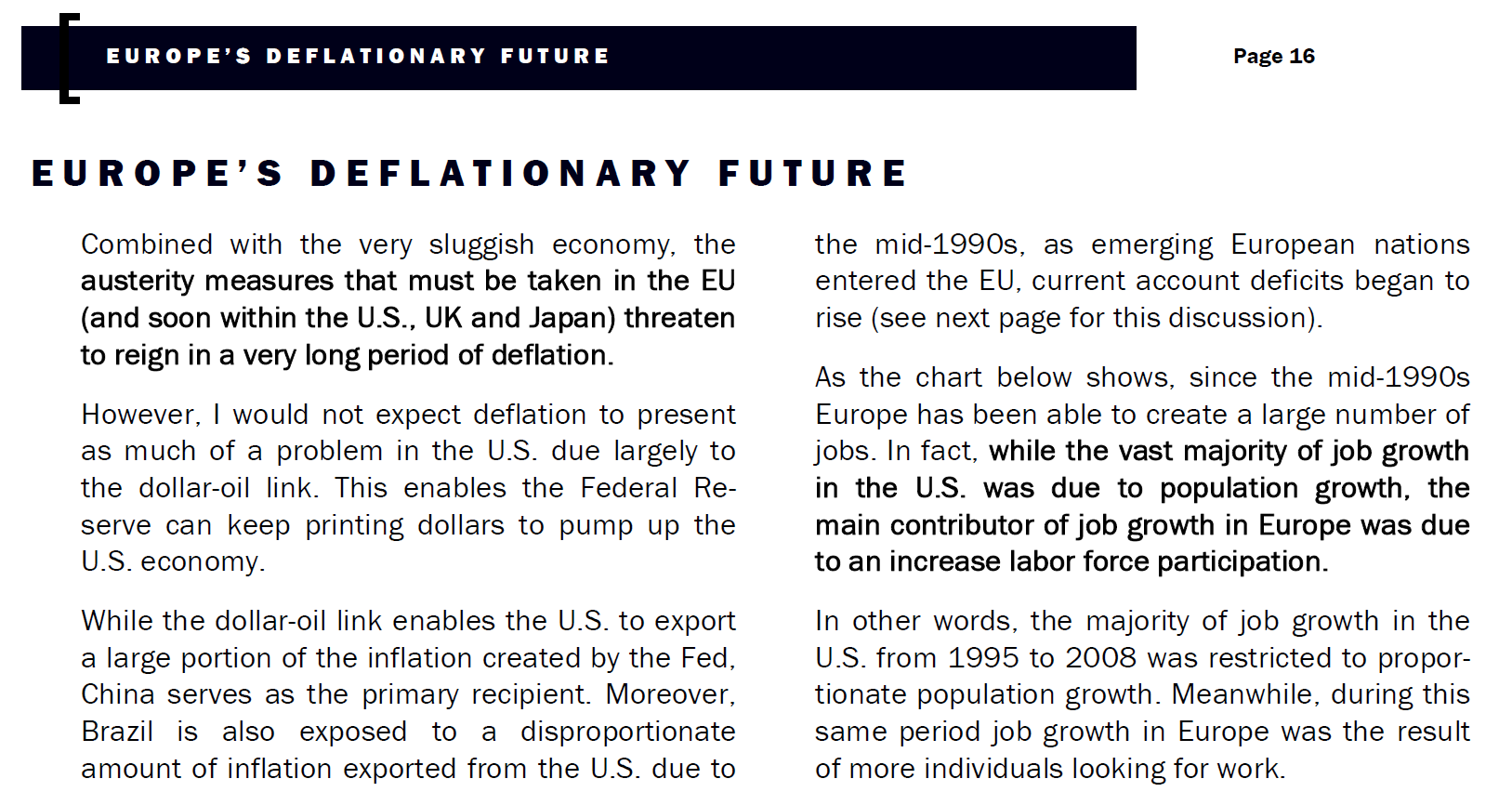

6. Deflation in EU (2011)

7. Collapse of Commodities Market (2011)

8. Collapse of Canadian dollar (2014)

9. Collapse of Australian dollar (2014)

10. Collapse of Brazilian real (2012-2015)

11. Outperormance of the US dollar (2014 -2015)

12. Collapse of gold and silver 2010-2011

13. ECB would begin a quantitative easing program (2012)

14. Extremely accurate trading guidance for gold and silver (2012-2016)

15. Extremely accurate trading guidance for US dollar vs euro, yen, franc, real (2012-2016)

16. Estimated 85% accuracy rate for commodities (and gold & silver) trading guidance (2012-2016)

17. Close to 100% accuracy in US stock market forecasting (2008-2016)

18. The complete up and down cycle of interest rate hikes and cuts in Brazil from 2012-2015

19. Predicted deflation in China (2013, Global Economic Analysis, Brazil Part 3 Nov 15, 2013).

19. China would cut interest rates to record lows (2014).

20. China's stock market bubble (predicted Dec 2014 and Jan 2015)

21. Japan's recession (2014)

22. Brazil's recession (2013-2016)

23. EU's recessions (2011 and 2013)

24. QE by the ECB (2013) and expansion of QE (2015)

25. Collapse of China's stock bubble (June 2015)

26. Collapse of interest rates in China to new record lows (2014)

27. Downgrade of Brazilian Sovereign Debt to Junk

28. First US interest rate hike after the financial crisis in December 2015 (predicted in 2014 and never changed the forecast)

Newsletter Performance Highlights:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20] [21] [22] [23] [24] [25] [26]

Video Presentation Highlights:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13]

The links discussing the results of the video presentations above pertain to two video series published in April 2012 – “20 Stocks Over $100” and “60 Stocks Poised for HUGE Moves”

Note: several additional winners from these presentations that have not been included here for lack of time.

In the past, we also gave away some nice freebies as well:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19]

It is critical to understand that the media does not care about airing real experts who are unbiased and have great track records. In fact, the media wants to do the opposite since its ad sponsors stand to benefit more if the audience is fed lines from broken clocks and idiots. Doing so makes the sheep trade more often which racks up trading commissions.

And when the lemmings blow their accounts up after listening to media pinheads, they run to Merrill Lynch and other Wall Street firms, mutual fund companies, and insurance companies.

This is all very good business for the media and its sponsors.

But it is a disaster for those who pay attention to the media.

Understand the difference between notifying and bragging. If the media gave Mike just 5% of the coverage he is due, people would know his track record. If he were to go on about his track record in public at that point, it would be considered bragging.

But when you have been completely shut out of exposure by all media including the internet, stating your acccomplishments is by no means bragging. We call it waking up the sheep as to the Jewish Mafia and its media scams.

Additional Forecasts:

1) Brazil's economic collapse would commence in a few years (2011).

2) Brazilian real collapse (2011).

3) India would perform the best of the 3 major Emerging Markets over the next year (early 2014).

4) The US dollar would continue its strength through at least the first half of 2015 (late 2014).

5) The euro, Canadian dollar and Australian dollar would remain weak through at least the first part of 2015 (2014).

6) China stock bubble (2015) and collapse (2016).

7) China collapse (2021).

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.

We will be making more of these videos in the future so the newer guests of the website can see that no one can come close to the track record of Mike Stathis. We hope to make 20 o......

Opening Statement from the December 2015 Dividend Gems Originally published on December 20, 2015 As expected, on December 16, 2015 the Federal Reserve raised short-term interest rates by 25...

NOTE: this is not the correct audio. We will replace it with the correct one when we locate it. The following audio was created several months ago, but we forgot to release it earlier. ...

We get emails all the time from people telling us that they want to subscribe to our research and newsletters, but they just can’t afford it. That’s hogwash.

Opening Statement from the September 2015 Dividend Gems Originally published on September 13, 2015 In late 2014 (in the Intelligent Investor) we warned investors about a new period we expect...

Opening Statement from the August 2015 Dividend Gems Originally published on August 16, 2015 Earnings Thus far about 90% of firms have reported Q2 earnings. All things considered, the resu...

Opening Statement from the August 2015 Intelligent Investor Originally published on August 5, 2015 The stock market mounted a nice rally shortly after the release of the July issue, affording in...

That's right folks. Once again, Mike Stathis nailed the market selloff before it began, helping to position his clients in cash.

As subscribers to our research are aware, for many months we have been warning about the issues that Wall Street and the investment world recent woke up to. As a result, we had been advising investors...

Opening Statement from the July 2015 Intelligent Investor (Part 1) Originally published on July 8, 2015 Due to the situation in Greece, the US stock market did not trend higher as expected. Moreov...

You might recall that I have profiled a few mutual fund disasters. If you haven't already read these articles, I strongly suggest you do so ASAP. Mutual Fund Disasters: An Overview &n...

Opening Statement from the June 2015 Intelligent Investor (Part 1) First published on June 3, 2015 for subscribers to the Intelligent Investor (Part 1) Last month we reminded investors of our spec...

In coming weeks/months, the site will be permanently closed to the general public. Only active Members and Clients will be able to access the website. The email alert list will be phased......

Opening Statement from the April 2015 Intelligent Investor (Part 1) First published on April 8, 2015 for subscribers to the Intelligent Investor Alcoa marked the beginning of Q1 earnings sea...

Opening Statement from the March 2015 issue of Dividend Gems First published on March 13, 2015 for subscribers to Dividend Gems We have been discussing several themes in recent months. Firs...

Opening Statement from the March 2015 Intelligent Investor (Part 1) First published on March 4, 2015 for subscribers to the Intelligent Investor Nearly all firms from the S&P 500 having...

In this video, Mike blows the lid off the entire financial industry, exposing it for what it is. Mike presents a chilling reality that virtually NO ONE outside of the industry knows about....

Opening Statement from the February 2015 issue of Dividend Gems First published on February 16, 2015 for subscribers to Dividend Gems In the month of January we released three videos discussing se...

Opening Statement from the January 2015 issue of Dividend Gems First published on January 19, 2015 for subscribers to Dividend Gems As we expected would be the case, over the past several months...

Opening Statement from the December 2014 issue of Dividend Gems First published on December 21, 2014 for subscribers to Dividend Gems Over the past several months economic headwinds from ar...

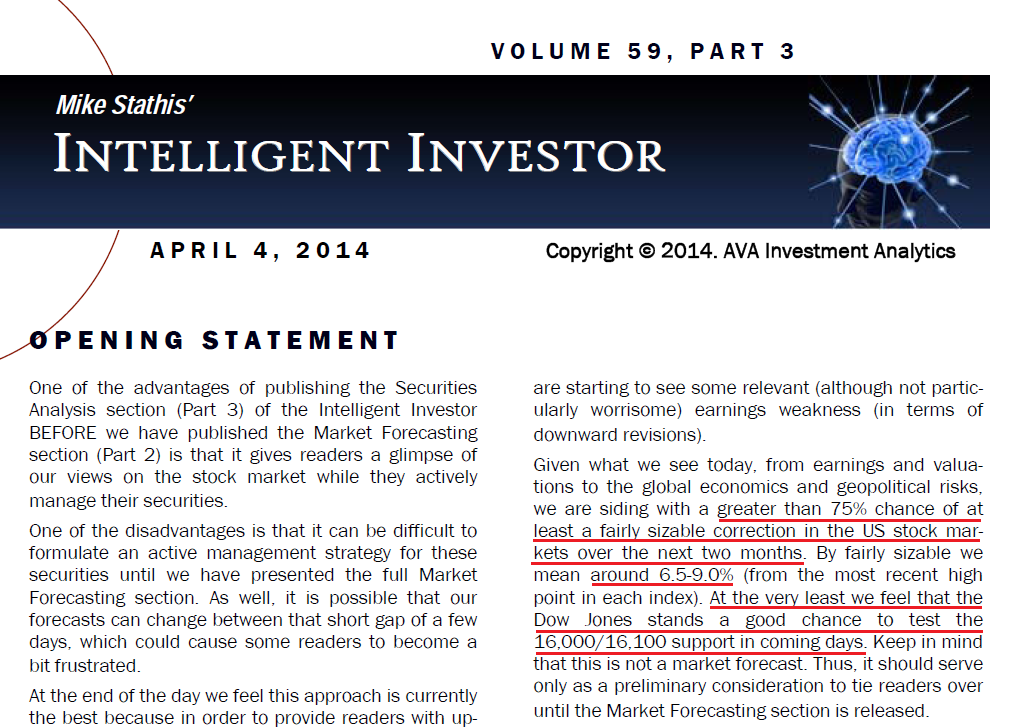

Once again, Mike Stathis nailed the most recent market sell off in April.

Opening Statement from the January 2015 Intelligent Investor (Part 3) First published on January 7, 2015 for subscribers to the Intelligent Investor Over the past couple of months we have be...

As you listen to these excerpts from the October 2014 research (October 12 2014 Global Economic Supplement Audio 2) note the value in the securities discussion alone. Also note that most of these sec......

We just released an important update for gold, currencies and US stock market forecasts. This report was published on video and discusses gold, silver, US dollar, Swiss franc, euro and the US stock...

Note: We are no longer releasing regular excerpts of Mike's Market Forecasting to the general public. We may release some excerpts to the public in the future if we have time and if we so deci......

Opening Statement from the November 2014 Intelligent Investor (Part 3) First published on November 5, 2014 for subscribers to the Intelligent Investor In the Opening Statement section (Part 3)...

It's simple folks. The Jewish Mafia wants to SCREW YOU by creating the illusion of valuable content. This is all part of the Jewish media scam.

Opening Statement from the October 2014 issue of Dividend Gems First published on October 19, 2014 for subscribers to Dividend Gems The irrationality of the masses coupled with the IMF&rsquo...

You can find more information on these books here.

Opening Statement from the October 2014 Intelligent Investor (Part 3) First published on October 7, 2014 for subscribers to the Intelligent Investor As forecast in the September Market Fore...

Understanding Volatility and More Expectations & Volatility ...

That’s right. Mike Stathis accurately forecast the recent market selloff AGAIN. Yet, he continues to be banned by ALL MEDIA. Instead the criminal media feeds its unfortunate vic......

Opening Statement from September 2014 Intelligent Investor (Part 3) First published on September 2, 2014 for subscribers to the Intelligent Investor ...we wanted to mention one point from th...

Not only has one of our dividend gems returned 50% (excluding dividends) over the past 5 months (and Mike recommended readers buy positions right when it bottomed) but Mike also successfully guided ac...

How would you like to be on the receiving end of stocks that get bought out?

Opening Statement from July 2014 Dividend Gems First published on July 17, 2014 for subscribers to Dividend Gems According to the most recent consensus estimates at our disposal, operating earnin...

If you did not already know what Mike talks about in this clip, it means you are spending your time filling your head with trash from the bought off media.

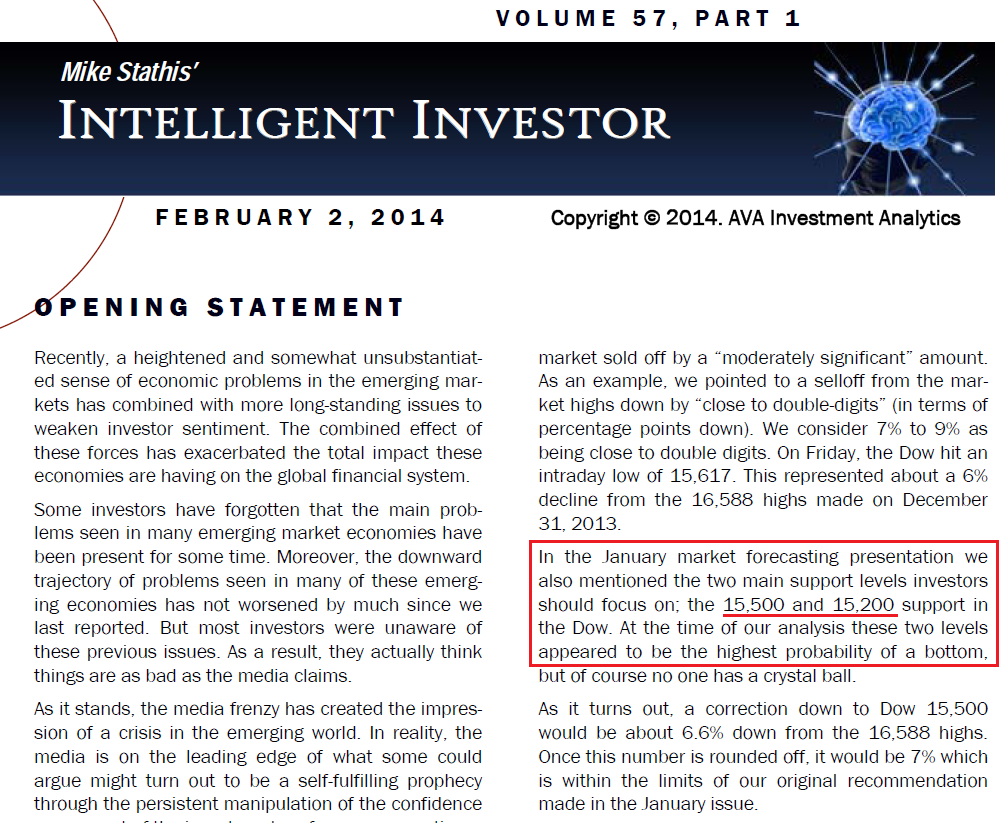

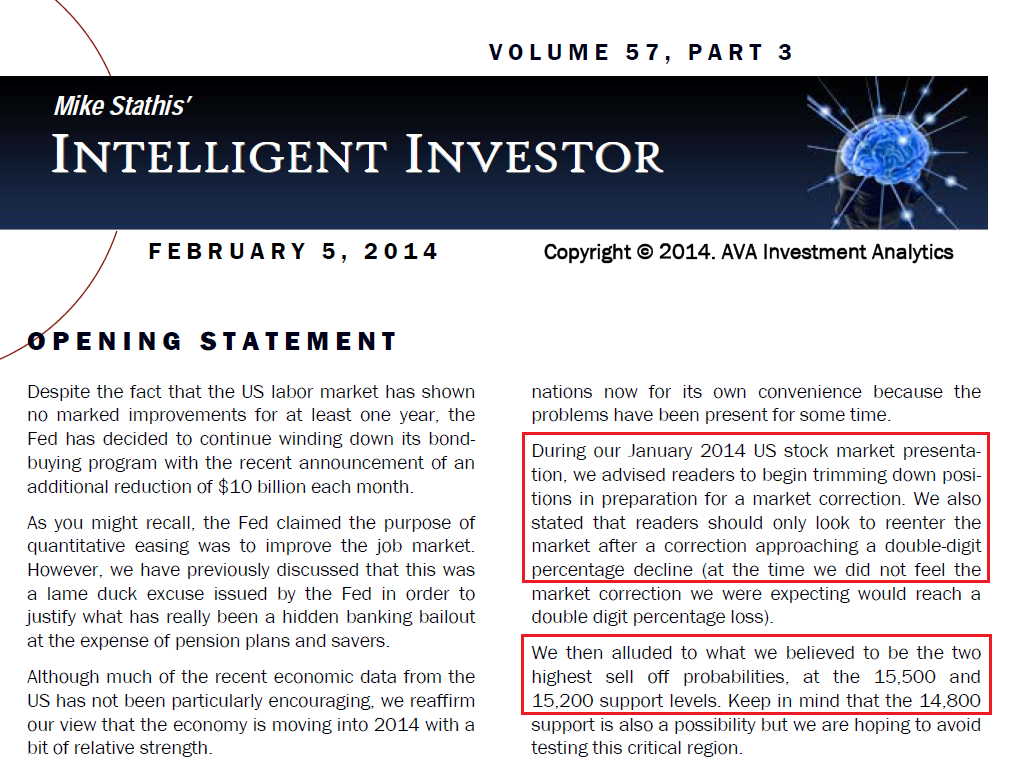

Last month we posted some brief excerpts from our January 2014 80-min, 2-video presentation on the US Stock Market Forecast and Analysis, which is included as one of many segments of the Intellig...

Recently the financial media has been issuing all kinds of statements about the emerging markets in order to create drama and panic. Does this behavior seem familiar? The financial media is...

In this video you will see how Mike predicted the three small sell offs in 2013. You will also get a sample of the latest market forecast released in early January. You will also see how he has predic...

The release of this video is part of a new series we have recently launched for the purpose of helping the public become more familiar with the track record and insights of Mike Stathis. Make sur...

Remarkably, even after many years of bad performance, John Hussman still manages several funds with more than $2 billion under management. Let's take a good look at Hussman and see if he is a good f...

We will be making more of these videos in the future so the newer guests of the website can see that no one can come close to the track record of Mike Stathis. We hope to mak......

We have released an instructional video to subscribers of the Intelligent Investor entitled "Discussion about How to Look at Each Security." In this video, Mike goes over some finer points on...

Watch, listen, laugh, and learn.

As expected, the U.S. stock market continues to soar. Last month we stated that Dow 15,000 would soon be reached. This is precisely what happened. We have also been emphasizing the fact that the ris...

We just released a securities update for subscribers of Dividend Gems, highlighting a couple of buying opportunities as well as the typical educational content you have come to expect from Mike Stathi...

Get ready for Dow Jones 15,000 because it’s coming, and soon. Earnings continue to shine while the U.S. economy remains stagnant. But earnings are also pretty good in many regions of the world w...

We recently discussed one of the securities we cover in the Intelligent Investor, pointing to the huge gains (more than 80% in the past 30 days). Here, we show an example of another freebie we gave...

The following is an example of one of the stocks we have been pushing pretty hard in the Intelligent Investor newsletter.

We are now beginning to see some earnings weakness in excess of that expected by investors. We feel that continued earnings disappointments could initiate a period of temporary downside in the U.S. st...

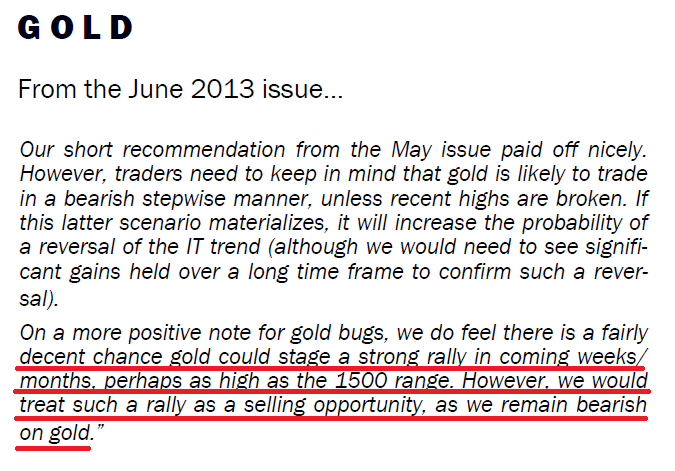

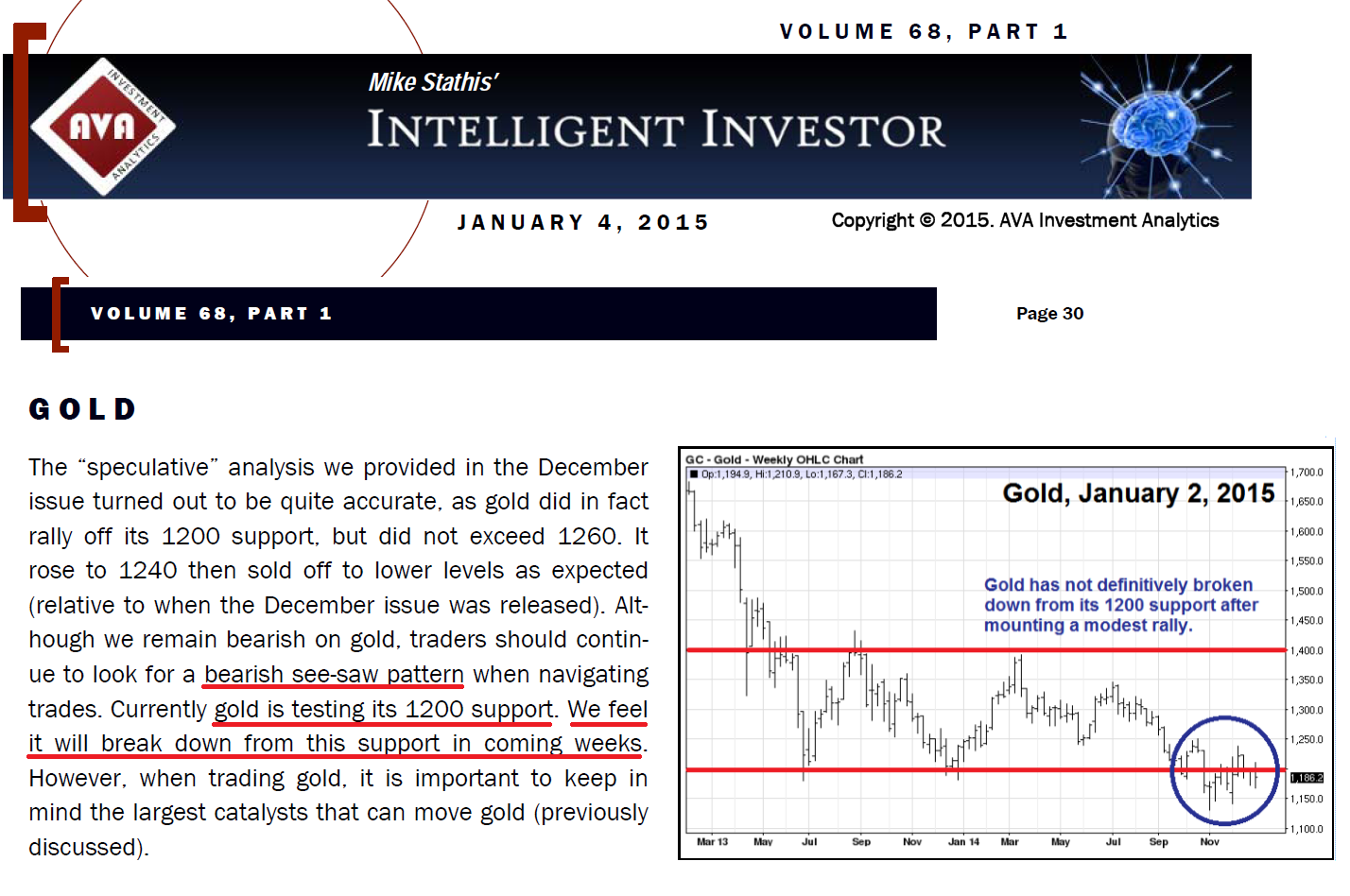

Today, one of the securities on the recommended list from the Intelligent Investor popped. We wanted to provide some guidance and educational points regarding this recent activity. However, what initi...